Fincash » Investment Plan » Investing Rules from Vijay Kedia

Table of Contents

Top Investing Rules from Indian Investor Vijay Kedia

Dr. Vijay Kishanlal Kedia is a successful Indian investor. He is the founder and CEO of Kedia Securities Pvt. Ltd. The Economic Times described him as the ‘Market master’. In 2016, Vijay Kedia was awarded a 'Doctorate Degree for Excellence' in the Field of Management.

| Details | Description |

|---|---|

| Name | Dr. Vijay Kishanlal Kedia |

| Education | University of Calcutta |

| Occupation | Businessman |

| Company | Kedia Securities Pvt. Ltd |

| Title | Founder |

| Business World List | #13 Successful Investor |

He is from a Marwadi family who was into stock-broking. At the age of 14, he realised he had a passion for the stock market. Kedia got into trading because he had to support his family. His knack for investment and trading helped him gain huge returns in no time. In 2016, he was featured as #13 in the Business World list of Successful Investors in India. In 2017, ‘Money Life Advisory’ launched a microsite called ‘Ask Vijay Kedia’. He has given major management tips at the London Business School, TEDx and various other global platforms.

Vijay Kedia Portfolio 2020

Mentioned below is Vijay Kedia’s Portfolio for June 2020.

A detailed description of the quantity held in the stock with the holding percentage is mentioned below:

| Stock Name | Holders Name | Current Price (Rs.) | Quantity Held | Holding Percent |

|---|---|---|---|---|

| Lykis Ltd | Kedia Securities Private Limited and Vijay Kishanal Kedia | 19.10 | 4,310,984 | |

| Innovators Façade Systems Ltd | Vijay Kedia | 19.90 | 2,010,632 | 10.66 |

| Repro India Ltd. | Kedia Securities Private Limited and Vijay Kishanal Kedia | 374.85 | 901,491 | 7.46% |

| Everest Industries Ltd. | Vijay Kedia | 207.90 | 615,924 | 3.94% |

| Vaibbhav Global Ltd. | Vijay Kedia | 1338.40 | 700,000 | 2.16% |

| Neuland Laboratories Ltd | Kedia Securities Private Limited | 781.05 | 250,000 | 1.95% |

| Sudharshan Chemical Industries Ltd. | Vijay Kishanlal Kedia | 409.35 | 1,303,864 | 1.88% |

| Chevoit Company Industries Ltd. | Mr.Vijay Kishanlal Kedia | 558.10 | 100,740 | 1.56% |

| Tejas Networks Ltd. | Kedia Securites Private Limited | 57.70 | 1,400,000 | 1.52% |

| Atul Auto Ltd. | Kedia Securities Private Limited | 155.80 | 321,512 | 1.47% |

| Panasonic Energy India Company Ltd. | Vijay Kishanlal Kedia | 137.45 | 93,004 | 1.24% |

| Ramco System Ltd. | Vijay Kishanalal Kedia | 140.65 | 339,843 | 1.11% |

| Cera Santaryware Ltd. | Vijay Kedia | 2228.85 | 140,000 | 1.08% |

| Astec Lifesciences Ltd. | Kedia Securities Private Limited | 939.00 | 200,000 | 1.02% |

| Kokuyo Camlin Ltd. | Vijay Kishanlal Kedia | 52.45 | - | Below 1% First Time |

| Yash Pakka Ltd. | Vijay Kishanlal Kedia | 32.45 | - | Below 1% First Time |

| Affordable Robotic & Automation Ltd. | Vijay Kishanlal Kedia | 42.50 | 1,072,000 | Filing awaited (10.56% march 2020) |

Talk to our investment specialist

Top Investment Strategies from Vijay Kedia

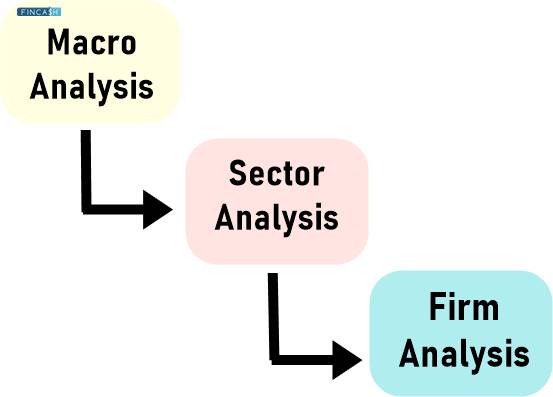

1. Look for Good Management

Vijay Kedia believes that one should invest in companies with good and transparent management. Various aspects make up a company and those are important to be considered before Investing. Always look for the qualitative aspects of the company.

Understanding the quality of the work of the company along with the skills it showcases through its management is a good way of evaluating. This shows profitability in the future.

Don’t just look at the price of the stock. It can be misleading at times. Look for indirect metrics like how long managers work in the company and the kind of compensation they get. Look at stock buyback and how efficiently the management of the company is working.

2. Invest Long-term

Vijay Kedia firmly believes in long term investments. He says companies take time to mature and grow. Rome was never built in a day. Investing long-term is beneficial because the market is volatile in nature. The price swings can cause huge loss if not considered properly.

When investments are held for a longer period of time, the Volatility is less as compared to short-term investments. Stocks have high short-term volatility risks. Therefore, investing for long-term in stocks is beneficial for great returns.

Kedia suggests it is always good to invest for a minimum of 5 years.

3. Have a Balanced Approach

Kedia says it is important to have a balanced approach. It is not good to be overly optimistic during an upward trend and very pessimistic in a downtrend. He says investing does not have to be stressful work. It can be easy and relaxed if you have a confident approach.

Having a balanced portfolio based on a long-term plan makes a big difference. You should understand the basics of investing in the first place. It is to make money. You are investing money to make money. Having fear and insecurities can get the best of you and lead to face huge losses.

No one can predict the next day in the market. The market is changing every day and you need to have a balanced approach to deal with the situation.

4. Don’t Invest to Earn Bread

Vijay Kedia advises to never depend on the stock market for your livelihood. It is important to have an alternative source of Income. You can withstand market changes and be an active trader. Many investors have invested to earn money without having a regular business or a job. This has led to a huge loss and accumulated debts.

Always make sure to have a primary source of income and treat the investment as an important but secondary source of income.

Earning money will help you invest and make more money. That is the very goal of investment- making more money.

Conclusion

Vijay Kedia has been an inspiration for many Indian investors. His advice is truly beneficial when it comes to investing. Always earn money to invest and have a balanced approach. Don’t be overly positive or negative about the market. Make sure to do good research and find the best company you want to invest in. Look for management style and skills when it comes to understanding the quality of the company.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.