Table of Contents

What is Enterprise Value-to-Revenue Multiple (EV/R)?

The Enterprise Value-to-revenue multiple (EV/R) refers to a stock valuation metric comparing a firm's enterprise value to its revenue. Investors use EV/R as one of the numerous fundamental indicators to analyze if a stock is priced reasonably.

In the instance of a proposed acquisition, the EV/R multiple is frequently employed to estimate a company's value.

Uses of EV to Revenue Multiple

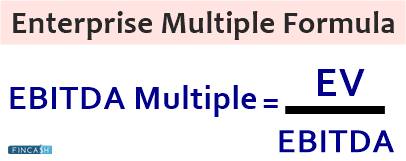

It's impossible to value a firm using EV/EBITDA or P/E ratios if it doesn't have a positive EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) or positive Net Income. In this situation, a financial analyst will need to move up the income statement to gross profit or revenue.

Having a negative EV/EBITDA multiple is useless if EBITDA is negative. Similarly, a company with a marginally positive EBITDA (around zero) will have a huge multiple, which isn't particularly beneficial.

For these reasons, an EV/Revenue multiple is required for the valuation of early-stage companies (typically operating at a loss) and high-growth enterprises (often operating at breakeven).

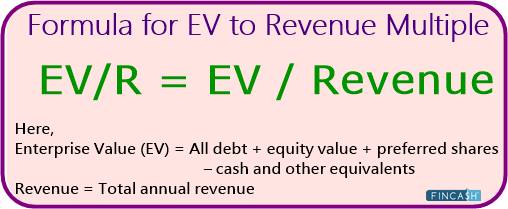

Formula for EV to Revenue Multiple

EV/R = EV / Revenue

Here,

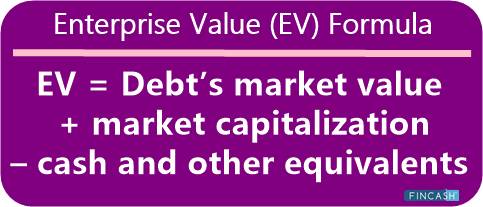

- Enterprise Value (EV) = All debt + equity value + preferred shares – cash and other equivalents

- Revenue = Total annual revenue

Talk to our investment specialist

Benefits EV to Revenue Multiple

- It's beneficial for businesses experiencing a loss.

- Companies with negative or near-zero EBITDA may find this helpful.

- For most companies, income data are easy to come by.

- The ratio is simple to compute.

Difference Between Enterprise Value-to-EBITDA (EV/EBITDA) and Enterprise Value-to-Revenue (EV/R) Multiples

The enterprise value-to-revenue (EV/R) ratio measures a company's ability to produce revenue. In contrast, the enterprise value-to-EBITDA (EV/EBITDA) ratio measures a company's ability to generate operating cash flows.

EV/EBITDA considers operating expenses, whereas EV/R only considers the top line. EV/R has the advantage of being able to be employed for companies that have yet to earn revenue or profits, such as Amazon in its early days.

Limitations of EV/R

The enterprise value-to-revenue multiple is helpful to evaluate companies in the same Industry and as a benchmark for the ratio from best in breed in the industry to determine if it represents good or bad performance.

In addition, unlike the Market cap, which can be found on sites like Yahoo! Finance, the EV/R multiple necessitates calculating the enterprise value. If you choose the enlarged version, you'll need to add the debt and deduct the cash, as well as consider other variables.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.