Table of Contents

What is Net Liquid Assets?

Net liquid assets are generally referred to as the measure of a near-term or immediate liquidity position of a company. It is calculated as liquid assets subtracted from Current Liabilities.

Liquid assets are generally accounted for Receivables, marketable securities and cash that can be converted readily to cash at their estimated current value.

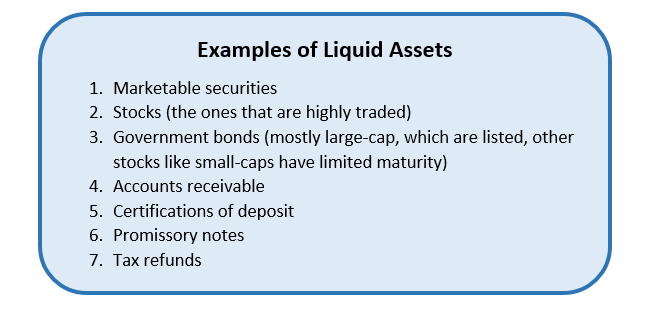

Common Examples of Liquid Assets

Some of the most common examples of liquid assets include:

- Cash

- Cash Equivalents

- money market accounts

- Marketable securities

- Short-term Bonds

- accounts receivable

Understanding Net Liquid Assets

The net Liquid asset’s amount is one of the many measures that provide a snapshot of a firm’s financial condition. Marketable securities and cash are ready to be deployed. On the other hand, accounts receivables can be converted into cash in a short period. As far as inventory is concerned, it is not qualified as a liquid asset as it cannot be sold readily without any substantial discount. Current liabilities primarily incorporate:

- accounts payable

- income tax payable

- Accrued liabilities

- Current portion of long-term debt

Subtracting current liabilities from liquid assets displays a company’s financial flexibility to make instant payments.

Talk to our investment specialist

Advantages of Net Liquid Assets

Here are some noteworthy advantages of net liquid assets:

- A strong, substantial net liquid asset position is highly essential for a company as it showcases that the company is capable of paying off short-term obligations, be it debts or payments to suppliers

- It also indicates that a firm can make new investments without taking any financing

- Companies with strong net liquid asset positions are better placed during times of economic upheaval

- Without a strong net liquid asset position and substantial revenue during the economic downturn, a company may not be able to fulfil obligations and might end up becoming bankrupt

- With net liquid assets, it becomes easier to get financing from banks as it showcases the ability to pay off debts during times of distress

Keep in mind that there should be a balance between the company striking enough liquid assets and a lot of liquid assets. The general rule of thumb is that the firm should have a minimum of six months of liquid assets to fulfil short-term obligations and cover all operating expenses. If that can be done, the company is said to be financially good.

Net Liquid Assets Example

Let’s understand this with an example of net liquid assets. Suppose ABC Incorporations has the following parts on its Balance Sheet for current liabilities and current assets:

Current Liabilities

- Accounts Payable: Rs. 53.8 million

- Accrued Liabilities: Rs. 73.5 million

- Current Portion of Long-Term Debt: Rs. 9.5 million

- Income Tax Payable: Rs. 1.7 million

Current Assets

- Cash: Rs. 22.7 million

- Accounts Receivable: Rs. 29.5 million

- Inventory: Rs. 110.5 million

- Prepaid Expenses: Rs. 11.7 million

- Income Tax Receivable: Rs. 1.5 million

- Other Current Assets: Rs. 10.3 million

So, the net liquid assets would be:

Cash + Accounts Receivables – Current Liabilities =

Rs. 22.7 million + Rs. 29.5 million – Rs. 138.5 million = Rs. (-) 86.3 million.

The negative position of net liquid for a company could be a matter of concern. However, such a situation is quite common for a retailer. Still, it reflects that the firm is not in its best financial position.

Importance of Net Liquid Assets

Net liquid assets are important as a firm constantly requires cash to meet obligations. Without adequate cash, a firm cannot pay its employees' salaries or bills to vendors. Liquid assets are also required during short-term emergency.

Wrapping Up

Undoubtedly, a liquid asset is a thing of future economic benefit to a firm that can be easily exchanged for cash. If you are an owner of a firm or are responsible for the finances, make sure your company has enough net liquid assets to tackle every possible situation.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.