Table of Contents

What is Goal-Based Investing?

When you invest money in an investment product, the main objective is to multiply the amount invested as quickly as possible or make profits. The concept of goal-based Investing is in quite a contrast to this traditional mindset. As the name suggests, goal-based investing is funding for a specific goal.

A specific and clearly defined purpose and investments are made to provide for its funding. There can even be a combination of goals. The investment options are also chosen considering various factors, such as the number of required returns, the time when the funds are required, the purpose of investing, etc.

What are Goals?

Since investing is for pre-determined goals, they vary from person to person depending upon their needs. These goals can be broadly divided into three categories based on time:

- Short-term - Rent payment, holiday trip, buying gadget like mobile / laptop, health emergency, certificate course, etc.

- Medium-term - Buying a car, child's education, degree course, start-up business plan, etc.

- Long-term - retirement plan, child's marriage, Life Insurance, investing in start-up companies, etc.

How does Goal-based Investing work?

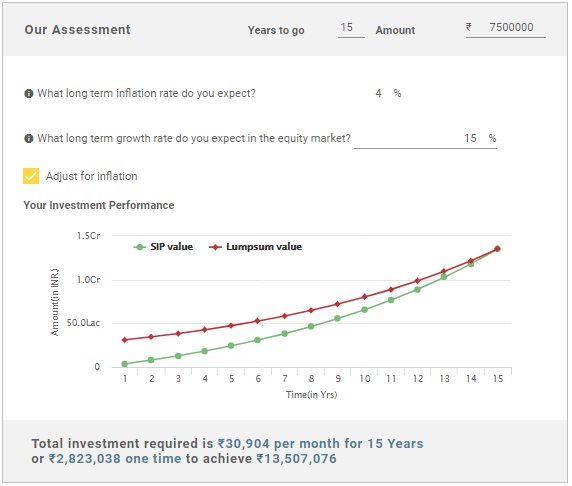

When an investment expert designs a plan for any person who is investing without a specific goal, they choose those options that yield the maximum returns in the minimum time. But when it comes to goal-based investing, the selection of investment options is careful and requires more analysis on the part of the expert. It is majorly affected by the time and amount requirements of the investor. Let’s understand this with an example:

Suppose a female X is 45 years old and has a 15-year-old daughter. X wishes to invest an amount and use the returns for two things:

- Her child’s higher education, and

- Her retirement plans

Now the investment expert will invest the money in such a way that a part of it generates higher returns in relatively less time, and a part of it will be invested to generate returns over a longer period. So, a major part of it can go into equities, and a lesser part can be invested in sources like fixed Income.

Talk to our investment specialist

Benefits of Goal-Based Investing

After you make a decision to invest an amount, you just go and invest in any option that seems lucrative, irrespective of the certainty of returns. On the contrary, when you identify your goals and invest according to their requirements, you are in a win-win situation. Some of the benefits of goal-based investing are:

- A leading objective of goal-based investing is to acquire a certain amount of funds at a certain stage of life for a specific purpose

- An inherent advantage of this type of investing is that there is less risk. When there is a requirement for a certain amount of funds at the specified time, the investor will try to avoid risky investments as much as possible

- Another major benefit is financial stability due to careful financial and investment planning

Challenges in Goal-Based Investing

There is another side to the picture of goal-based investing. There are some challenges a person might face while going for this type of investing. These are:

- It requires a lot of planning and analysis of Financial goals and investment options. This is a rigorous process and might tire you out

- It is very difficult to do all of this on your own unless you have immense knowledge of investments and returns. The need for an investment consultant cannot be ignored

- Since financial resources are limited and financial goals are comparatively greater in number, you need to prioritise your goals. This can be a difficult task for most people

Goal-Based Investing Vs. Traditional Investing

Here is a thorough comparison of goal-based investing vs. traditional investing:

| Basis | Goal-Based Investing | Traditional Investing |

|---|---|---|

| Meaning | It is investing for a pre-specified goal | It is investing to generate returns |

| Objective | The objective is the purpose for which investment is made | The objective is to generate the highest possible gains |

| Risk | The risk is limited | There is a higher risk as investing is very aggressive |

| Investment Portfolio | The investment portfolio will always have a combination of various investment options depending upon the goals | The investment portfolio might or might not involve a combination of investment options |

Conclusion

In a world where people are increasingly realising the importance of Financial Literacy, financial planning, and investments, a concept like goal-based investing is exactly what they need. But since it is a very novel mechanism, and there is still a lot to learn and explore about it, people are a bit hesitant. Nevertheless, it is clear that this concept guarantees financial security in the future. So, if you are trying to save funds to accomplish a set objective, try your hands at goal-based investing today.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.