Table of Contents

Net Debt Per Capita

Net Debt Per Capita is a measure of a nation's debt relative to its population. It is calculated by dividing the total public debts of a country by its population, giving an indicator on how much debt each person in that country holds. High net debt per capita indicates more economic hardship as citizens bear greater shares of their respective government’s public debts and are likely subject to higher Taxes or cuts in key services due to rising costs from taking out new loans.

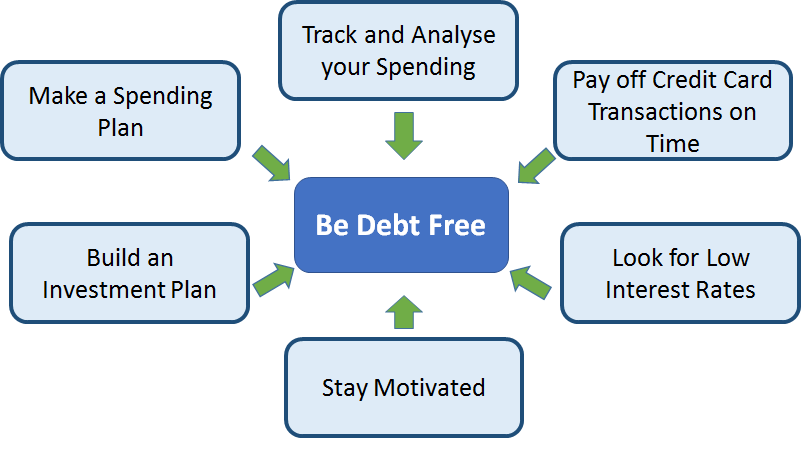

Low net debt can indicate less stress on local economies, allowing for greater government spending for infrastructure projects and other investments which lead to increased Economic Growth opportunities throughout their nations. Ultimately, this ratio offers insight into how well a nation’s finances have been managed and gives investors, creditors, businesses, and governments early indications of possible future performance within the international Economy.

Understanding India's Net Debt

Net debt of India is the total amount of money borrowed from external sources. This includes government loans and equity investments by foreign entities or investors on behalf of the Indian Government. The net debt also stands for the gross borrowing minus any repayment made on existing liabilities, such as Bonds and treasury bills. It was estimated that in 2020, India’s net debt stood at $848 billion dollars which amounted to 41% of its nominal GDP or Gross Domestic Product (GDP).Net borrowings in India have been increasing since 2015 due to rising expenditure and a slower-than-expected Economic Growth Rate. Overall, it can be said that national debt acts as an important indicator for understanding financial health status within an economy. High levels are often seen as a signifier for weakness within the country’s fiscal situation while lower levels indicate healthier balance sheets with more savings being accumulated than spent

India's Government Debt: An Analysis (2023)

As of 2023, India's government debt continues to be a topic of analysis and discussion. The government's debt, which comprises both internal and external borrowings, plays a crucial role in financing various development projects and sustaining the economy. While the exact figures may vary over time, India's debt-to-GDP ratio remains a key indicator of its fiscal health. Efforts are being made to manage and reduce the debt burden through fiscal discipline, economic reforms, and strategic debt management policies. Monitoring and evaluating the government's debt situation is essential for ensuring sustainable economic growth and financial stability in India.

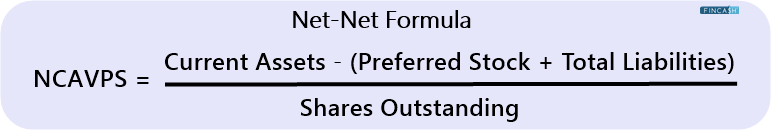

Calculating Net Debt per Capita

Calculating the net debt per capita in India involves a systematic approach to derive a meaningful indicator of the country's financial health. The process begins with obtaining accurate data on the total government debt, including both internal and external borrowings, and subtracting any assets held by the government. This net debt is then divided by the population of India to determine the net debt per capita. Accurate and up-to-date information on the government's liabilities, such as outstanding loans, bonds, and other forms of borrowings, is essential for precise calculations. The calculation process requires meticulous data collection, verification, and analysis.

By calculating net debt per capita, policymakers, economists, and researchers can gain insights into the individual burden of government debt on each citizen. This indicator helps assess the fiscal sustainability, debt management strategies, and the potential impact on the economy and individuals' well-being. Regular monitoring and analysis of net debt per capita contribute to informed decision-making and effective fiscal planning.

Interpreting Net Debt per Capita: Implications and Significance

Interpreting the net debt per capita in India unveils crucial implications and significance for the country's economic landscape. This indicator provides insights into the average individual's share of the government's debt burden. A higher net debt per capita may imply increase repayment obligations and potential risks to long-term fiscal stability. It highlights the need for prudent debt management, fiscal reforms, and sustainable economic policies. Monitoring changes in net debt per capita helps assess the effectiveness of government borrowing and expenditure policies. Understanding its implications enables policymakers, economists, and investors to make informed decisions, ensuring fiscal responsibility and long-term economic well-being for India.

Conclusion

The analysis of net debt per capita shows that it is a key indicator of the financial health of an economy. In general, study results suggest that countries with higher levels of net debt are likely to be more prone to macroeconomic shocks and may experience slower economic growth compared to those with lower levels. The study also points out how important it is for policymakers to keep the ratio of total borrowings over GDP in check, as too much borrowing can lead to long-term economic hardship. Additionally, there was evidence suggesting that Income inequality had an impact on levels of net debt – indicating that governments should create policies targeted at raising incomes for those who need them most. By monitoring their own national macroeconomic indicators such as GDP and unemployment rate as well as global trends, nations have all the tools they need to properly manage their finances and ensure sustained prosperity in terms of long-term economic stability.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.