Table of Contents

How to Make a Monthly Budget Plan?

What does ‘budget’ mean to you? Saving money? Cutting down costs? Following rules? Or you have never thought of it? Well, we are here to tell you the importance of budgeting! Planning for a monthly budget is not only an important part of a Financial plan, but it plays a vital role in your overall savings. So, let us first understand the importance of a monthly budget.

Monthly Budget: Importance

In basic terms, budget rules savings and spending. It can help you to manage your Income right without going into debt. It prevents from unnecessary spending and helps in achieving Financial goals. A well planned monthly budget will direct you in many ways, such as-

- Gaining control over your money

- Making the best use of your earning

- Help you achieve your goals

- Tracking your spending

So, now when you have understood the importance of creating a monthly budget, let’s learn about how to plan an efficient monthly budget!

Budgeting Tools: To Make Monthly Budget Plan

Layout Goals

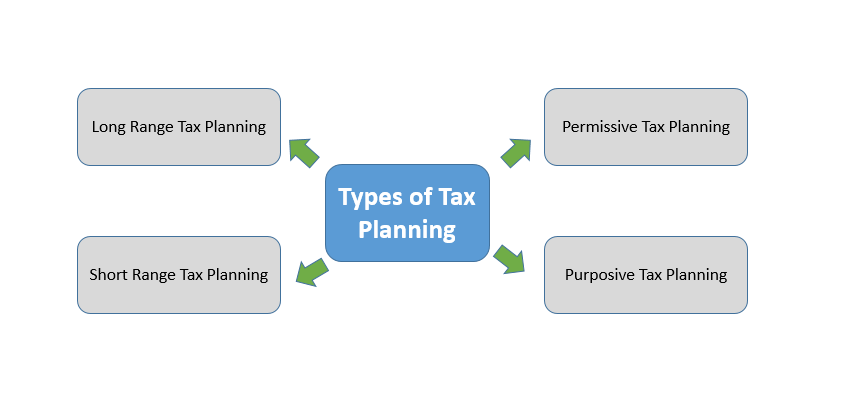

We all have certain financial goals and targets that we want to achieve in a particular life span. List down all your goals that you foresee in the future. Classify these goals into short term and long term goals. For example, buying a new gadget or a car would be part of short-term goals, while saving for a big fat wedding, children’s education, retirement, etc., would come under long term goals.

Remember, while making a budget, financial goals matter a lot. They encourage you to save more. So, start setting your goals now!

Talk to our investment specialist

Make an Expenditure Plan

In order to track your expenses, an expenditure plan is very important. When you make an expenditure plan, record all your previous expenses. By doing so, you will get an idea about your spending, which will precisely help you in making your next budget. Some of the common expenditure examples are food expense, electricity/water/phone bills, house rent/Home Loan, tax, travelling expenses, weekends/holiday expense, etc. It is important for you to review your budget constantly to figure out if you are on the right track.

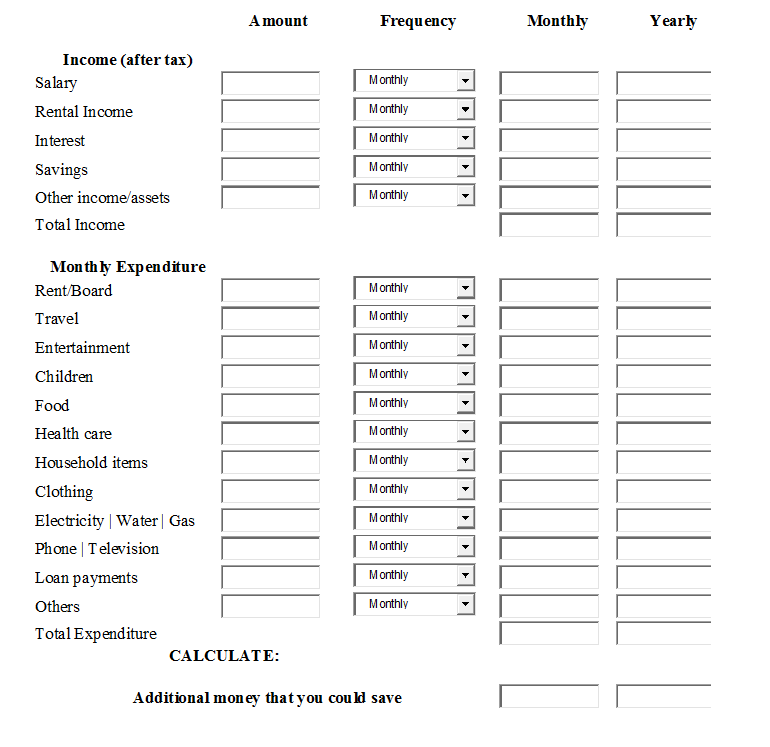

Budget/ Expense Calculator

The Budget calculator allows you to calculate your monthly expenses and savings. So, make such monthly expense sheet (as given below) and calculate it.

Create a Budget

Now, when you know the aforementioned things, start setting your monthly budget efficiently. You need to draw two spending categories- Fixed Expenses and Variable Expenses. The fixed expense will hold all your monthly fixed expenditures like food, home rent/home loan, car loan, electricity bills, etc. Whereas, the variable expense would include those expenditures which may change month to month, for example- entertainment, travel/holidays, dining out etc.

When you set a monthly budget to make sure that your variable expenditures are low compared to the fixed expenditures.

Be Debt Free

Most of you might have some kind of loans or liabilities that need to be paid off. Paying off all major loans should be part of your monthly budget. But, being liable to heavy debts by means of credit cards is not a healthy financial plan. If you are using a credit card, make sure you pay your monthly dues on the due date (or before). If you want to be a debt free person, you can instruct your Bank to pay off the credit card outstanding on the due date, by debiting from your bank account.

Planning for a monthly budget may take a lot of your attention, but it’s only to make a secure financial life! So, don’t wait for tomorrow and start making your monthly budget today!