+91-22-48913909

+91-22-48913909

Table of Contents

Top Monthly Income Plan Rated by FINCASH for 2025 - 2026

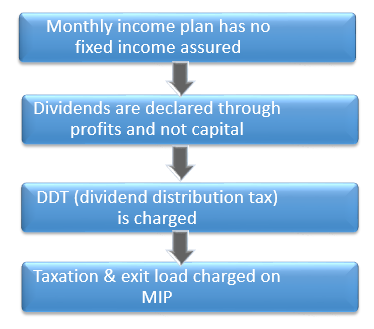

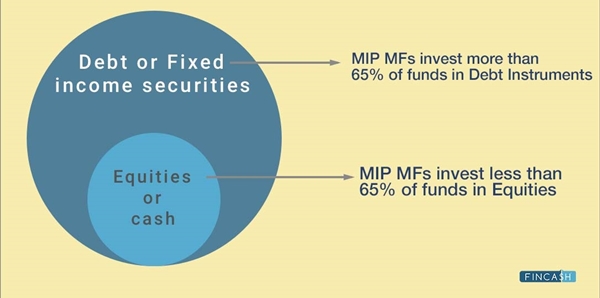

Monthly Income Plan is a combination of equity and debt instruments. About more than 65% is being invested in interest yielding Debt fund like the certificate of deposits, Debentures, corporate Bonds, government securities, etc. And the remaining portion of the Monthly Income Plan is invested in equity instruments like stocks or shares.

Monthly Income Plans are managed in a way that the fixed-income portion aims to generate a regular revenue while the equity portion gives the kicker. MIPs are an ideal option for individuals who are looking for steady income. Also, investors who are risk-averse, MIPs are a good stepping stone to Investing in equities, with a limited equity exposure. Following are the best Monthly Income Plans to invest in.

Talk to our investment specialist

Top Rated Monthly Income Plan

Fund NAV Net Assets (Cr) Rating 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Information Ratio 5 YR (%) Exit Load Aditya Birla Sun Life Regular Savings Fund Growth ₹64.7333

↑ 0.37 ₹1,374 ☆☆☆☆☆ 2.2 1.2 9.8 8 10.5 7.48% 4Y 9M 7Y 9M 7D -0.1 12.5 0-365 Days (1%),365 Days and above(NIL) SBI Debt Hybrid Fund Growth ₹70.3259

↑ 0.45 ₹9,580 ☆☆☆☆☆ 1.8 -0.1 8.9 9.6 11 7.83% 4Y 5M 5D 7Y 3M 11D 0 12.6 0-1 Years (1%),1 Years and above(NIL) ICICI Prudential MIP 25 Growth ₹73.2296

↑ 0.48 ₹3,086 ☆☆☆☆☆ 1.9 1.6 9.2 9.4 11.4 8.02% 2Y 1M 6D 3Y 4M 13D 0 11 0-1 Years (1%),1 Years and above(NIL) BOI AXA Conservative Hybrid Fund Growth ₹33.1568

↑ 0.18 ₹63 ☆☆☆☆ 0.9 -0.5 3.4 6.7 7 7.21% 2Y 11M 5D 3Y 8M 26D 0.42 12 0-1 Years (1%),1 Years and above(NIL) Kotak Debt Hybrid Fund Growth ₹57.2447

↑ 0.39 ₹2,975 ☆☆☆☆ 1.9 0.1 9.4 10.2 11.4 7.29% 7Y 10M 20D 17Y 4M 17D 0.85 12.7 0-1 Years (1%),1 Years and above(NIL) UTI Regular Savings Fund Growth ₹67.5026

↑ 0.45 ₹1,610 ☆☆☆☆ 2.3 0.5 10.4 9.3 11.6 7.09% 11Y 4M 17D 6Y 6M 11D 0 12.4 NIL Sundaram Debt Oriented Hybrid Fund Growth ₹29.2274

↑ 0.17 ₹27 ☆☆☆☆ 2.6 1.2 8.1 7.5 8 6.84% 6Y 3M 18D 11Y 7M 18D -0.94 9.8 NIL Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 15 Apr 25 Note: Ratio's shown as on 28 Feb 25

Why Are These Top Performers?

Fincash has employed the following parameters for shortlisting the top performing funds:

Past Returns: Return analysis of last 3 years.

Parameters & Weights: Information ratio with some modifications for our ratings and rankings.

Qualitative & Quantitative Analysis: Quantitative measures like Average Maturity, Credit Quality, Expense Ratio, Sharpe Ratio, Sortino Ratio, Alpa, including fund age and the size of the fund has been considered. Qualitative analysis like the reputation of the fund along with the fund manager is one of the important parameters that you would see in the listed funds.

Asset Size: The minimum AUM criteria for debt Mutual Funds are INR 100 Crores with some exceptions at times for new funds that are doing well in the Market.

Performance with Respect to Benchmark: Peer average.

Smart Tips to Invest in Monthly Income Plan

Some of the important tips to consider while investing in monthly income plan are:

Investment Tenure: Investors planning to invest in monthly income plan should stay invested for minimum three years.

Invest via a SIP: SIP or Systematic Investment plan is the most efficient way to invest in a Mutual Fund. They not only provide a systematic way of investing, but also ensures regular investment growth. You can invest in a SIP with an amount as low as INR 500.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.