+91-22-48913909

+91-22-48913909

Table of Contents

What is Monthly Income Plan (MIP)?

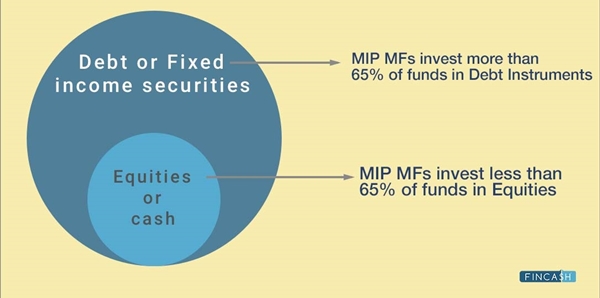

A Monthly Income Plan (MIP) is a debt oriented Mutual Fund that gives income in the form of dividends. This plan is a combination of equity and debt instruments. It is a debt oriented fund with the major portion of the investment (more than 65%) being invested in interest yielding Debt fund like Debentures, certificate of deposits, corporate Bonds, Commercial Paper, government securities etc. The remaining portion of the Monthly Income Plan is invested in equity markets like stocks or shares. So, a MIP provides enhanced regular returns through equities, which one can choose to receive within a preferred period like quarterly, half-yearly or annually. The debt portion being massive, Monthly Income Scheme is comparatively stable, safe and consistent than other Hybrid Fund.

Features of Monthly Income Plan (MIP)

Some of the important features of MIP are:

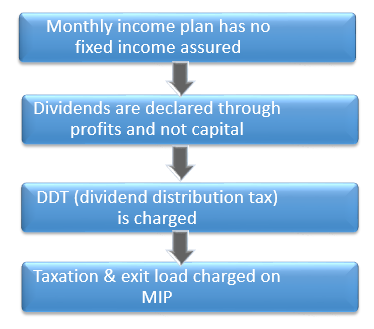

No fixed income assured

Though it’s a common belief that MIP Mutual Fund provides fixed monthly income, there is no guarantee of such MFs. Due to the investment in equities, the returns depend on the fund performance and the Market status.

Dividends are declared thorough profits and not capital

As per the laws, dividends for Monthly Income Scheme can be paid only from the additional income and not the Capital investment. Whatever may be the NAV (Net Asset Value) of your fund that time, the dividends can be claimed only on the Earned Income.

Talk to our investment specialist

Only DDT (Dividend Distribution Tax) is charged on Monthly Income Scheme

If you opt for MIP with dividend option, the income that you earn periodically in the form of dividends is charged a Dividend Distribution Tax (DDT). So, the returns are not totally tax-free in this kind of mutual fund.

Taxation & Exit Load on MIP

The lock-in period of certain Monthly Income Schemes is as high as 3 years, so if the scheme is sold before the maturity period a certain exit load is applicable. Also, the MIPs invest most of their assets in debt instruments so the taxation on them is debt.

Types of Monthly Income Plan

Typically, Monthly Income Plans are of two types. So, before you choose to invest in any of the plans, have a look at its different types mentioned below.

MIP with Dividend Option

With this option, one can earn income at regular intervals in the form of dividends. Though the dividends received are tax-free in the hands of the investor, but the mutual fund company deducts a certain amount of Dividend Distribution Tax (DDT) before you get the payment. So the overall return is comparatively less. Also, the quantum of dividends is not fixed as it depends on the fund performance in equity markets.

MIP with Growth Option

There is no money paid at regular intervals with the growth option of a Monthly Income Plan. The profits earned on the capital gets accumulated to the existing capital. So, the Net Asset Value or NAV of this option of MIP is much higher than the dividend option. One can avail the returns along with the capital only when selling the units. But, by opting for SWP or Systematic Withdrawal Plan to invest in the growth option of a Monthly Income Plan, one can earn Fixed Income as well.

Best Monthly Income Schemes 2025

Fund NAV Net Assets (Cr) Min Investment Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) Since launch (%) 2023 (%) ICICI Prudential MIP 25 Growth ₹72.7458

↑ 0.34 ₹3,086 5,000 100 1 1 7.9 9 10.8 9.9 11.4 DSP BlackRock Regular Savings Fund Growth ₹57.116

↑ 0.24 ₹162 1,000 500 2.4 2.1 9.5 8.9 10.4 8.7 11 Aditya Birla Sun Life Regular Savings Fund Growth ₹64.3603

↑ 0.31 ₹1,374 1,000 500 1.2 1.4 8.6 7.6 12.3 9.3 10.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25 Monthly Income funds having AUM/Net Assets above 100 Crore. Sorted on Last 3 Year Return.

Conclusion

financial planning is a key to managing your savings. Do you wish to invest lump sum money for your short term Financial goals to avail better returns than a Fixed Deposit? But afraid of the volatile stock market? If so, Monthly Income Plans (MIPs) are highly suitable for you. This plan not only provide a regular income but ensure better returns as well. So, what are you waiting for, invest in a MIP now!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like

Very Insightful