Table of Contents

Operating Cost Meaning

Operating costs are linked with the business administration on a daily level. Operating Income is calculated by subtracting operating costs from revenue and is displayed on a company's income statement.

Inclusion and Exclusions of Operating Costs

Operating costs include the following:

- Direct Costs of Goods Sold (COGS)

- Selling, General, and Administrative (SG&A) costs

- Rent

- Wages

- Other overhead expenses

- Maintenance costs

- Raw Materials charges

Operating costs exclude the following non-operating expenses relating to:

- Financings

- Investments

- Interest

- Foreign exchange translation

Operating Cost Calculator

Operating expenses are significant because they can evaluate a company's cost and inventory management Efficiency. It emphasises the level of investment that a company must make to generate revenue, which is the company's primary goal. If a company's operating expenses are higher as a percentage of sales than its competitors, it could imply less efficiency in generating those sales. The formula and steps below can be used to calculate a business's operational costs.

The relevant information can be found on the company's income statement, which is used to report the financial results for the Accounting period.

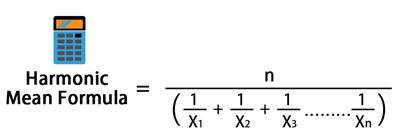

Operating Cost Formula:

Operating Cost = COGS + Operating Expenses (OPEX)COGS = Opening Stock + Purchases + Direct Expenses – Closing Stock.

Talk to our investment specialist

Types of Operating Cost

There are three sorts of operating costs:

Fixed Costs

Fixed costs do not fluctuate as sales increase or decrease. They do not represent a company's productivity, and a firm must continue paying them regardless of performance. Examples of such costs are:

- Overhead charges

- insurance

- Administrative expenses

- Equipment

- Security

Variable Costs

Variable costs fluctuate as a company's sales and output increase or decrease. As a company's output grows, it must purchase more raw ingredients, hire more production personnel, or consume more electricity, resulting in more significant costs. They include expenses like:

- Raw material costs

- Production salaries

- Power

Semi-Variable Costs

Semi-variable expenses are often referred to as mixed or semi-fixed costs. Mixed costs may appear at or below a certain production level or sales, but they alter as sales or output climb over that level.

Overtime pay is one example as it is non-existent and constant below a particular level of productivity; above that level, it becomes flexible and rises or declines in tandem with production.

Operating Expenses List

While operating costs do not usually include Capital Expenditures, they might include a variety of charges, such as:

- Legal and accounting fees

- Bank costs

- Marketing and sales cost

- Travel costs

- Entertainment expenses

- Non-capitalised R&D expenses

- Office supply charges

- Rent

- Maintenance and repair charges

- Utility costs

- Wages and Salary expenses

The cost of goods sold and the expenses directly related to the production of services and goods will be included in operating costs, such as:

- Direct material expenses

- Direct labour

- Plant or production Facility's rent

- Wages and Benefits for production workers

- Repair expenses of equipment

- Utility charges or Taxes of the production services

Operating Cost Example

A gifted potter wants to create a shop with a workshop and storage space. The first consideration is startup costs. The rent is Rs. 2,000 monthly, including utilities, with a two-month deposit of Rs. 4,000 required.

The entire cost of the furnishings is Rs. 6,000, while the computer gear and software are Rs. 1,000. He also needs Rs. 1,000 worth of retail signage and Rs. 2,000 worth of upgraded pottery equipment. Therefore, his initial investment is Rs. 14,000 (Rs. 4,000 + Rs. 6,000 + Rs. 1,000 + Rs. 1,000 + Rs. 2,000).

Consider his running expenses, beginning with the cost of producing his ceramics. He believes that he will require about Rs. 2,000 in resources to manufacture 100 new pieces per month. He expects to sell at least 80 pieces every month, averaging Rs. 100 per piece and totalling Rs. 8,000 in Earnings.

His cost of goods sold (COGS) is Rs. 2,000, which is deducted from his total income to yield a gross profit of Rs. 6,000 (Rs. 8,000 - Rs. 2,000 = Rs. 6,000). He must pay Rs. 2,000 in monthly rent, Rs. 500 in marketing, Rs. 1,000 for his one employee, Rs. 100 on his startup loan and another Rs. 500 for taxes, office supplies, and a business phone line from this.

The entire cost of his operations is Rs. 4,100 (Rs. 2,000 + Rs. 500 + Rs. 1,000 + Rs. 100 + Rs. 500). He has a net profit of Rs. 1,900 after subtracting these. COGS plus operating expenses equals his operating cost. As a result, his monthly running expenses are Rs. 6,100. The annual operating cost is Rs. 73,200 when multiplied by 12. His entire annual revenues are Rs. 96,000, leaving him with a net profit of Rs. 22,800.

What Effect does Operating Costs Percentage have on Profit?

High or rising operating costs can eat into a company's net profit. Management of a corporation seeks to stabilise or reduce operational costs while balancing the need to produce goods that meet Market needs. If the operational costs become too high, managers would need to raise the price of their products to retain profitability. They risk losing clients to competitors who can produce equivalent goods at a lower cost.

Conclusion

Looking at a company's OPEX has the disadvantage of being an absolute number rather than a ratio. As a result, even if two companies are in the same Industry, it is absurd to use it as a criterion to compare them. They can, however, be quite useful in the horizontal analysis because they can reflect the company's prior success.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.