FICO Score

What is FICO Score?

A FICO score is a Credit Score by the Fair Issac Corporation (FICO). This score is used by lenders when they want to assess the credit risk while lending money. The lender uses this score along with other details of the borrower and determines whether credit should be extended or not.

FICO is a major software company providing services to businesses and consumers alike. It is well-known for producing the consumer credit score for financial institutions. The score is useful when determining to lend money.

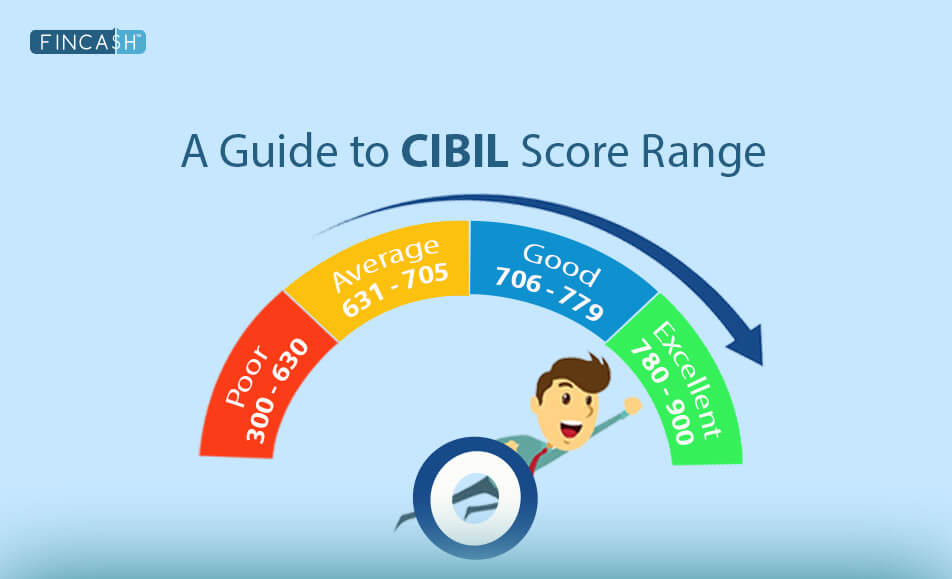

FICO Credit Score Range

FICO score ranges between 300 and 850. If a borrower has a FICO score between 670-739, the score indicated a Good Credit history. The borrower has high chances of getting the credit sanctioned. However, if the score is between 580-669, the chances of getting finance with a good interest rate fall drastically.

FICO scores are widely used while making credit decisions in the U.S. Having a low FICO score has proved to be a deal-breaker for many borrowers. Lenders in the mortgage Industry follow the FICO score standard very strictly. It is important for the borrowers to keep away from spending too much of their credit cards, paying debts late or applying for new credit cards wrongly. This affects the FICO score.

The FICO score is updated from time to time. The recent version is FICO score 8.

Talk to our investment specialist

Five Areas of FICO Score to Remember

In order to stay in the goodwill of a FICO score and maintain creditworthiness, the borrowers have to determine to take into five key areas:

- Payment history

- The current level of indebtedness

- Types of credit cards used

- New credit accounts

- Credit history length

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.