Defining Held-To-Maturity

Securities that are bought by businesses with the intent to hold them until maturity are known as Held-to-Maturity (HTM) securities. They differ from trading securities or securities open for sale as they are not held until maturity.

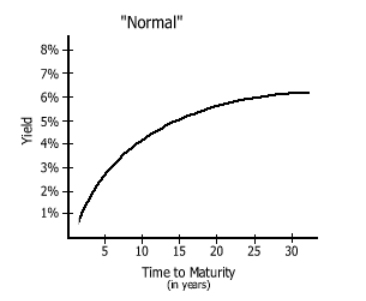

Companies mainly employ HTM securities to diversify their investment portfolios, insulate from interest rate Volatility, and create a modest, low-risk Capital Gain for a longer period. Debt instruments such as corporate or government Bonds typically make up the investments.

How do HTM Securities Work?

The most popular HTM investment types are bonds and other debt instruments. They are bought to be held until the maturity period and have predetermined payment schedules and fixed dates of maturation. Stocks aren't considered HTM securities as they lack a maturity date. Firms often divide their holdings in equity and debt into several groups for Accounting purposes. Other classifications include "available for sale" and "held for trading," in addition to HTM securities. These several categories are handled differently on a company's financial statements in terms of their investment value and any associated gains and losses.

Talk to our investment specialist

Advantages of HTM Securities

Here are the benefits associated with HTM securities:

- Typically, holding securities until maturity has very little risk. Returns are guaranteed if the bond issuer does not Default

- Since the returns on a bond are predetermined at the time of purchase, they are not sensitive to news events or Industry trends (i.e., the Face Value, coupon payments, and maturity date)

- Bonds are lower-Beta assets, allowing investors to diversify their Portfolio risks and plan their long-term investment portfolios

Cons of HTM Securities

Here are the disadvantages of HTM securities:

- Held-to-maturity securities impact the company's liquidity. Companies cannot rely on these assets to be sold if they need cash in the short term, as they commit to holding these securities till maturity

- As the returns on these securities are predetermined, there is also a limited upside potential while downside protection exists. The company's returns won't increase if financial markets rise overall

Held to Maturity Accounting Treatment

The accounting treatment of held-to-maturity securities and the other security kinds previously discussed is the main distinction between them. Held-to-maturity securities are recorded at the original cost rather than the Fair Market Value on the company's Balance Sheet and are updated accordingly. It implies that the securities' value on the company's balance sheet will not change from one accounting period to the next. Gains or losses arising from bonds and other debt instruments due to interest rate fluctuations get recorded when the securities mature.

Held to Maturity Example

Consider Apple buying a 10-year bond worth Rs. 1,000 and holding it till it matures. Apple will be paid 0.625% annually and get the bond's face amount, or Rs. 1,000, in ten years. Apple will earn an interest Income of 0.625%, or Rs. 6.25 annually, during the next ten years regardless of whether interest rates rise or decline.

Unrealised Gains and Losses on Held to Maturity Securities

Any unrealised gains and losses would not be reported to the income statement or balance sheet for held-to-maturity debt instruments because Fair Value measurement is not applicable. As the maturity value will equal the carrying amount on the balance sheet, there shouldn't be any realised gains or losses at maturity.

Conclusion

Only HTM securities with a one-year or a short maturity date are represented as current assets. Securities having maturities greater than just one year get classified as long-term assets. They are recorded at amortised cost, which includes the actual acquisition cost and all subsequent expenditures incurred up to that point. Temporary price changes for securities held to maturity do not show up in corporate accounting statements, in contrast to securities kept for trade. On accounting accounts, fair value is shown for securities that are both offered for sale and held for trading.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.