Table of Contents

Negative Bond Yield

What is a Negative Bond Yield?

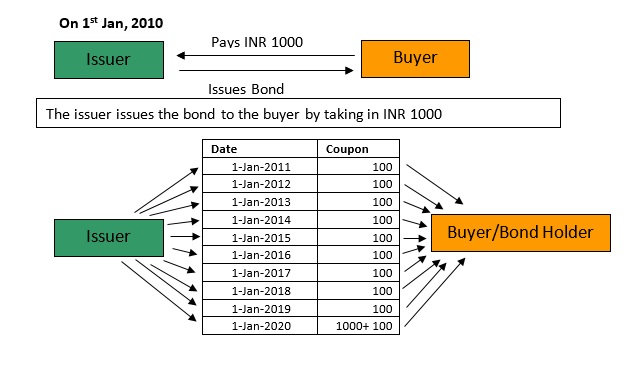

Negative Yielding Bond phenomenon occurs when the bond holder purchases the bond at a higher price than the amount they receive at the maturity of the bond. In other words, the negative bond yield is when the investor or bondholders end up paying the net amount at the maturity of the Bonds rather than getting the return on their investment through the interest. The bond can be defined as the investment instrument that is issued by private corporations or public companies to raise funds for a financial project. Those who are interested in buying these bonds are supposed to purchase them at the Face Value.

The investors that have purchased these bonds will earn a return on their investment through coupon rate every month or once in a quarter. Basically, this is the interest rate the company has to pay to each bondholder for keeping the bonds of the corporation. As long as the investor holds these bonds, they are paid the interest or coupon rate on their investment. Each bond has a specific maturity period. When this investment instrument reaches maturity, the company has to pay back the Capital amount to each investor. That’s when the investor gets the principal amount they had invested to purchase the bond.

When does Negative Yielding Bond Occur?

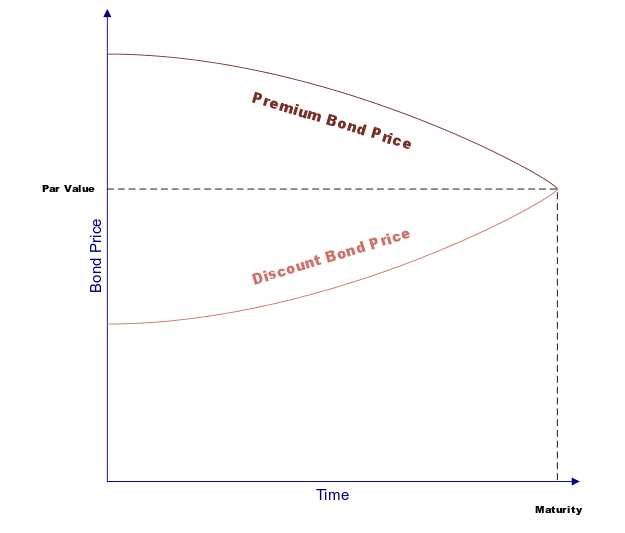

Like other instruments, the value of bonds can increase and plunge based on certain financial and economic factors. However, each bond has a face value, which is the initial price at which the investors purchase the bonds. The bond value can be INR 100 to 1000 (and more). Note that the bond Market can fluctuate the price of the bond.

They can price these bonds depending on a few factors, including the Economic Conditions, maturity period, the credibility of the organization issuing the bond, and the demand and supply factors. That means the price of the bonds could be higher or lower at the maturity. If that happens, the investor might not get the principal amount when they sell these bonds. This mainly happens when the bondholder keeps the bond for a long duration (5-10 years).

Talk to our investment specialist

Example of the Negative Yielding Bonds

There is a chance the bond you purchased for INR 90 will be sold for INR 100 at maturity. Now, a negative yield bonus occurs when the bondholder experiences a loss on the bond at maturity.

In simple terms, the investor doesn’t get back the principal amount they had invested when buying the bonds. For example, the investor might purchase the bonds for INR 110 (face value) and get only INR 100 when they resell these bonds at maturity. However, the investment will be considered the negative-yielding only when the interest or coupon they earned before the maturity period does not cover the loss.

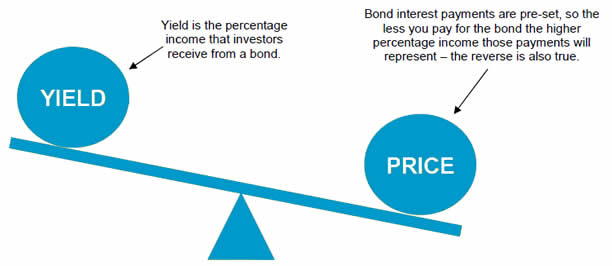

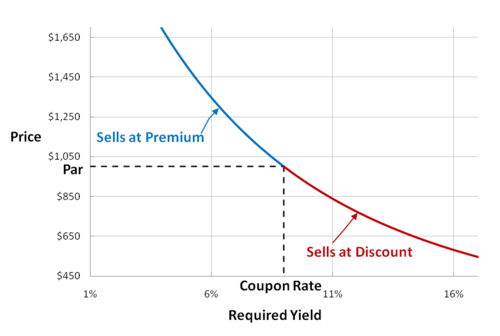

Note that the price movement of the bond has an inverse relation to the interest or coupon rate. That’s because bonds happen to be fixed-rate investment, which is why most investors trade their bonds if they anticipate a high-interest rate.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.