Table of Contents

Net Interest Income in Banks

A Bank's Net Interest Income (NII), which is a metric for measuring Financial Performance, indicates the difference between the income from its interest-bearing assets and the costs related to repaying its interest-bearing liabilities. All types of loans, personal and business, mortgages, and securities make up the assets of a conventional bank. Customer deposits that bear interest make up the liabilities.

Net interest income is the amount of money that comes in from interest on assets that is more than what is paid out in interest on deposits.

Importance of Net Interest Income

Here are some key benefits of NII:

- It is a gauge of financial performance—net interest margins increase in an Economy where interest rates are rising, and vice versa

- With the aid of NII, you can comprehend the quality of the loan Portfolio, the impact of interest rate alterations on the bank's profitability, etc

- Investors interested in bank stocks can analyse the bank's financials by examining the NII.

- Since Non-Performing Assets (NPAs) significantly impact a bank's NII, this metric can also be used to gauge the bank's asset quality

Talk to our investment specialist

Net Interest Income Formula

The bank receives interest payments on loans that are still outstanding, which generates interest income. It is determined as,

Interest Income = Financial Asset * Effective Interest Rate

The cost a lender offers to the borrower during a financing transaction is known as interest expense. It is more specifically the interest that builds up on unpaid liabilities.

Interest Expense = Effective Interest Rate * Financial Liability

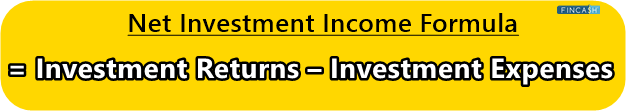

Net Interest Income is determined as follows: Interest earned minus interest paid equals net interest income. The mathematical net interest income formula is:

Net Interest Income = Interest earned - Interest paid

Difference between interest income and the amount paid to lenders:

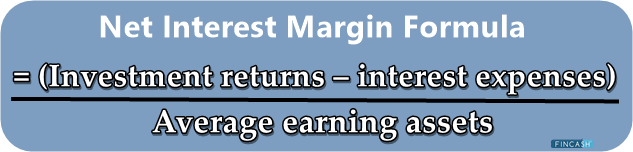

net interest margin = (Interest Revenue - Interest Expense) / Average Earning Assets

Factors Leading to Variations in NII

Here are the factors that cause variations in NII:

- Variable-rate assets and liabilities are more susceptible to interest rate changes, which has a higher impact on the NII

- A rise in interest rates may cause interest income to climb more than interest expenses if the spread between rate-sensitive assets and liabilities widens, pushing the NII value higher. The opposite is also true

- Changes in the bank's NPAs impact the NII too

Net Interest Income Examples

Suppose a bank earns Rs. 50 million in interest if its portfolio of loans totals Rs.1 billion and earns an average interest rate of 5%.

On the liabilities side, the bank's interest expenditure would be Rs. 24 million if it had Rs. 1.2 billion in outstanding client deposits generating 2% interest.

Net Interest Income = Interest earned - Interest paid

Net interest income for the bank will be = Rs. 50 million - Rs. 24 million

Net interest income = Rs. 26 million

Conclusion

Even while a bank's assets can generate more interest than its obligations, that does not necessarily imply that it is profitable. Such other businesses and banks have extra costs like utilities, rent, employee compensation, and salaries for management. The final result can be negative after deducting these costs from net interest income.

However, banks may also generate income from sources other than interest on loans, like fees from investment banking or consulting services. When assessing a bank's profitability, investors should consider non-interest income and expenses in addition to net interest income.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.