Table of Contents

- Negative Interest Rate Example

- Negative Interest Rate in India

- Negative Interest Rate Countries 2021

- How does Negative Interest Rate Work?

- Negative Interest Rates on Savings

- Negative Interest Rate Loan

- Significant Consequences of Negative Interest Rate

- Why Would Central Banks Use Negative Interest Rate Policies (NIRP) to Stimulate the Economy?

- The Bottom Line

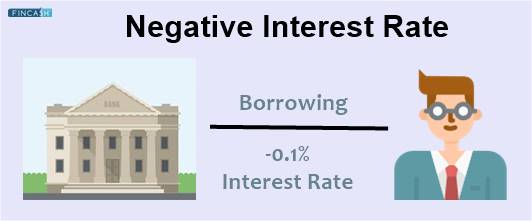

Defining Negative Interest Rate

A negative interest rate is defined as an interest provided to borrowers. Central banks use these rates to encourage borrowing during economic downturns. With the help of a negative interest rate, the Reserve Bank of India (RBI) lowers the total cost of borrowing in the Economy to increase economic activity through more significant investment and consumer expenditure.

In other words, this monetary policy tool implies lenders will pay interest to borrowers and will earn interest on money saved.

Negative Interest Rate Example

To safeguard the local export Industry against an increase in the currency rate, the Japanese central bank, for example, cut interest rates in 2016 and imposed a % levy on any reserves placed with the central bank. This is an example of negative interest rates being used as a monetary policy tool.

Negative Interest Rate in India

Retail Inflation is expected to reach 5.3% in 2021-22, according to the Reserve Bank of India's most recent monetary policy review. The Real Rate of Return on an investment is the actual rate of return less the current inflation rate.

Real Interest Rate = Return gained - Rate of inflation throughout the time of investment

Consider SBI's one-year FD, which now pays 5% interest. If inflation in the next year is 5.3%, the real rate of interest you get on your money will be -0.3%.

Talk to our investment specialist

Negative Interest Rate Countries 2021

As the globe is presently experiencing a worldwide pandemic, all economies are in a unique position to prevent their economies from collapsing and, as a result, are modifying their monetary policies to suit the times. Switzerland (-0.75%), Denmark (-0.50%), and Japan (-0.1%) are the countries currently experiencing negative interest rates.

How does Negative Interest Rate Work?

An interest rate effectively represents the cost of borrowing. This implies that when borrowers take out any debt, such as a loan or a mortgage, lenders charge them interest. Lenders have been known to compensate borrowers when they take out a loan. This is known as a negative interest rate environment.

In banking scenarios, negative interest rates work upside down. Instead of a bank paying you to keep your money in a Savings Account or a Certificate of Deposit (CD), you'll have to pay them to keep it. And instead of paying interest on a loan, you'll make some money with negative rates if you go out and buy a car.

Negative Interest Rates on Savings

When there is a negative interest rate on savings, the central bank will charge negative interest. Depositors will be required to pay regularly to maintain their money with the bank in this case. This occurs in a negative interest rate environment.

Negative Interest Rate Loan

Borrowing money from a bank becomes less costly when the bank rate is dropped. When interest rates are low or negative, financial institutions are more inclined to charge customers reduced interest rates on loans. Customers will then spend this money on products and services, contributing to economic development and inflation. Lower interest rates usually result in a lower exchange rate.

Significant Consequences of Negative Interest Rate

The overnight rate is when the RBI loans to commercial banks daily. Banks are encouraged to borrow more with this rate since they are paid interest on their borrowings. This also enables banks to expand their lending. Similarly, the meagre cost of borrowing attracts individuals and businesses, leading to increased investment and consumption expenditure.

Companies can also borrow money at negative interest rates to increase their cash balances. However, this rate impacts the exchange rate, depreciating the currency and raising demand for local goods in international markets.

Increased borrowing and spending in the economy and higher exports increase aggregate demand, and the economy emerges from Recession. In short, Negative interest rates make Income on deposits and savings negligible; instead, charges are imposed, making saving unappealing. This, in turn, encourages individuals and businesses to spend more rather than savings.

Negative (or near to zero) interest rate Bonds are unappealing to investors. They often seek safer, income-producing products, like stocks, when the RBI decreases the overnight rate to zero or below.

Why Would Central Banks Use Negative Interest Rate Policies (NIRP) to Stimulate the Economy?

The fear of a deflationary spiral is quite common among monetary policymakers. People and companies prefer to hang on to their cash during difficult economic times, such as deep economic recessions or depressions while waiting for the economy to revive.

On the other hand, this conduct can exacerbate the economy's weakening since a lack of spending leads to greater job losses, reduced Earnings, and price declines, all of which worsen people's anxieties and encourage them to hoard even more.

Prices decrease as consumption slows even further, creating another reason for people to wait until prices fall even further, and so on. The Negative Interest Rate Policies (NIRP) is a technique to stimulate business borrowing and investment while discouraging cash hoarding when central banks have already dropped interest rates to zero.

For instance, in 2016, the Japanese central bank decreased the interest rate. It announced a 0.1% levy on any reserves placed in the central bank to safeguard the domestic export industry from a rise in the currency rate. This is an example of monetary policy utilizing negative interest rates.

The Bottom Line

Negative interest rates are a monetary policy in which interest rates are set to be less than 0%. When there are vital signs of deflation, central banks and regulators deploy this uncommon policy instrument. Instead of collecting interest, commercial banks are charged interest to maintain funds with a country's central bank when interest rates are negative. Consumers and companies should presumably benefit from this dynamic. On the other hand, commercial banks are often hesitant to pass negative interest rates on to their consumers.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.