What is Par?

Par is known as the short form of the par value that can be referred to as preferred stocks, Bonds, or common stock with varying meanings based on the context. Most commonly, par signifies bonds; wherein, it means the Face Value.

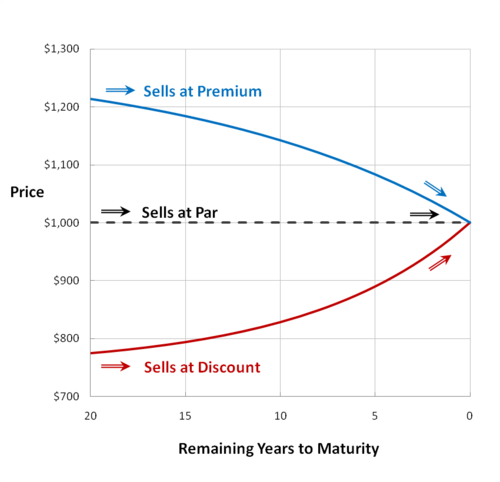

A bond can trade below or above par, indicating the wider interest rate environment and the apparent creditworthiness of the issuer.

Understanding Par

Bonds

In the most common use, par value gets applied to bonds. The term is referred to the bond’s face value, which is the value whereat the issuer gets to redeem the bond at its maturity. Also, the par value is used to calculate the coupon rate. Primarily, the coupon rate is different from the yield of the bond that fluctuates as per the prices of the bond. Most of the bonds are issued at par value; however, the same is not the case always. On secondary markets, often, bonds get traded above or below the par rate. In such a situation, there are no changes in the annual coupon payments. But the bonds get redeemed at the full face value.

Preferred Stock

Although a preferred stock is equity, it has resemblances to a debt instrument, which makes it hybrid security. Preferred stockholders have more priority over common shareholders as far as claiming the assets of a bankrupt company are concerned. Generally, this stock type pays high dividends, which has to be paid in full before a common stockholder can get his. For preferred stock, par value signifies the same meaning as for the bonds. Some of the issues turn callable; thus, meaning that the firm is allowed to rebuy them at the par value after a specific date.

Also, dividends are usually set according to the par value of the stock. In case a preferred stock is trading at a discount or a premium to par, the consequences are almost the same as that of the bond.

Talk to our investment specialist

Common Stock

In contrast to preferred stock and bonds, the par value of common stock, also referred to as ordinary shares, doesn’t have any bearing on the Market value. Progressively, common stock issues don’t have any par value. In fact, this value of common stock can somehow impact the tax treatment of a company. Not just that, but it also holds importance for callable common stock, which is comparatively a rare occasion.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.