Salvage Value

As per the Salvage Value meaning, it is referred to as the estimated Book Value of the given asset after experiencing complete Depreciation. It is ultimately based on what the given organization would expect receiving in exchange for the asset towards the end of its functional life. Therefore, the estimated salvage value of the asset serves to be a vital component when it comes to calculating the overall depreciation schedule.

The estimated salvage value can be easily determined for any given asset that the organization will be depreciating on the respective books over the passage of time. Every organization out there is known to have its specific standards for calculating salvage value. Some organizations might consider choosing to always undergo depreciation of the asset to zero value. This is because the given salvage value might be too minimal.

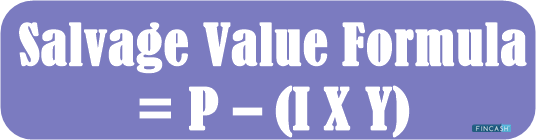

Salvage Value Formula

Salvage Value = P – (I X Y)

- P is the original price

- I is the depreciation

- Y is the number of years

Generally, salvage value is regarded as an important component as it will be carrying the overall value of the asset on the books of the company after depreciation has been expensed fully. It is ultimately depended on the value that an organization would expect to receive from the asset’s sales at the end of the functional life. In some typical cases, salvage value might just refer to the value that the organization believes it is capable of obtaining by selling some inoperable, depreciable asset for parts.

Talk to our investment specialist

Assumptions Regarding Depreciation & Salvage Value

Companies are known to take into consideration the respective matching principle while making assumptions for salvage value and asset depreciation. The matching principle serves to be the concept of accrual Accounting requiring a company to understand expense in the given period as linked revenues that might be earned. If the company would expect that the asset will be contributing to revenue for a longer period, it is going to have a long, functional life.

In case the organization is not sure of the functional life of the asset, it might forecast a reduced number of years along with a higher salvage value for carrying the assets on the respective books after complete depreciation or selling the asset at the salvage value. In case the organization wishes to front load the given Range of depreciation expenses, it could make use of some method of Accelerated Depreciation that is known to deduct increased upfront depreciation expenses. Most of the organizations out there are known to make use of the salvage value of nil amount as they believe that the utilization of the asset has completely matched the overall expense recognition with the given revenues across its functional life.

There are several forecasts required for creating depreciation schedules. Some of the common methods of depreciation are double-declining balance, declining balance, units of production, sum-of-years digits, and straight line. Each of the given method is known to require the overall consideration of the respective salvage value.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.