Table of Contents

Tail Risk Investment

As per the tail risk investment meaning, it is a type of Portfolio risk that occurs when the investment moves more than 3 standard deviations from the respective mean and tends to be greater than what gets revealed by some normal distribution.

Tail risks are known to feature events having a smaller probability of occurrence while occurring at both ends of the normal distribution curve.

Getting an Understanding of the Tail Risk Investments

Conventional portfolio strategies follow the overall idea that the respective Market returns follow the trends of normal distribution. However, as per the meaning of tail risk investments, it is suggested that the returns’ distribution does not tend to be normal, rather skewed –having thicker tails. The presence of thick tails indicates that there happens to be a probability –which could be minimal, that the investment may move beyond the value of 3 standard deviations.

Distributions that get characterized by thicker tails are mostly observed by analyzing the hedge fund returns.

Normal Distributions & Asset Returns

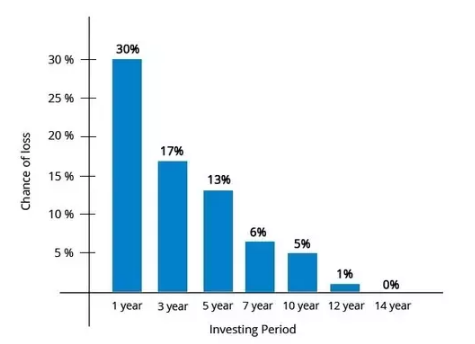

When the investment portfolio is put together, it is predicted that the returns’ distribution follow a pattern of normal distribution. Under the given assumption, the overall probability that the given returns will be moving between the 3 standard deviations and means, either positively or negatively, tends to be around 99.7 percent. This implies that the overall probability of the respective returns to move more than 3 standard deviations beyond the means would to be 0.3 percent.

The assumption that the market returns will be following the normal distribution serves to be the key to several financial markets –including the Black-Scholes Merton model for option pricing and the MPT(Modern Portfolio Theory) by Harry Markowitz. However, the given assumption is not known to properly reflect the respective market returns. Moreover, tail events are known to have a significant effect on the respective market returns.

Talk to our investment specialist

Other Distributions and the Respective Tails

Stock market returns follow the normal distribution having excessive kurtosis. Kurtosis serves to be an important statistical measure that is utilized for indicating whether or not observed data is following the light or heavy tailed distribution with respect to the given normal distribution. The normal distribution curve tends to feature kurtosis that is equivalent to three. Therefore, in case security follows the distribution having kurtosis more than three, then it is believed to have heavy tails.

A heavy-tailed or leptokurtic distribution is known to indicate situations under which extreme conditions tend to occur much more than the respective expectations. As such, the securities that tend to follow the given distribution have witnessed returns exceeding three standard deviations across the mean value above 0.3 percent of the outcomes that are observed.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.