Tangible Book Value Per Share (TBVP)

Tangible Book Value per share refers to the method where a firm's value is determined based on a per-share Basis by measuring the equity without including intangible assets. The intangible assets refer to those with no physical elements. This makes the process of valuation of intangible assets difficult.

The tangible book value of a firm refers to what common shareholders can expect to receive if the firm runs out of money and is forced to liquidate its assets at the book value price. Intangible assets like goodwill are not a part of the process since they can't be sold for cash during liquidation.

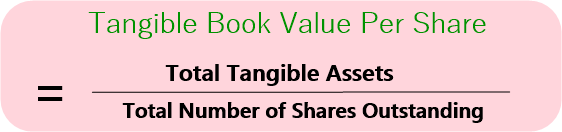

Tangible Book Value Per Share Formula

TBVPS = Total Tangible Assets / Total Number of Shares Outstanding

Why is TBVP Important?

It is important to keep the shareholders informed of what they are getting into. Moreover, it also helps with the pricing of assets bought and the materials used to produce them. For example, if a firm produces motorbikes, the completed motorbikes, unused parts of motorbikes, Raw Materials used to manufacture the bike are all part of TBVPs.

The selling price of these assets will be determined during the liquidation of the assets. Furthermore, equipment like machinery etc used to manufacture the goods is also part of TBVPs. Real Estate, computers, etc are all important when it comes to calculating the assets for liquidation.

Talk to our investment specialist

Drawbacks of TBVP

Critics say that since the book value is the ratio of the stockholder equity to the number of shares outstanding, it takes into account only the Accounting valuation. This is not an accurate reflection of the current Market valuation or of what could be the selling price of the product.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.