+91-22-48913909

+91-22-48913909

Table of Contents

6 सर्वोत्तम लिक्विड म्युच्युअल फंड 2022

सामान्य शब्दात,सर्वोत्तम लिक्विड फंड कर्ज आहेतम्युच्युअल फंड किंवा त्याऐवजीपैसा बाजार म्युच्युअल फंड फक्त गुंतवणुकीच्या कालावधीत फरक आहे.लिक्विड फंड खूप कमी पैशात गुंतवणूक कराबाजार सारखी साधनेठेव प्रमाणपत्र, ट्रेझरी बिले, व्यावसायिक कागदपत्रे इ.

या फंडांचा गुंतवणुकीचा कालावधी खूपच लहान असतो, साधारणपणे काही दिवसांपासून ते काही आठवड्यांपर्यंत (तो एक दिवसही असू शकतो!). लिक्विड फंडांची सरासरी अवशिष्ट मॅच्युरिटी 91 दिवसांपेक्षा कमी असते कारण ते सिक्युरिटीजमध्ये गुंतवणूक करतात ज्यांची वैयक्तिकरित्या मॅच्युरिटी 91 दिवसांपर्यंत असते. अल्पकालीन असल्यानेकर्ज निधी, हे फंड अल्प कालावधीसाठी कमी-जोखीम गुंतवणुकीसाठी शोधत असलेल्या गुंतवणूकदारांसाठी अत्यंत योग्य आहेत.

सर्वोत्कृष्ट लिक्विड फंडांचा कमी मॅच्युरिटी कालावधी निधी व्यवस्थापकांना पूर्ण करण्यास मदत करतोविमोचन गुंतवणूकदारांची मागणी सहज. बाजारात, विविध लिक्विड फंड गुंतवणूक उपलब्ध आहेत.

लिक्विड फंडात गुंतवणूक का करावी?

- लिक्विड फंडांना लॉक-इन किंवा खूप कमी लॉक-इन कालावधी नसतो.

- कमी मुदतीच्या कालावधीमुळे लिक्विड म्युच्युअल फंडाचा व्याजदर सर्व अल्पकालीन गुंतवणुकींमध्ये सर्वात कमी आहे.

- कोणतेही प्रवेश आणि निर्गमन भार लागू नाहीत.

- लिक्विड फंड हे गुंतवणूकदारांसाठी एक उत्तम उपाय आहे ज्यांना त्यांची निष्क्रिय रोकड अल्प कालावधीसाठी जोखीम न घेता ठेवायची आहे.भांडवली तोटा.

बचत बँक खात्यापेक्षा लिक्विड फंड चांगले?

गुंतवणूक लोकप्रिय बचतीमध्ये पैसे टाकण्यापेक्षा लिक्विड फंड्समध्ये गुंतवणुकीचा चांगला पर्याय आहेबँक खाते योजना.

बँक खाती जतन करण्याच्या त्याच्या परिचित आणि संस्थात्मक स्वरूपामुळे, सरासरी भारतीय करदात्याचा त्यांच्यावर अधिक विश्वास असतो. तथापि, असे दिसते की ते यापुढे सर्वात लोकप्रिय अल्पकालीन गुंतवणूक नाहीत. वेगवेगळ्या गुंतवणुकीची उद्दिष्टे असलेल्या गुंतवणुकदारांकडून म्युच्युअल फंडाची वाढती स्वीकृती हे कारण आहे. बचत बँक खात्यात असलेल्या तुमच्या कष्टाने कमावलेल्या पैशावर तुम्हाला वर्षाला फक्त ३.५% व्याज मिळते. तथापि, सर्वोत्तम लिक्विड फंडांनी मागील 1 वर्षाच्या कालावधीत वार्षिक सरासरी 6.5-7.5% इतका परतावा दिला आहे.आधार.

तर, केवळ परताव्यावर, लिक्विड फंड बचत बँक खात्यावर स्कोअर करतात. तुमच्याकडे वाढ किंवा बोनस येत असल्यास, लिक्विड फंडांमध्ये गुंतवणूक करा आणि नंतर पार्टी करा.

Talk to our investment specialist

6 सर्वोत्तम लिक्विड फंड भारत आर्थिक वर्ष 22 - 23

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Liquid Fund Growth ₹2,872.2

↑ 0.48 ₹42,867 0.7 1.9 3.7 7.3 7.4 7.17% 1M 9D 1M 9D LIC MF Liquid Fund Growth ₹4,664.06

↑ 0.77 ₹11,549 0.7 1.8 3.6 7.3 7.4 7.41% 1M 18D 1M 18D DSP BlackRock Liquidity Fund Growth ₹3,681.47

↑ 0.62 ₹22,387 0.7 1.9 3.6 7.3 7.4 0.12% 1M 10D 1M 17D Invesco India Liquid Fund Growth ₹3,544.35

↑ 0.60 ₹14,276 0.8 1.9 3.6 7.3 7.4 7.12% 1M 14D 1M 14D ICICI Prudential Liquid Fund Growth ₹381.917

↑ 0.06 ₹55,112 0.7 1.9 3.6 7.3 7.4 7.22% 1M 7D 1M 11D Aditya Birla Sun Life Liquid Fund Growth ₹415.483

↑ 0.07 ₹57,091 0.8 1.9 3.6 7.3 7.3 7.33% 1M 13D 1M 13D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Apr 25 द्रव वरील एयूएम/निव्वळ मालमत्ता असलेले निधी१०,000 कोटी आणि 5 किंवा अधिक वर्षांसाठी निधीचे व्यवस्थापन. वर क्रमवारी लावलीमागील 1 कॅलेंडर वर्षाचा परतावा.

To provide a high level of liquidity with reasonable returns commensurating with low risk through a portfolio of money market and debt securities. However there can be no assurance that the investment objective of the scheme will be achieved. Axis Liquid Fund is a Debt - Liquid Fund fund was launched on 9 Oct 09. It is a fund with Low risk and has given a Below is the key information for Axis Liquid Fund Returns up to 1 year are on An open ended scheme which seeks to generate reasonable returns with low risk and high liquidity through a judicious mix of investment in money market

instruments and quality debt instruments. However, there is no assurance that the investment objective of the Scheme will be realised. LIC MF Liquid Fund is a Debt - Liquid Fund fund was launched on 11 Mar 02. It is a fund with Low risk and has given a Below is the key information for LIC MF Liquid Fund Returns up to 1 year are on The Scheme seeks to generate reasonable returns commensurate with low risk from a portfolio constituted of money market and high quality debts DSP BlackRock Liquidity Fund is a Debt - Liquid Fund fund was launched on 23 Nov 05. It is a fund with Low risk and has given a Below is the key information for DSP BlackRock Liquidity Fund Returns up to 1 year are on To provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through a portfolio of money market and debt securities. Invesco India Liquid Fund is a Debt - Liquid Fund fund was launched on 17 Nov 06. It is a fund with Low risk and has given a Below is the key information for Invesco India Liquid Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Liquid Plan) To provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through investments made primarily in money market and debt securities. ICICI Prudential Liquid Fund is a Debt - Liquid Fund fund was launched on 17 Nov 05. It is a fund with Low risk and has given a Below is the key information for ICICI Prudential Liquid Fund Returns up to 1 year are on (Erstwhile Aditya Birla Sun Life Cash Plus Fund) An Open-ended liquid scheme with the objective to provide reasonable returns at a high level of safety and liquidity through judicious investments in high quality debt and money market instruments. Aditya Birla Sun Life Liquid Fund is a Debt - Liquid Fund fund was launched on 30 Mar 04. It is a fund with Low risk and has given a Below is the key information for Aditya Birla Sun Life Liquid Fund Returns up to 1 year are on 1. Axis Liquid Fund

CAGR/Annualized return of 7% since its launch. Ranked 21 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7.1% and 2022 was 4.9% . Axis Liquid Fund

Growth Launch Date 9 Oct 09 NAV (20 Apr 25) ₹2,872.2 ↑ 0.48 (0.02 %) Net Assets (Cr) ₹42,867 on 28 Feb 25 Category Debt - Liquid Fund AMC Axis Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.23 Sharpe Ratio 3.92 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.17% Effective Maturity 1 Month 9 Days Modified Duration 1 Month 9 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,358 31 Mar 22 ₹10,710 31 Mar 23 ₹11,322 31 Mar 24 ₹12,142 31 Mar 25 ₹13,034 Returns for Axis Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Apr 25 Duration Returns 1 Month 0.7% 3 Month 1.9% 6 Month 3.7% 1 Year 7.3% 3 Year 6.8% 5 Year 5.5% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2023 7.4% 2022 7.1% 2021 4.9% 2020 3.3% 2019 4.3% 2018 6.6% 2017 7.5% 2016 6.7% 2015 7.6% 2014 8.4% Fund Manager information for Axis Liquid Fund

Name Since Tenure Devang Shah 5 Nov 12 12.41 Yr. Aditya Pagaria 13 Aug 16 8.64 Yr. Sachin Jain 3 Jul 23 1.75 Yr. Data below for Axis Liquid Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 99.82% Other 0.18% Debt Sector Allocation

Sector Value Cash Equivalent 73.61% Corporate 16.99% Government 9.21% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity India (Republic of)

- | -5% ₹2,218 Cr 225,000,000

↑ 225,000,000 91 Days Tbill

Sovereign Bonds | -4% ₹1,770 Cr 178,500,000 Canara Bank

Domestic Bonds | -3% ₹1,474 Cr 30,000

↑ 30,000 Export-Import Bank of India

Commercial Paper | -3% ₹1,449 Cr 29,500

↑ 29,500 India (Republic of)

- | -3% ₹1,280 Cr 130,000,000

↑ 130,000,000 National Bank for Agriculture and Rural Development

Commercial Paper | -3% ₹1,213 Cr 24,700

↑ 24,700 91 DTB 28032025

Sovereign Bonds | -3% ₹1,198 Cr 120,000,000 Reliance Retail Ventures Limited

Commercial Paper | -2% ₹1,011 Cr 20,500

↓ -500 HDFC Bank Ltd.

Debentures | -2% ₹983 Cr 20,000

↑ 20,000 Bank Of Baroda

Certificate of Deposit | -2% ₹983 Cr 20,000

↑ 20,000 2. LIC MF Liquid Fund

CAGR/Annualized return of 6.9% since its launch. Ranked 25 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.7% . LIC MF Liquid Fund

Growth Launch Date 11 Mar 02 NAV (20 Apr 25) ₹4,664.06 ↑ 0.77 (0.02 %) Net Assets (Cr) ₹11,549 on 15 Mar 25 Category Debt - Liquid Fund AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating ☆☆☆ Risk Low Expense Ratio 0.24 Sharpe Ratio 3.53 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.41% Effective Maturity 1 Month 18 Days Modified Duration 1 Month 18 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,355 31 Mar 22 ₹10,700 31 Mar 23 ₹11,295 31 Mar 24 ₹12,105 31 Mar 25 ₹12,989 Returns for LIC MF Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Apr 25 Duration Returns 1 Month 0.7% 3 Month 1.8% 6 Month 3.6% 1 Year 7.3% 3 Year 6.8% 5 Year 5.4% 10 Year 15 Year Since launch 6.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 7.4% 2022 7% 2021 4.7% 2020 3.3% 2019 4.3% 2018 6.5% 2017 7.3% 2016 6.6% 2015 7.6% 2014 8.4% Fund Manager information for LIC MF Liquid Fund

Name Since Tenure Rahul Singh 5 Oct 15 9.49 Yr. Data below for LIC MF Liquid Fund as on 15 Mar 25

Asset Allocation

Asset Class Value Cash 99.76% Other 0.24% Debt Sector Allocation

Sector Value Cash Equivalent 75.98% Corporate 18.6% Government 5.18% Credit Quality

Rating Value AA 1.69% AAA 98.31% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Bank Ltd.

Certificate of Deposit | -4% ₹420 Cr 8,500 91 Days Tbill Red 08-05-2025

Sovereign Bonds | -3% ₹396 Cr 40,000,000 Birla Group Holdings Private Limited

Commercial Paper | -3% ₹393 Cr 8,000

↑ 8,000 India (Republic of)

- | -3% ₹345 Cr 35,000,000

↑ 35,000,000 National Bk For Agriculture & Rural Dev. **

Net Current Assets | -3% ₹319 Cr 6,500

↑ 6,500 LIC Housing Finance Ltd

Commercial Paper | -3% ₹300 Cr 6,000

↑ 6,000 91 DTB 17042025

Sovereign Bonds | -3% ₹298 Cr 30,000,000

↓ -10,000,000 Motilal Oswal Financial Services Limited

Commercial Paper | -3% ₹295 Cr 6,000 Net Receivables / (Payables)

CBLO | -2% ₹248 Cr 91 Days Tbill

Sovereign Bonds | -2% ₹248 Cr 25,000,000 3. DSP BlackRock Liquidity Fund

CAGR/Annualized return of 6.9% since its launch. Ranked 36 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.8% . DSP BlackRock Liquidity Fund

Growth Launch Date 23 Nov 05 NAV (18 Apr 25) ₹3,681.47 ↑ 0.62 (0.02 %) Net Assets (Cr) ₹22,387 on 28 Feb 25 Category Debt - Liquid Fund AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk Low Expense Ratio 0.24 Sharpe Ratio 4.73 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 0.12% Effective Maturity 1 Month 17 Days Modified Duration 1 Month 10 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,345 31 Mar 22 ₹10,694 31 Mar 23 ₹11,295 31 Mar 24 ₹12,107 31 Mar 25 ₹12,995 Returns for DSP BlackRock Liquidity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Apr 25 Duration Returns 1 Month 0.7% 3 Month 1.9% 6 Month 3.6% 1 Year 7.3% 3 Year 6.8% 5 Year 5.4% 10 Year 15 Year Since launch 6.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 7.4% 2022 7% 2021 4.8% 2020 3.3% 2019 4.2% 2018 6.5% 2017 7.4% 2016 6.6% 2015 7.6% 2014 8.3% Fund Manager information for DSP BlackRock Liquidity Fund

Name Since Tenure Karan Mundhra 31 May 21 3.84 Yr. Shalini Vasanta 1 Aug 24 0.66 Yr. Data below for DSP BlackRock Liquidity Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 99.8% Other 0.2% Debt Sector Allocation

Sector Value Cash Equivalent 71.14% Corporate 26.78% Government 1.88% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Treps / Reverse Repo Investments

CBLO/Reverse Repo | -9% ₹1,921 Cr 19,206,454,979

↑ 19,206,454,979 91 DTB 10042025

Sovereign Bonds | -3% ₹622 Cr 62,500,000

↑ 2,500,000 Canara Bank

Certificate of Deposit | -3% ₹615 Cr 12,500

↑ 12,500 Union Bank of India

Domestic Bonds | -3% ₹541 Cr 11,000

↑ 11,000 Punjab National Bank

Certificate of Deposit | -2% ₹523 Cr 10,500 Bank Of Baroda

Certificate of Deposit | -2% ₹495 Cr 10,000 National Bank For Agriculture And Rural Development

Commercial Paper | -2% ₹494 Cr 10,000 HDFC Bank Limited

Certificate of Deposit | -2% ₹492 Cr 10,000 Bank of Baroda

Debentures | -2% ₹492 Cr 10,000

↑ 10,000 91 Days Tbill

Sovereign Bonds | -2% ₹471 Cr 47,500,000 4. Invesco India Liquid Fund

CAGR/Annualized return of 7.1% since its launch. Ranked 9 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.8% . Invesco India Liquid Fund

Growth Launch Date 17 Nov 06 NAV (18 Apr 25) ₹3,544.35 ↑ 0.60 (0.02 %) Net Assets (Cr) ₹14,276 on 28 Feb 25 Category Debt - Liquid Fund AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆☆ Risk Low Expense Ratio 0.22 Sharpe Ratio 4.35 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 7.12% Effective Maturity 1 Month 14 Days Modified Duration 1 Month 14 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,351 31 Mar 22 ₹10,700 31 Mar 23 ₹11,302 31 Mar 24 ₹12,117 31 Mar 25 ₹13,004 Returns for Invesco India Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Apr 25 Duration Returns 1 Month 0.8% 3 Month 1.9% 6 Month 3.6% 1 Year 7.3% 3 Year 6.8% 5 Year 5.4% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 7.4% 2022 7% 2021 4.8% 2020 3.3% 2019 4.1% 2018 6.5% 2017 7.4% 2016 6.7% 2015 7.6% 2014 8.4% Fund Manager information for Invesco India Liquid Fund

Name Since Tenure Krishna Cheemalapati 25 Apr 11 13.86 Yr. Prateek Jain 14 Feb 22 3.04 Yr. Data below for Invesco India Liquid Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 99.77% Other 0.23% Debt Sector Allocation

Sector Value Cash Equivalent 77.9% Corporate 20.76% Government 1.11% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Limited

Commercial Paper | -4% ₹500 Cr 50,000,000 91 DTB 30052025

Sovereign Bonds | -4% ₹489 Cr 49,500,000

↓ -500,000 91 Days Tbill Red 24-04-2025

Sovereign Bonds | -4% ₹482 Cr 48,500,000

↓ -1,000,000 Triparty Repo

CBLO/Reverse Repo | -3% ₹417 Cr 182 Days Tbill (Md 01/05/2025)

Sovereign Bonds | -3% ₹347 Cr 35,000,000 Union Bank Of India

Certificate of Deposit | -2% ₹300 Cr 30,000,000

↑ 30,000,000 Larsen & Toubro Ltd.

Commercial Paper | -2% ₹300 Cr 30,000,000

↑ 30,000,000 Axis Bank Ltd.

Certificate of Deposit | -2% ₹296 Cr 30,000,000 HDFC Bank Limited

Certificate of Deposit | -2% ₹295 Cr 30,000,000 91 Days Tbill Red 08-05-2025

Sovereign Bonds | -2% ₹292 Cr 29,461,600 5. ICICI Prudential Liquid Fund

CAGR/Annualized return of 7.1% since its launch. Ranked 20 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.8% . ICICI Prudential Liquid Fund

Growth Launch Date 17 Nov 05 NAV (20 Apr 25) ₹381.917 ↑ 0.06 (0.02 %) Net Assets (Cr) ₹55,112 on 28 Feb 25 Category Debt - Liquid Fund AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.29 Sharpe Ratio 3.63 Information Ratio -2.39 Alpha Ratio -0.09 Min Investment 500 Min SIP Investment 99 Exit Load NIL Yield to Maturity 7.22% Effective Maturity 1 Month 11 Days Modified Duration 1 Month 7 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,360 31 Mar 22 ₹10,706 31 Mar 23 ₹11,304 31 Mar 24 ₹12,115 31 Mar 25 ₹13,001 Returns for ICICI Prudential Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Apr 25 Duration Returns 1 Month 0.7% 3 Month 1.9% 6 Month 3.6% 1 Year 7.3% 3 Year 6.8% 5 Year 5.4% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 7.4% 2022 7% 2021 4.8% 2020 3.2% 2019 4.3% 2018 6.6% 2017 7.4% 2016 6.6% 2015 7.7% 2014 8.3% Fund Manager information for ICICI Prudential Liquid Fund

Name Since Tenure Nikhil Kabra 1 Dec 23 1.33 Yr. Darshil Dedhia 12 Jun 23 1.8 Yr. Data below for ICICI Prudential Liquid Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 99.76% Other 0.24% Debt Sector Allocation

Sector Value Cash Equivalent 63.73% Corporate 23.51% Government 12.52% Credit Quality

Rating Value AA 0.24% AAA 99.76% Top Securities Holdings / Portfolio

Name Holding Value Quantity India (Republic of)

- | -7% ₹3,939 Cr 400,000,000

↑ 400,000,000 HDFC Bank Limited

Certificate of Deposit | -3% ₹1,849 Cr 37,000 Small Industries Development Bank Of India

Commercial Paper | -3% ₹1,498 Cr 30,000 Net Current Assets

Net Current Assets | -3% -₹1,494 Cr IDBI Bank Limited

Certificate of Deposit | -3% ₹1,483 Cr 30,000 India (Republic of)

- | -3% ₹1,479 Cr 150,000,000

↑ 150,000,000 HDFC Bank Limited

Certificate of Deposit | -2% ₹1,330 Cr 27,000 National Bank For Agriculture And Rural Development

Commercial Paper | -2% ₹1,286 Cr 26,000 Punjab National Bank

Certificate of Deposit | -2% ₹1,231 Cr 25,000 91 Days Tbill Red 08-05-2025

Sovereign Bonds | -2% ₹1,144 Cr 115,500,000 6. Aditya Birla Sun Life Liquid Fund

CAGR/Annualized return of 7% since its launch. Ranked 15 in Liquid Fund category. Return for 2024 was 7.3% , 2023 was 7.1% and 2022 was 4.8% . Aditya Birla Sun Life Liquid Fund

Growth Launch Date 30 Mar 04 NAV (17 Apr 25) ₹415.483 ↑ 0.07 (0.02 %) Net Assets (Cr) ₹57,091 on 28 Feb 25 Category Debt - Liquid Fund AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Low Expense Ratio 0.34 Sharpe Ratio 3.8 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 7.33% Effective Maturity 1 Month 13 Days Modified Duration 1 Month 13 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,364 31 Mar 22 ₹10,714 31 Mar 23 ₹11,323 31 Mar 24 ₹12,137 31 Mar 25 ₹13,026 Returns for Aditya Birla Sun Life Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Apr 25 Duration Returns 1 Month 0.8% 3 Month 1.9% 6 Month 3.6% 1 Year 7.3% 3 Year 6.8% 5 Year 5.5% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2023 7.3% 2022 7.1% 2021 4.8% 2020 3.3% 2019 4.3% 2018 6.7% 2017 7.4% 2016 6.7% 2015 7.7% 2014 8.4% Fund Manager information for Aditya Birla Sun Life Liquid Fund

Name Since Tenure Sunaina Cunha 15 Jul 11 13.72 Yr. Kaustubh Gupta 15 Jul 11 13.72 Yr. Sanjay Pawar 1 Jul 22 2.75 Yr. Data below for Aditya Birla Sun Life Liquid Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 98.6% Debt 1.19% Other 0.21% Debt Sector Allocation

Sector Value Cash Equivalent 82.67% Corporate 15.83% Government 1.28% Credit Quality

Rating Value AA 0.12% AAA 99.88% Top Securities Holdings / Portfolio

Name Holding Value Quantity Net Receivables / (Payables)

CBLO | -9% -₹4,821 Cr 91 Days Tbill

Sovereign Bonds | -4% ₹1,984 Cr 200,000,000 91 DTB 10042025

Sovereign Bonds | -2% ₹1,259 Cr 126,500,000 Reliance Industries Limited

Commercial Paper | -2% ₹1,247 Cr 25,000 91 Days Tbill Red 24-04-2025

Sovereign Bonds | -2% ₹1,241 Cr 125,000,000 Punjab National Bank

Domestic Bonds | -2% ₹1,230 Cr 25,000

↑ 25,000 HDFC Bank Limited

Certificate of Deposit | -2% ₹1,207 Cr 24,500

↓ -500 91 DTB 30052025

Sovereign Bonds | -2% ₹1,125 Cr 114,017,700 National Bank For Agriculture And Rural Development

Commercial Paper | -2% ₹1,015 Cr 20,500

↑ 500 Reliance Retail Ventures Limited

Commercial Paper | -2% ₹998 Cr 20,000

लिक्विड म्युच्युअल फंडाचे मूल्यांकन कसे करावे?

लिक्विड म्युच्युअल फंड शोधत असताना, फक्त मागील परतावा नसावाघटक विचारासाठी. इतर घटक जसे की निधीचा आकार, ट्रॅक रेकॉर्ड, क्रेडिट गुणवत्ताअंतर्निहित सिक्युरिटीज देखील लक्षात ठेवल्या पाहिजेत.

1. गुंतवणूक योजना

लिक्विड फंड वेगवेगळ्या योजनांसह येतात जसे दैनिक लाभांश योजना, साप्ताहिक लाभांश योजना, मासिक लाभांश योजना आणि वाढ योजना. वाढीच्या पर्यायामध्ये, योजनेद्वारे झालेला नफा त्यात परत गुंतवला जातो. याचा परिणाम होतोनाही योजनेचे (नेट अॅसेट व्हॅल्यू) कालांतराने वाढत आहे. लाभांश पर्यायामध्ये, फंडाने केलेला नफा पुन्हा गुंतवला जात नाही. ला लाभांश वितरित केला जातोगुंतवणूकदार वेळोवेळी. गुंतवणूकदार त्यांच्या सोयीनुसार त्यांची योजना निवडू शकतात आणितरलता गरजा

2. खर्चाचे प्रमाण

म्युच्युअल फंड तुमचे फंड व्यवस्थापित करण्यासाठी शुल्क आकारतात ज्याला एक्सपेन्स रेशो म्हणतात. नुसारसेबी मानदंड, खर्च गुणोत्तराची वरची मर्यादा आहे2.25%. लिक्विड फंडांच्या बाबतीत, ते कमी कालावधीत तुलनेने जास्त परतावा देण्यासाठी कमी खर्चाचे प्रमाण राखतात.

3. गुंतवणूक होरायझन

तुमच्या गुंतवणुकीच्या क्षितिजाचे नियोजन करा. लिक्विड फंड हे केवळ 91 दिवसांच्या अगदी कमी कालावधीत अतिरिक्त रोख गुंतवणूक करण्यासाठी असतात. त्यामुळे, तुमच्याकडे निष्क्रिय रोख असल्यास, तुम्ही येथे अल्प कालावधीसाठी गुंतवणूक करू शकता आणि बँकेपेक्षा चांगला परतावा मिळवू शकताबचत खाते. जर तुमच्याकडे 1 वर्षापर्यंतची गुंतवणूक क्षितिज जास्त असेल, तर तुलनेने जास्त परतावा मिळविण्यासाठी तुम्ही कमी कालावधीच्या फंडांमध्ये गुंतवणूक करण्याचा विचार करू शकता.

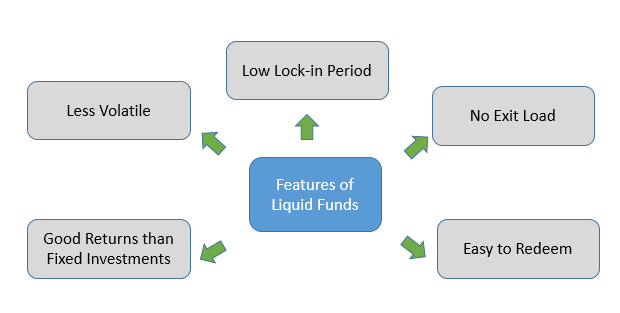

लिक्विड म्युच्युअल फंडाची वैशिष्ट्ये

1. लिक्विड म्युच्युअल फंडाचा एक्झिट लोड

लिक्विड म्युच्युअल फंड ही कमी मॅच्युरिटी कालावधी असलेली अल्प-मुदतीची गुंतवणूक आहे हे लक्षात घेऊन, या श्रेणीतील बहुतांश फंड रिडेम्पशनवर कोणतेही एक्झिट लोड आकारत नाहीत. तसेच, जर तेथे कोणतेही एक्झिट लोड असेल, तर ते अगदी नाममात्र असते आणि सामान्यतः एका आठवड्यापेक्षा जास्त नसते. लिक्विड फंडांमध्ये साधारणपणे एक्झिट लोड नसतो कारण ते खूप कमी गुंतवणूक उत्पादने असतात.

2. लिक्विड फंड गुंतवणुकीची अस्थिरता

साधारणपणे, लिक्विड फंडाची अस्थिरता कमी असते कारण गुंतवणूक काही दिवस ते आठवडे टिकते. त्यामुळे गुंतवणुकीत नुकसान होण्याचा धोका खूपच कमी आहे. तथापि, नुकसानीची संधी टाळण्यासाठी बाजाराची स्थिती लक्षात घेऊन लिक्विड फंड गुंतवणूक करण्याचे सुचवले आहे.

3. सर्वोत्तम लिक्विड फंडांचा लॉक-इन कालावधी

लिक्विड म्युच्युअल फंड हे अल्पकालीन गुंतवणुकीचे पर्याय आहेत हे लक्षात घेता, लिक्विड फंडांना कोणताही लॉक-इन कालावधी नसतो. लिक्विड फंड्स एक दिवसाच्या कमी कालावधीसाठी दोन आठवड्यांपर्यंत गुंतवले जाऊ शकतात.

4. लिक्विड फंड परतावा

लिक्विड फंड हा उच्च कालावधीत सर्वोत्तम अल्पकालीन गुंतवणूक आहेमहागाई कालावधी उच्च चलनवाढीच्या काळात लिक्विड फंडावरील व्याजदर जास्त असतो. अशा प्रकारे, लिक्विड म्युच्युअल फंडांना चांगला परतावा मिळण्यास मदत होते. बँक मुदत ठेवी किंवा बचत खात्यांसारख्या इतर पारंपारिक गुंतवणुकीपेक्षा लिक्विड फंडाचा परतावा सहसा जास्त असतो. तथापि, तुमच्या गरजेनुसार योग्य पर्याय (वृद्धी, लाभांश पेआउट, लाभांश री-गुंतवणूक) निवडून सर्वोत्तम लिक्विड फंडांमध्ये गुंतवणूक करण्याचा सल्ला दिला जातो.

5. लिक्विड फंड कर आकारणी

साधारणपणे, लिक्विड फंड रिटर्न्स लाभांशाच्या रूपात मिळतात त्यावर गुंतवणूकदारांच्या हातात कर आकारला जात नाही. तथापि, म्युच्युअल फंड कंपनीकडून अंदाजे २८% लाभांश वितरण कर (DDT) वजा केला जातो. शिवाय, ज्या गुंतवणूकदारांनी वाढीचा पर्याय निवडला आहे त्यांच्यासाठी अल्पकालीनभांडवली लाभ व्यक्तीच्या कर स्लॅबनुसार कर कापला जातो. हा करवजावट बचत खात्याप्रमाणेच आहे.

लिक्विड फंड्समध्ये ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

लिक्विड फंडांबद्दल जागरूकता नसल्यामुळे, लोक त्यामध्ये गुंतवणूक करत नाहीत आणि त्याऐवजी बचत खात्यात मोठी रक्कम ठेवतात. परंतु, काहीतरी चांगले सुरू करण्यास कधीही उशीर झालेला नाही. तर, आजच सर्वोत्तम लिक्विड फंडांमध्ये गुंतवणूक करा!

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

Good knowledgeable information, you should have to give an example