Table of Contents

एफडी वि डेट म्युच्युअल फंड

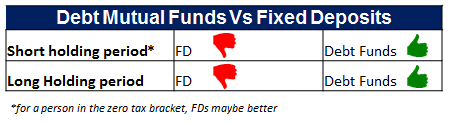

एफडी विकर्ज निधी? विचार करत आहेकुठे गुंतवणूक करावी चांगला परतावा मिळविण्यासाठी तुमची बचत. सर्वसाधारणपणे, लोक विचार करतातगुंतवणूक मुदत ठेव किंवा FD हा सर्वात सोयीचा पर्याय आहे कारण तो सुरक्षित आहे आणि निश्चित परतावा देतो. पण तो सर्वोत्तम मार्ग आहे का? जरी मुदत ठेव हा सर्वांसाठी एक सोपा गुंतवणुकीचा पर्याय आहे, तथापि, करपात्र असलेल्या मुदत ठेवींचा परतावा डेट फंडाच्या तुलनेत खूपच कमी असतो. शिवाय, दीर्घ कालावधीसाठी ठेवल्यास, कर्जम्युच्युअल फंड चांगले परतावा देतात. डेट म्युच्युअल फंड किंवा मुदत ठेवींमध्ये गुंतवणूक करण्याचा अंतिम निर्णय घेण्यापूर्वी, या गुंतवणुकीची तपशीलवार तुलना करा.

सारांश:

डेट म्युच्युअल फंड (डेट फंड) विरुद्ध मुदत ठेवी (एफडी)

जोखीम घेण्याची क्षमता आणि अपेक्षित होल्डिंग कालावधी द्वारे आम्हाला हे खंडित करणे आवश्यक आहेगुंतवणूकदार प्रश्नामध्ये.

लहान होल्डिंग कालावधी (1 वर्ष किंवा कमी)

येथे डेट फंडाचे पर्याय मर्यादित असतीललिक्विड फंड, अति-अल्पकालीन निधी आणि अल्पकालीनउत्पन्न निधी रिटर्न्स किंवा उत्पन्न सामान्यतः लिक्विड ते अल्ट्रा-शॉर्ट ते शॉर्ट टर्म फंडात जास्त असते, परंतु या डेट फंड आणि मुदत ठेव यांच्यातील उत्पन्नाचा फरक त्यांच्या मागील एका वर्षातील परताव्याच्या विचारात निश्चित केला जाऊ शकतो.

डेट म्युच्युअल फंड (श्रेणी सरासरी परतावा)

| डेट म्युच्युअल फंडाचा प्रकार | मागील १ वर्ष. परत (%) |

|---|---|

| लिक्विड फंड | ७.३६ |

| अल्ट्रा शॉर्ट-टर्म डेट फंड | ९.१८ |

| अल्पकालीन कर्ज निधी | ९.७८ |

| डायनॅमिक डेट फंड | १३.८९ |

| दीर्घकालीन कर्ज निधी | १३.१९ |

| गिल्ट शॉर्ट टर्म फंड | 11.76 |

| गिल्ट दीर्घकालीन निधी | १५.०६ |

| 20 फेब्रुवारी 2017 पर्यंतचा डेटा |

मुदत ठेव किंवा FD सरासरी परतावा दर

मुदत ठेवींचा सरासरी परतावा दर 8-8.5% p.a पर्यंत आहे. 2016 मध्ये (म्हणून कोणीही वरील परताव्याची टेबलमध्ये तुलना करू शकतो). तथापि, गेल्या एका वर्षात, परताव्याचा दर 6.6-7.5% p.a पर्यंत घसरला आहे.

वरील उदाहरणासह, हे स्पष्ट होते की कर्ज निधीचा परतावा सरासरी दर मुदत ठेवींपेक्षा चांगला आहे.

Talk to our investment specialist

दीर्घकालीन होल्डिंग कालावधी

दीर्घ हेतू असलेल्या होल्डिंग कालावधीसह, डेट फंड एफडीपेक्षा चांगले सिद्ध होऊ शकतात.

येथे गुंतवणूक करण्याचे पर्याय असे असतील:

- दीर्घकालीन उत्पन्न निधी

- दीर्घकालीन गिल्ट,

- कॉर्पोरेटबंधन फंड (उच्च उत्पन्न निधी), लिक्विड वर नमूद केलेल्या पर्यायांव्यतिरिक्त, अल्ट्रा-शॉर्ट आणि शॉर्ट टर्म फंड देखील वापरले जाऊ शकतात.

होल्डिंग कालावधी 3 वर्षे किंवा त्याहून अधिक असू शकतो हे लक्षात घेता, आम्ही खालील म्हणू शकतो:

- सहभांडवल इंडेक्सेशन फायद्यांसह 20% वर नफा कर, निव्वळ कर घटना किमान असेल (तथापि, कराच्या वर्षानुसार कर घटनांची गणना केली पाहिजे)

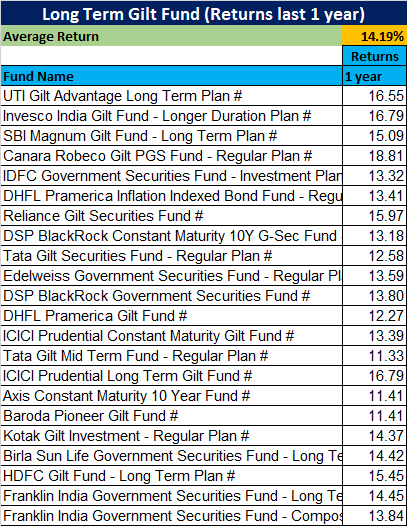

- दीर्घकालीन उत्पन्न निधी/गिल्ट फंड उच्च उत्पन्नासह आणि त्याव्यतिरिक्त, जर व्याजदर कमी झाले तर खूप जास्त परतावा मिळेल.

- या डेट फंड्ससह एखाद्याला उच्च दुहेरी अंकी परतावा मिळू शकतो.

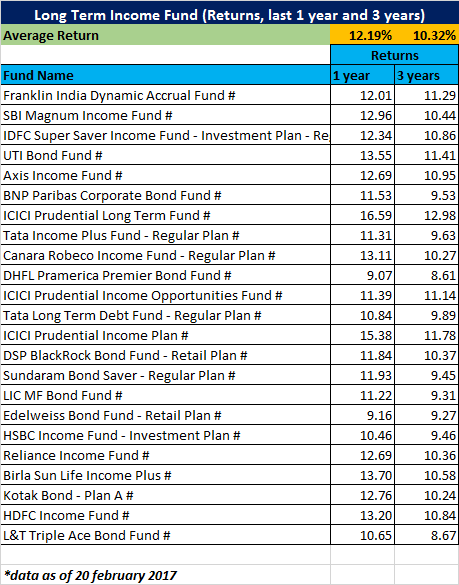

दीर्घकालीन उत्पन्न निधीवरील परताव्याचे खालील उदाहरण घ्या, श्रेणीसाठी मागील 1-वर्षाचा सरासरी परतावा 12.19% आहे आणि शेवटच्या 3 वर्षांचा 10.32% आहे. या कालावधीत कोणत्याही एफडीने असा परतावा दिला नसता. गिल्ट फंडाचा परतावा आणखी जास्त आहे. याच कालावधीत, गेल्या वर्षी बहुतेक बँकांमध्ये एफडीचे दर 8-8.5% प्रतिवर्ष होते, (जरी आज दर 6.5 - 7.5% पर्यंत खाली आले आहेत)

त्यामुळे एखाद्या गुंतवणूकदाराचा दीर्घकालीन होल्डिंग कालावधी आणि व्याजदर कमी होत असताना, डेट फंड (दीर्घकालीन उत्पन्न किंवा गिल्ट) FD पेक्षा अधिक चांगला परतावा देईल. व्याजदर कमी होत नसतानाही, उच्च उत्पन्न कॉर्पोरेट बाँड फंड त्याच कालावधीत एफडीला मागे टाकतील.

डेट म्युच्युअल फंड आणि मुदत ठेवींवर कर आकारणी

डेट फंड आणि फिक्स डिपॉझिट्सचा परतावा निश्चित करण्यातही कर आकारणी महत्त्वाची भूमिका बजावते. सामान्यतः, मुदत ठेवींवर कर आकारणी ३३% (कराचा किरकोळ दर) असते तर डेट फंडांवर जर एखाद्याने ३ वर्षांपेक्षा कमी कालावधीची गुंतवणूक केली तर डीडीटी (लाभांश वितरण कर) वजा केल्यास लाभांश वितरण कर हा अधिक चांगला पर्याय असेल. अंदाजे २५% वर (+अधिभार इ.). हे दर्शविते की डेट म्युच्युअल फंडांवर कर आकारणी मुदत ठेवींपेक्षा तुलनेने कमी आहे.

डेट फंडाचे अतिरिक्त फायदे हे आहेत:

- तरलता: पासून 1-2 दिवसात पैसे उपलब्धविमोचन

- व्यावसायिक व्यवस्थापन: गतिशीलपणे धोरण बदलण्याची आणि बाजारपेठेचा फायदा घेण्याची क्षमता

- मुदतीपूर्वी पैसे काढण्याचा दंड नाही.

सारांश:

| पॅरामीटर्स | म्युच्युअल फंड | मुदत ठेवी |

|---|---|---|

| परताव्याचा दर | खात्रीशीर परतावे नाहीत | निश्चित परतावा |

| महागाई समायोजित परतावा | उच्च चलनवाढ समायोजित परताव्याची संभाव्यता | सहसा कमी चलनवाढ समायोजित परतावा |

| धोका | कमी ते उच्च जोखीम (निधीवर अवलंबून | कमी धोका |

| तरलता | द्रव | द्रव |

| मुदतपूर्व पैसे काढणे | एक्झिट लोड/नो लोडसह परवानगी आहे | दंडासह परवानगी |

| गुंतवणुकीची किंमत | व्यवस्थापन खर्च/खर्चाचे प्रमाण | कोणतीही किंमत नाही |

टॉप 8 सर्वोत्तम कामगिरी करणारे डेट फंड 2022

खाली वरील निव्वळ मालमत्ता/एयूएम असलेल्या डेट फंडांची यादी आहे1000 कोटी आणि 3 वर्षांच्या चक्रवाढीवर क्रमवारी लावली (CAGR) परतावा.

The primary investment objective of the Scheme is to generate regular income through investments in debt & money market instruments in order to make regular dividend payments to unit holders & secondary objective is growth of capital. Aditya Birla Sun Life Medium Term Plan is a Debt - Medium term Bond fund was launched on 25 Mar 09. It is a fund with Moderate risk and has given a Below is the key information for Aditya Birla Sun Life Medium Term Plan Returns up to 1 year are on An Open-ended income scheme with the objective to generate optimal returns with high liquidity through active management of the portfolio by investing in high quality debt and money market instruments. Aditya Birla Sun Life Dynamic Bond Fund is a Debt - Dynamic Bond fund was launched on 27 Sep 04. It is a fund with Moderate risk and has given a Below is the key information for Aditya Birla Sun Life Dynamic Bond Fund Returns up to 1 year are on (Erstwhile SBI Magnum Gilt Fund - Long Term Plan) To provide the investors with returns generated through investments in government securities issued by the Central Government and / or a State Government SBI Magnum Gilt Fund is a Debt - Government Bond fund was launched on 30 Dec 00. It is a fund with Moderate risk and has given a Below is the key information for SBI Magnum Gilt Fund Returns up to 1 year are on The Scheme aims to generate returns through investments in Central Govt Securities. DSP BlackRock Government Securities Fund is a Debt - Government Bond fund was launched on 30 Sep 99. It is a fund with Moderate risk and has given a Below is the key information for DSP BlackRock Government Securities Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Income Plan) To generate income through investments in a range of debt and money market instruments of various maturities with a view to maximising income while maintaining the optimum balance of yield, safety and liquidity. ICICI Prudential Long Term Bond Fund is a Debt - Longterm Bond fund was launched on 9 Jul 98. It is a fund with Moderate risk and has given a Below is the key information for ICICI Prudential Long Term Bond Fund Returns up to 1 year are on The Scheme aims to provide reasonable returns by investing in portfolio of Government Securities with average maturity of around 10 years. However, there can be no assurance that the investment objective of the

Scheme will be realized. ICICI Prudential Constant Maturity Gilt Fund is a Debt - 10 Yr Govt Bond fund was launched on 12 Sep 14. It is a fund with Moderate risk and has given a Below is the key information for ICICI Prudential Constant Maturity Gilt Fund Returns up to 1 year are on (Erstwhile SBI Magnum Gilt Fund Short Term) To provide the investors with the returns generated through investments in government securities issued by the Central Govt. and State Govt. SBI Magnum Constant Maturity Fund is a Debt - 10 Yr Govt Bond fund was launched on 30 Dec 00. It is a fund with Moderately Low risk and has given a Below is the key information for SBI Magnum Constant Maturity Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Long Term Gilt Fund) To generate income through investment in Gilts of various maturities. ICICI Prudential Gilt Fund is a Debt - Government Bond fund was launched on 19 Aug 99. It is a fund with Moderate risk and has given a Below is the key information for ICICI Prudential Gilt Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Medium Term Plan

CAGR/Annualized return of 8.9% since its launch. Ranked 6 in Medium term Bond category. Return for 2024 was 10.5% , 2023 was 6.9% and 2022 was 24.8% . Aditya Birla Sun Life Medium Term Plan

Growth Launch Date 25 Mar 09 NAV (23 Apr 25) ₹39.349 ↑ 0.01 (0.03 %) Net Assets (Cr) ₹2,206 on 31 Mar 25 Category Debt - Medium term Bond AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.55 Sharpe Ratio 2.48 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Yield to Maturity 7.89% Effective Maturity 4 Years 10 Months 24 Days Modified Duration 3 Years 7 Months 17 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,987 31 Mar 22 ₹12,025 31 Mar 23 ₹14,567 31 Mar 24 ₹15,635 31 Mar 25 ₹17,673 Returns for Aditya Birla Sun Life Medium Term Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 1.9% 3 Month 5.3% 6 Month 7.1% 1 Year 14.5% 3 Year 14.3% 5 Year 12.4% 10 Year 15 Year Since launch 8.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 10.5% 2022 6.9% 2021 24.8% 2020 7.1% 2019 8.1% 2018 -4.4% 2017 5.6% 2016 7% 2015 10.9% 2014 9.5% Fund Manager information for Aditya Birla Sun Life Medium Term Plan

Name Since Tenure Sunaina Cunha 1 Sep 14 10.59 Yr. Mohit Sharma 6 Aug 20 4.65 Yr. Data below for Aditya Birla Sun Life Medium Term Plan as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.74% Equity 4.08% Debt 91.93% Other 0.25% Debt Sector Allocation

Sector Value Corporate 51.47% Government 39.97% Cash Equivalent 3.74% Securitized 0.5% Credit Quality

Rating Value A 3.53% AA 30.9% AAA 63.02% BBB 2.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.18% Govt Stock 2033

Sovereign Bonds | -22% ₹483 Cr 47,000,000

↓ -1,500,000 National Bank For Agriculture And Rural Development

Debentures | -5% ₹100 Cr 10,000

↑ 10,000 Nuvama Wealth Finance Ltd

Debentures | -4% ₹95 Cr 9,500

↑ 1,500 7.1% Govt Stock 2034

Sovereign Bonds | -4% ₹94 Cr 9,196,700

↑ 500,000 360 One Prime Ltd. 9.4%

Debentures | -3% ₹65 Cr 6,500

↑ 6,500 Narayana Hrudayalaya Limited

Debentures | -3% ₹60 Cr 6,000 Vedanta Limited

Debentures | -3% ₹60 Cr 6,000 7.23% Government Of India (15/04/2039)

Sovereign Bonds | -2% ₹52 Cr 5,000,000 LIC Housing Finance Limited

Debentures | -2% ₹50 Cr 5,000 Creditaccess Grameen Limited

Debentures | -2% ₹50 Cr 500,000 2. Aditya Birla Sun Life Dynamic Bond Fund

CAGR/Annualized return of 7.7% since its launch. Ranked 16 in Dynamic Bond category. Return for 2024 was 8.8% , 2023 was 6.9% and 2022 was 6% . Aditya Birla Sun Life Dynamic Bond Fund

Growth Launch Date 27 Sep 04 NAV (23 Apr 25) ₹46.3685 ↑ 0.04 (0.08 %) Net Assets (Cr) ₹1,767 on 31 Mar 25 Category Debt - Dynamic Bond AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderate Expense Ratio 1.21 Sharpe Ratio 0.81 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-90 Days (0.5%),90 Days and above(NIL) Yield to Maturity 7.33% Effective Maturity 14 Years 7 Months 20 Days Modified Duration 7 Years 7 Months 2 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,824 31 Mar 22 ₹11,337 31 Mar 23 ₹12,141 31 Mar 24 ₹13,078 31 Mar 25 ₹14,280 Returns for Aditya Birla Sun Life Dynamic Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2.8% 3 Month 4.3% 6 Month 5.7% 1 Year 11.7% 3 Year 8.9% 5 Year 7.6% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.8% 2022 6.9% 2021 6% 2020 4.9% 2019 9.7% 2018 -0.9% 2017 5.7% 2016 2.2% 2015 14% 2014 7.4% Fund Manager information for Aditya Birla Sun Life Dynamic Bond Fund

Name Since Tenure Mohit Sharma 22 Mar 21 3.94 Yr. Bhupesh Bameta 6 Aug 20 4.57 Yr. Data below for Aditya Birla Sun Life Dynamic Bond Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 2.72% Debt 97% Other 0.28% Debt Sector Allocation

Sector Value Government 65.45% Corporate 31.54% Cash Equivalent 2.72% Credit Quality

Rating Value A 2.48% AA 7.71% AAA 89.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.23% Government Of India (15/04/2039)

Sovereign Bonds | -20% ₹347 Cr 33,577,900 7.18% Govt Stock 2037

Sovereign Bonds | -16% ₹277 Cr 27,000,000 7.1% Govt Stock 2034

Sovereign Bonds | -10% ₹170 Cr 16,590,200 Power Finance Corporation Limited

Debentures | -7% ₹124 Cr 12,500 7.34% Govt Stock 2064

Sovereign Bonds | -7% ₹124 Cr 11,914,000 Cholamandalam Investment And Finance Company Limited

Debentures | -5% ₹80 Cr 8,000 Bharti Telecom Limited

Debentures | -4% ₹76 Cr 7,500 State Bank Of India

Debentures | -4% ₹74 Cr 75 7.25% Govt Stock 2063

Sovereign Bonds | -3% ₹51 Cr 5,000,000 LIC Housing Finance Limited

Debentures | -3% ₹50 Cr 5,000 3. SBI Magnum Gilt Fund

CAGR/Annualized return of 8.1% since its launch. Ranked 3 in Government Bond category. Return for 2024 was 8.9% , 2023 was 7.6% and 2022 was 4.2% . SBI Magnum Gilt Fund

Growth Launch Date 30 Dec 00 NAV (23 Apr 25) ₹66.8899 ↑ 0.06 (0.09 %) Net Assets (Cr) ₹11,489 on 31 Mar 25 Category Debt - Government Bond AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 0.94 Sharpe Ratio 0.61 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.97% Effective Maturity 24 Years 14 Days Modified Duration 10 Years 2 Months 1 Day Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,724 31 Mar 22 ₹11,112 31 Mar 23 ₹11,744 31 Mar 24 ₹12,773 31 Mar 25 ₹13,915 Returns for SBI Magnum Gilt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 3.2% 3 Month 4.8% 6 Month 6% 1 Year 12.2% 3 Year 8.8% 5 Year 6.8% 10 Year 15 Year Since launch 8.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.9% 2022 7.6% 2021 4.2% 2020 3% 2019 11.7% 2018 13.1% 2017 5.1% 2016 3.9% 2015 16.3% 2014 7.3% Fund Manager information for SBI Magnum Gilt Fund

Name Since Tenure Rajeev Radhakrishnan 1 Nov 23 1.33 Yr. Tejas Soman 1 Dec 23 1.25 Yr. Data below for SBI Magnum Gilt Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 10.5% Debt 89.5% Debt Sector Allocation

Sector Value Government 89.5% Cash Equivalent 10.5% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.34% Govt Stock 2064

Sovereign Bonds | -37% ₹4,219 Cr 406,500,000

↓ -7,500,000 6.79% Government Of India (07/10/2034)

Sovereign Bonds | -36% ₹4,009 Cr 398,326,400

↑ 27,000,000 7.3% Govt Stock 2053

Sovereign Bonds | -10% ₹1,096 Cr 106,000,000

↓ -5,500,000 7.22% State Government Of Haryana 2038

Sovereign Bonds | -4% ₹402 Cr 40,000,000 7.13% State Government Of Karnataka 2041

Sovereign Bonds | -2% ₹249 Cr 25,048,600

↑ 4,500,000 7.16% State Government Of Madhya Pradesh 2037

Sovereign Bonds | -1% ₹100 Cr 10,000,000 Treps

CBLO/Reverse Repo | -5% ₹608 Cr Net Receivable / Payable

CBLO | -5% ₹574 Cr 8.83% Govt Stock 2041

Sovereign Bonds | -₹0 Cr 00

↓ -80,000,000 7.93% Govt Stock 2033

Sovereign Bonds | -₹0 Cr 00

↓ -6,000,000 4. DSP BlackRock Government Securities Fund

CAGR/Annualized return of 9.3% since its launch. Ranked 9 in Government Bond category. Return for 2024 was 10.1% , 2023 was 7.1% and 2022 was 2.7% . DSP BlackRock Government Securities Fund

Growth Launch Date 30 Sep 99 NAV (23 Apr 25) ₹97.3127 ↑ 0.14 (0.15 %) Net Assets (Cr) ₹1,566 on 31 Mar 25 Category Debt - Government Bond AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk Moderate Expense Ratio 1.1 Sharpe Ratio 0.52 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-7 Days (0.1%),7 Days and above(NIL) Yield to Maturity 7.04% Effective Maturity 29 Years 2 Months 26 Days Modified Duration 11 Years 6 Months Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,730 31 Mar 22 ₹11,166 31 Mar 23 ₹11,651 31 Mar 24 ₹12,744 31 Mar 25 ₹13,899 Returns for DSP BlackRock Government Securities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 3.4% 3 Month 4.9% 6 Month 5.9% 1 Year 12.9% 3 Year 8.6% 5 Year 6.8% 10 Year 15 Year Since launch 9.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 10.1% 2022 7.1% 2021 2.7% 2020 3.1% 2019 13.1% 2018 12.5% 2017 7.4% 2016 1.4% 2015 15.3% 2014 6.2% Fund Manager information for DSP BlackRock Government Securities Fund

Name Since Tenure Sandeep Yadav 1 Aug 24 0.58 Yr. Shantanu Godambe 1 Jun 23 1.75 Yr. Data below for DSP BlackRock Government Securities Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.77% Debt 96.23% Debt Sector Allocation

Sector Value Government 96.23% Cash Equivalent 3.77% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.34% Govt Stock 2064

Sovereign Bonds | -34% ₹555 Cr 52,000,000

↓ -3,500,000 7.3% Govt Stock 2053

Sovereign Bonds | -29% ₹473 Cr 45,000,000

↓ -3,000,000 7.09% Govt Stock 2054

Sovereign Bonds | -7% ₹112 Cr 11,000,000

↓ -4,000,000 7.14% Madhya Pradesh SDL 2043

Sovereign Bonds | -6% ₹103 Cr 10,000,000 7.26% Maharashtra SDL 2050

Sovereign Bonds | -6% ₹101 Cr 10,000,000 7.1% Govt Stock 2034

Sovereign Bonds | -5% ₹90 Cr 8,500,000

↑ 8,500,000 8.17% Govt Stock 2044

Sovereign Bonds | -4% ₹58 Cr 5,000,000 7.14% Maharashtra SDL 2039

Sovereign Bonds | -3% ₹50 Cr 5,000,000 7.85% MP Sdl 2032

Sovereign Bonds | -2% ₹27 Cr 2,500,000 7.22% Maharashtra SDL 2049

Sovereign Bonds | -1% ₹15 Cr 1,500,000 5. ICICI Prudential Long Term Bond Fund

CAGR/Annualized return of 8.6% since its launch. Ranked 12 in Longterm Bond category. Return for 2024 was 10.1% , 2023 was 6.8% and 2022 was 1.3% . ICICI Prudential Long Term Bond Fund

Growth Launch Date 9 Jul 98 NAV (23 Apr 25) ₹90.7205 ↑ 0.07 (0.08 %) Net Assets (Cr) ₹1,078 on 31 Mar 25 Category Debt - Longterm Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.97 Sharpe Ratio 1.03 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.09% Effective Maturity 23 Years 1 Month 6 Days Modified Duration 9 Years 6 Months 7 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,493 31 Mar 22 ₹10,688 31 Mar 23 ₹11,063 31 Mar 24 ₹12,017 31 Mar 25 ₹13,198 Returns for ICICI Prudential Long Term Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 3% 3 Month 4.9% 6 Month 6.7% 1 Year 12.6% 3 Year 8.6% 5 Year 5.7% 10 Year 15 Year Since launch 8.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 10.1% 2022 6.8% 2021 1.3% 2020 0.4% 2019 11% 2018 12.1% 2017 6.8% 2016 4.1% 2015 15.7% 2014 5.1% Fund Manager information for ICICI Prudential Long Term Bond Fund

Name Since Tenure Manish Banthia 22 Jan 24 1.11 Yr. Raunak Surana 22 Jan 24 1.11 Yr. Data below for ICICI Prudential Long Term Bond Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 5.41% Debt 94.36% Other 0.23% Debt Sector Allocation

Sector Value Government 77.89% Corporate 16.47% Cash Equivalent 5.41% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.34% Govt Stock 2064

Sovereign Bonds | -32% ₹391 Cr 37,701,500

↑ 2,500,000 7.18% Govt Stock 2037

Sovereign Bonds | -18% ₹222 Cr 21,603,830 6.92% Govt Stock 2039

Sovereign Bonds | -8% ₹101 Cr 10,063,500

↓ -8,000,000 7.23% Government Of India (15/04/2039)

Sovereign Bonds | -6% ₹72 Cr 7,000,000 The Great Eastern Shipping Company Limited

Debentures | -4% ₹53 Cr 536 HDFC Bank Limited

Debentures | -4% ₹51 Cr 5,000

↓ -2,500 LIC Housing Finance Limited

Debentures | -4% ₹50 Cr 500 7.12% Maharashtra SDL 2038

Sovereign Bonds | -4% ₹49 Cr 4,960,700

↑ 4,960,700 7.14% Maharashtra SDL 2039

Sovereign Bonds | -3% ₹40 Cr 4,000,000

↑ 4,000,000 7.09% Govt Stock 2054

Sovereign Bonds | -3% ₹35 Cr 3,500,000 6. ICICI Prudential Constant Maturity Gilt Fund

CAGR/Annualized return of 8.9% since its launch. Ranked 6 in 10 Yr Govt Bond category. Return for 2024 was 9.3% , 2023 was 7.7% and 2022 was 1.2% . ICICI Prudential Constant Maturity Gilt Fund

Growth Launch Date 12 Sep 14 NAV (23 Apr 25) ₹24.6915 ↓ 0.00 (-0.01 %) Net Assets (Cr) ₹2,537 on 31 Mar 25 Category Debt - 10 Yr Govt Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderate Expense Ratio 0.39 Sharpe Ratio 1.14 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-7 Days (0.25%),7 Days and above(NIL) Yield to Maturity 9.83% Effective Maturity 9 Years 9 Months 29 Days Modified Duration 6 Years 10 Months 13 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,799 31 Mar 22 ₹11,205 31 Mar 23 ₹11,591 31 Mar 24 ₹12,568 31 Mar 25 ₹13,796 Returns for ICICI Prudential Constant Maturity Gilt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2.9% 3 Month 4.7% 6 Month 6.7% 1 Year 12.6% 3 Year 8.6% 5 Year 6.6% 10 Year 15 Year Since launch 8.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 9.3% 2022 7.7% 2021 1.2% 2020 2.8% 2019 13.6% 2018 12.8% 2017 9.7% 2016 2.4% 2015 16.2% 2014 6.9% Fund Manager information for ICICI Prudential Constant Maturity Gilt Fund

Name Since Tenure Manish Banthia 22 Jan 24 1.11 Yr. Raunak Surana 22 Jan 24 1.11 Yr. Data below for ICICI Prudential Constant Maturity Gilt Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.14% Debt 96.86% Debt Sector Allocation

Sector Value Government 96.86% Cash Equivalent 3.14% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.1% Govt Stock 2034

Sovereign Bonds | -44% ₹1,121 Cr 109,556,400

↓ -62,500,000 6.64% Govt Stock 2035

Sovereign Bonds | -39% ₹988 Cr 100,000,000

↑ 70,000,000 7.18% Govt Stock 2037

Sovereign Bonds | -8% ₹200 Cr 19,500,000 6.19% Govt Stock 2034

Sovereign Bonds | -2% ₹48 Cr 5,000,000 6.92% Govt Stock 2039

Sovereign Bonds | -1% ₹35 Cr 3,500,000

↓ -2,500,000 7.23% Government Of India (15/04/2039)

Sovereign Bonds | -1% ₹31 Cr 3,000,000 6.67% Govt Stock 2035

Sovereign Bonds | -1% ₹25 Cr 2,500,000 6.79% Government Of India (07/10/2034)

Sovereign Bonds | -0% ₹6 Cr 549,300

↓ -3,000,000 7.18% Govt Stock 2033

Sovereign Bonds | -0% ₹1 Cr 72,600 Net Current Assets

Net Current Assets | -2% ₹56 Cr 7. SBI Magnum Constant Maturity Fund

CAGR/Annualized return of 7.9% since its launch. Ranked 1 in 10 Yr Govt Bond category. Return for 2024 was 9.1% , 2023 was 7.5% and 2022 was 1.3% . SBI Magnum Constant Maturity Fund

Growth Launch Date 30 Dec 00 NAV (23 Apr 25) ₹63.8107 ↓ -0.02 (-0.03 %) Net Assets (Cr) ₹1,831 on 31 Mar 25 Category Debt - 10 Yr Govt Bond AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderately Low Expense Ratio 0.64 Sharpe Ratio 1 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.74% Effective Maturity 9 Years 9 Months 29 Days Modified Duration 6 Years 9 Months 22 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,595 31 Mar 22 ₹10,971 31 Mar 23 ₹11,385 31 Mar 24 ₹12,324 31 Mar 25 ₹13,484 Returns for SBI Magnum Constant Maturity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2.8% 3 Month 4.5% 6 Month 6.3% 1 Year 12.2% 3 Year 8.5% 5 Year 6.1% 10 Year 15 Year Since launch 7.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 9.1% 2022 7.5% 2021 1.3% 2020 2.4% 2019 11.6% 2018 11.9% 2017 9.9% 2016 6.2% 2015 12.8% 2014 9.1% Fund Manager information for SBI Magnum Constant Maturity Fund

Name Since Tenure Rajeev Radhakrishnan 1 Nov 23 1.33 Yr. Tejas Soman 1 Dec 23 1.25 Yr. Data below for SBI Magnum Constant Maturity Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.09% Debt 96.91% Debt Sector Allocation

Sector Value Government 96.91% Cash Equivalent 3.09% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.1% Govt Stock 2034

Sovereign Bonds | -72% ₹1,320 Cr 129,000,000 7.18% Govt Stock 2037

Sovereign Bonds | -25% ₹467 Cr 45,500,000 Net Receivable / Payable

CBLO | -2% ₹42 Cr Treps

CBLO/Reverse Repo | -1% ₹15 Cr 8. ICICI Prudential Gilt Fund

CAGR/Annualized return of 9.5% since its launch. Ranked 5 in Government Bond category. Return for 2024 was 8.2% , 2023 was 8.3% and 2022 was 3.7% . ICICI Prudential Gilt Fund

Growth Launch Date 19 Aug 99 NAV (23 Apr 25) ₹102.742 ↑ 0.03 (0.03 %) Net Assets (Cr) ₹7,133 on 31 Mar 25 Category Debt - Government Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.12 Sharpe Ratio 0.87 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 6.94% Effective Maturity 15 Years 9 Months 14 Days Modified Duration 7 Years 22 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,828 31 Mar 22 ₹11,265 31 Mar 23 ₹11,915 31 Mar 24 ₹12,953 31 Mar 25 ₹14,074 Returns for ICICI Prudential Gilt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2.5% 3 Month 4.2% 6 Month 6% 1 Year 11% 3 Year 8.5% 5 Year 6.8% 10 Year 15 Year Since launch 9.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.2% 2022 8.3% 2021 3.7% 2020 3.8% 2019 12.6% 2018 10.8% 2017 6.8% 2016 2.1% 2015 18.2% 2014 5.5% Fund Manager information for ICICI Prudential Gilt Fund

Name Since Tenure Manish Banthia 22 Jan 24 1.11 Yr. Raunak Surana 22 Jan 24 1.11 Yr. Data below for ICICI Prudential Gilt Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 9.99% Debt 90.01% Debt Sector Allocation

Sector Value Government 90.01% Cash Equivalent 9.99% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.1% Govt Stock 2034

Sovereign Bonds | -33% ₹2,109 Cr 206,066,000

↓ -30,000,000 7.34% Govt Stock 2064

Sovereign Bonds | -21% ₹1,360 Cr 131,038,200

↑ 25,000,000 7.93% Govt Stock 2033

Sovereign Bonds | -15% ₹968 Cr 94,096,700 7.3% Govt Stock 2028

Sovereign Bonds | -7% ₹427 Cr 42,500,000 7.12% Maharashtra SDL 2038

Sovereign Bonds | -3% ₹214 Cr 21,496,400

↑ 21,496,400 91 Days Tbill Red 24-04-2025

Sovereign Bonds | -3% ₹189 Cr 19,000,000 7.14% Maharashtra SDL 2039

Sovereign Bonds | -3% ₹180 Cr 18,000,000

↑ 18,000,000 91 DTB 17042025

Sovereign Bonds | -3% ₹174 Cr 17,500,000

↓ -10,000,000 7.09% Govt Stock 2054

Sovereign Bonds | -2% ₹151 Cr 15,000,000 7.18% Govt Stock 2033

Sovereign Bonds | -2% ₹109 Cr 10,567,890

↓ -262,500

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.