Table of Contents

- How to Claim an Income Tax Refund?

- Form 30

- Eligibility for Income Tax Refund

- Documents Required to File ITR

- Which ITR Form Should You File?

- What's New in ITR Forms?

- How to Link Aadhaar to Income Tax Return?

- Ways to Track the Status of Income Tax Refund AY 21-22

- Check ITR Refund via the TIN NSDL Website

- What is Form 26AS?

- How to Download an Online Income Tax Return?

- Interest on Income Tax Return if Delayed

- Due Date to Claim ITR

- How is Income Tax Refund Processed?

- Importance of E-Filing of Income Tax Return

- Advantages of Income Tax Return Filing

- Is it Mandatory to File Income Tax?

- Conclusion

How to File Income Tax Refund?

A mismatch between the paid tax amount and the actual amount payable results in an income tax refund. A refund gets initiated if the amount paid exceeds the due amount. The ITR form, that must be submitted by every tax payers,varies based on the Income type, the category in which the taxpayer falls, and the net received income.

This article contains a brief guide on income tax refund, new ITR Forms, and various other aspects to e-filing of ITR.

How to Claim an Income Tax Refund?

The most straightforward way to file Income Tax Returns online is by declaring your investments on Form 16 and submitting the relevant proofs. If you haven't done so and are paying excess Taxes that you believe could have been avoided, you must complete Form 30.

It is essentially a request that your case should be investigated and that any overpayments of tax be returned. You must file your income tax refund claim before the end of the fiscal year. It's crucial to keep in mind that:

- Unless you've already submitted a claim to the Assessing Officer, this claim should include proof of return of income in a defined form.

- Non-residents with TDS income should file a refund claim with the "Assessing Officer, Non-resident Refund Circle, Bombay."

- If you have been charged tax on your income (dividends, etc.) under Sections 192–194, Section 194A, and Section 195, your claim should be accompanied by the required certificates suggested under Section 203.

Form 30

Basically, form 30 requests for the case to be evaluated and the excess tax that you’ve paid to be refunded. You must submit the income tax refund claim before the financial year ends. The claim has to be accompanied with this form.

Format and Structure of Form 30

I, (your name), of (address), do hereby state that my total income computed following the provisions of the Income Tax Act, 1961, during the year ending on (year) being the previous year for the assessment year commencing on the 1st of April (year), amounted to Rs. (amount); that the total income tax chargeable in respect of such total income is Rs. (amount) and that the total amount of Income Tax paid or treated as paid under:

Section 199, is Rs. (amount).

I, therefore, request a refund of Rs. (amount).

(Signature),

I hereby declare that I was resident but not ordinarily resident/non-resident during the previous year relevant to the assessment year this claim relates to and that what is stated in this application is correct.

Dated: (date).

(Signature).

Eligibility for Income Tax Refund

You will be eligible for ITR in a variety of circumstances, like:

- If the tax you paid in advance as per your self-assessment is greater than the tax you owe

- If your TDS from salary, dividends, interest on debentures or securities, or other sources exceeds the tax payable on a regular assessment Basis

If the tax levied based on regular assessments decreases due to an error in the assessment procedure is corrected

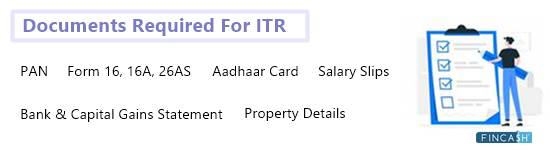

Documents Required to File ITR

Here are the essential documents that you must keep handy before starting the e-filing process:

- Savings Account passbook

- PPF account passbook

- Salary slips

- Aadhar card

- PAN card

- Interest certificates from post office and banks

- Proofs of Tax Saving Investments

- Proofs claiming deductions under section 80D to 80U (health insurance, education loan interests)

- Home Loan statement received from the Bank

- Form 16: This is the TDS certificate that is obtained from the company and shows the details of the salary you were paid and the TDS that was deducted.

- Form 16A: If TDS is deducted on payments other than salary, such as interest on fixed deposits, recurring deposits, etc., exceeding the specified limits under existing tax laws, you will need the Form-16A.

- Form 16B: If you have sold a property, you will receive Form-16B from the buyer, reflecting the TDS deducted from the amount received to you.

- Form 16C: It provides your tenant with a record of any TDS deducted from the rent you receive.

- Form 26AS: It acts as a consolidated statement of annual tax. It contains all information about taxes deposited against your PAN, TDS deducted by your employer, banks, and other organisations from payments provided to you.

Talk to our investment specialist

Which ITR Form Should You File?

The Indian Revenue Service (IRS) official website provides many forms that you must complete depending on your income. While some of these documents are simple to complete, others require additional information, like the profit and loss statements.

Here's a simple guide to help you comprehend the various formats available:

| Form Name | Purpose |

|---|---|

| ITR-1 (Sahaj) | Individuals who have total income up to Rs. 50 lakh, including Income from house property, salaries, other sources, and agricultural income of up to Rs. 5000, should file the ITR-1 or Sahaj |

| ITR-2 | Hindu Undivided Families (HUFs) and Individuals who do not have revenues or gains from a business or profession should file Form ITR-2 |

| ITR-3 | This form is for HUFs and individuals having income from business or professional gains and profits |

| ITR-4 (Sugam) | If your business is generating a presumed income, you must complete this form. HUFs, Individuals, and Firms (other than LLP) who are residents and have total income up to Rs. 50 lakh and income from business and profession estimated under sections 44ADA, 44AD, or 44AE must file this form |

| ITR-5 | It has to be chosen by LLPs, Associations of Persons (AOPs), Body of Individuals (BOIs), Artificial Juridical Person (AJP), Estate of deceased, Estate of insolvent, business trusts and investment funds |

| ITR-6 | This form can be chosen by any firm that is not claiming an exemption under Section 11. Companies filing returns under this section only have the provision to electronically do it. |

| ITR-7 | Companies and individuals who furnish returns under Sections 139(4A) to 139(4F) must choose this form |

What's New in ITR Forms?

The new IT return forms include relief measures, announced and established by the Central Board of Direct Taxes due to COVID-19. Here are the characteristics that you can see on the Income Tax Return forms:

Taxpayers with a Wider Range of Income: Individuals, HUFs, and partnership firms who have deposited more than Rs. 1 crores in any bank paid a power utility bill of amount more than Rs. 1 lakh or incurred personal travel expenses of Rs. 2 lakhs are now included in the tax net.

Separate Timetable: The new form has a separate schedule called Schedule DI that allows you to specify the amount invested or spent for which you need a tax refund.

Changes for Joint Homeowners: The previous provision barring joint homeowners from filing a Tax Return using ITR-1 or ITR-4 has been repealed.

How to Link Aadhaar to Income Tax Return?

When completing tax returns, you must include your Aadhar number. Also, you must ensure that the aadhaar number is linked to your PAN card number.

To do so, here are some steps to follow:

- In the new ITR forms available on the Income Tax website, type or write down the number in the space available.

- You can use the 28-digit enrolment ID in place of an Aadhar number if you have applied for one but haven't received it.

- If the Aadhar number has been electronically added before, it will be automatically inserted in the ITR forms.

Ways to Track the Status of Income Tax Refund AY 21-22

- On the new income tax e-filing portal, you can check your Income Tax refund status online.

- Log in to the portal using your PAN or Aadhar number.

- Then, under the e-file tab, choose the Income Tax Returns option.

- In the next step, select the View File Returns option.

The most recent tax returns in 2021 will be there. The issuing date of the tax refund, the refunded amount, and the clearance date for any refund due for this evaluation year will be displayed if you click on the 'View Details' option.

Check ITR Refund via the TIN NSDL Website

The NSDL website also allows taxpayers to verify their income tax refund status. The refund will appear ten days after the Assessing Officer has forwarded it to the refund banker.

Here are the vital steps for the TIN NSDL refund status check:

- Enter your PAN card details in the space provided at the website where you are asked to fill in your login-id.

- Choose the appropriate assessment year to check the status of your reimbursement. The assessment year for the most recent income tax return will be 2021-22.

- Click the Submit option after entering the Captcha code.

For AY 2021-22, your income tax refund status will reflect on your screen.

Refund is Credited will appear on the screen if your income tax refund has been credited to your bank account. It will also display the bank account number's last four digits, the Reference Number, and the date when the refund was credited.

It can also display the message Refund Returned on the screen. It indicates that your tax refund has not been credited to your bank account. There may be multiple reasons, including an incorrect bank account number or an account's IFSC code becoming inactive.

What is Form 26AS?

The tax deducted at source on investments or payments that individuals, workers, and freelancers made, is shown on Form 26AS. This allows taxpayers to get refunds for unpaid taxes or late tax payments.

The new Form 26AS, effective in AY2020-21, has been updated to ensure an easier process of filing ITRs online and encourage compliance with all tax requirements.

- The financial transaction statements are a vital aspect of the new Form 26AS. As the name suggests, these are statements in which taxpayers recall any significant financial transactions that would be beneficial to them when submitting their returns.

- Your Aadhar card details, DOB, house, and email addresses, as well as your cellphone number, will be displayed in the new format of 26AS.

- It will show any pending or concluded tax proceedings with the tax authorities.

How to Download an Online Income Tax Return?

The IT department generates the income tax verification form after you have filed your ITR so that taxpayers can verify the legality and legitimacy of e-filing. These only apply if you haven't used a digital signature on your returns. You can download the income tax return verification form with a few simple clicks.

- Go to the official Income Tax Portal and log in.

- By selecting the View Returns/ Forms option, you can see e-filed tax returns.

- Select the Income-tax returns option from the available drop-down menu.

- All of the years for which returns have been filed will be listed.

- To download the ITR-V, click on the acknowledgement number.

- Select ITR-V Acknowledgment to begin the download.

- Enter the password to open the document that has been downloaded. Your PAN number in lower case, coupled with your birthdate, is the password.

Interest on Income Tax Return if Delayed

If the refund payment gets delayed, the IT Department can levy interest at a rate of 6% per annum under Section 244A of the Income Tax Act. The interest on your refund will be calculated from the day the tax was paid to the date the refund was issued.

For example, if you seek a Rs. 10,000 refund for the 2021-22 fiscal year and receive it in March 2022, the interest on your refund will be calculated from April 2021 to March 2022, making the final amount receivable to be Rs. 10600.

Due Date to Claim ITR

Refunds of income taxes must be claimed within one year of the end of the assessment year. Here are some key facts to remember:

- If six consecutive assessment years have passed, ITR claims will not be considered.

- The refund amount should be less than Rs. 50 lakhs for a single assessment year.

- Refunds of late claims will not be subject to interest.

- The assessing officer may reassess the claim if the delayed claims require verification.

How is Income Tax Refund Processed?

The ITR gets processed by the Income Tax authorities stationed at the Centralised Processing Centre (CPC) in Bengaluru. Once the assessee files the ITR, the refunds are handled.

The IT refund banker accepts orders for a refund of income tax generated and delivered by the IT authorities whenever any tax reimbursement arises during the processing of ITRs. Refunds will be made either electronically, i.e., direct credit to the account, or through Refund Cheque, based on the option selected by you while filing the yearly ITR.

Therefore, you should submit the correct account number and IFSC code, as well as accurate address information, including the PIN code, when filing the returns. Refunds sent by check are sent via Speed Post to the address provided.

Importance of E-Filing of Income Tax Return

Electronic filing (e-filing) is a method of submitting tax returns via the internet. This is done using a pre-approved tax preparation software of the Income Tax Department. E-filing provides several advantages that have increased the popularity of the online tax payment method.

You get to file a tax return from the comfort of your home at any time of the financial year. Here are some of the advantages that you can enjoy:

When seeking a refund, keep in mind that there is a strong chance that a Tax Deduction at Source (TDS) has been applied. If you wish to seek a TDS Refund (as per tax legislation), you must file an ITR for that purpose.

Verification of documentation is simple. Income tax returns assist you in preparing paperwork that details your Earnings and can be utilised when applying for loans. An ITR document provides a thorough picture of your overall income.

ITRs serve as proof of income and assist your insurance in determining the amount of compensation that must be given in the event of accidental death or disability. It is regarded as a certified and official document.

Advantages of Income Tax Return Filing

Filing tax returns is a yearly action that every responsible citizen should do. It acts as a foundation to let the government estimate the quantity and means of a person's expenditures.

Here, you can request refunds as needed. Jotted down below are some advantages you can gain by filing the ITR.

Demonstrates Your Accountability

Individuals who make a certain amount of annual income are required to file a tax return by a specific date. Those who earn less than the necessary amount can file returns as well as per their wish. This makes it easier for people and enterprises to engage in several transactions because the tax department records their earnings and any applicable tax paid.

Necessary in Some Situations

Even if your income does not qualify you for required filing, it is still better to voluntarily submit returns. In several of the Indian states, registering immovable property requires you to submit three years' worth of tax returns as verification. Thus, it's easier to record a transaction if you file returns.

Needed When Taking a Credit Card or a Loan

If you wish to ever apply for a home loan, keep a record of filing returns because the home loan firm will certainly require it. If you want to be a co-borrower while applying for a loan, you may want to consider filing your partner’s tax returns too. Credit card providers, too, may require proof of return before providing a card.

Required When Claiming Compensation for Past Losses

Whether or not you earn an income as required for returns, there are numerous benefits of filing returns on time. Multiple losses sustained by an individual or a corporation cannot be used to calculate tax in later years. As a result, it's best to submit returns frequently because you never know when you might need to claim prior losses.

Necessary to Avoid Fines and Penalties

The non-filed returns can result in a Rs. 5,000 penalty under the Income Tax Act. To avoid any overhead charges, ensure that you timely apply for an ITR.

Is it Mandatory to File Income Tax?

Your income Tax Rate is pre-determined. A delay in filing returns will result in late filing penalties and make it difficult for you to obtain a loan or a travel visa. You may also face legal consequences in the future if you avoid filing it, especially if you are required to file an amended return.

Conclusion

The Indian Revenue Service provides an online tool for tracking your refund and its status. Once filed, you can find out the status of the refund ten days after it has been sent. To receive your tax refund, you must complete e-filing. Make sure to e-file this year to receive your tax refund sooner.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.