Fincash » Coronavirus- A Guide to Investors » Coronavirus Outbreak: RBI Policy

Table of Contents

RBI Cuts Reverse Repo Rate to 3.75% from 4%

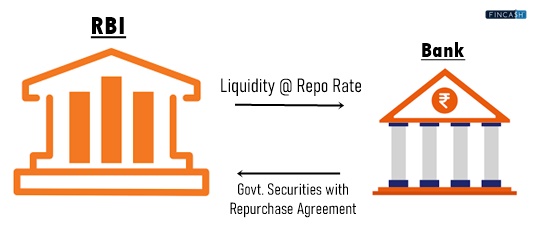

On 27th March 2020, the Reserve Bank of India (RBI) announced cutting the repo rate to 4.4%. This was the lowest ever fall of the repo rate. The reverse repo rate was also lowered by a great 90 Basis Points on 27th March 2020.

Once again RBI came to the rescue of the melting economic condition of the country. On 17th April 2020, the RBI cut the reverse repo rate again by 25 Basis points to 3.75% while it was 4% earlier. This was a move towards helping the Economy elevate from the economic pressure caused by the novel COVID-19 virus.

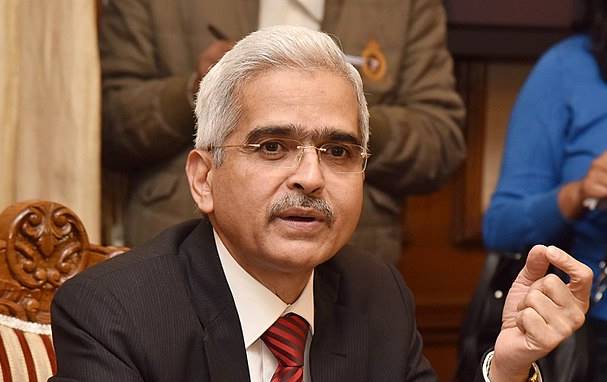

RBI governor Shaktikanta Das addressed the media on 17th April and said that on April 15 it was noticed that Rs.6.91 crore was identified as surplus in the system. He further mentioned that in order to allow banks to use this surplus into the economy, reverse repo rate was being reduced by 25bps from 4% to 3.75% under the Liquid Adjustment Facility (LAF).

According to a recent report, the policies and measures implemented by the RBI in the face of COVID-19 will ensure liquidity in the system and enable the financial markets and institutions to function well amid the uncertainty of the global pandemic. Monetary transmission to affected banks will also become easier.

Previously on 27th March 2020, the Cash Reserve Ration (CRR) of all banks was reduced to 100bps to 3% of Net Demand and Time Liabilities (NDTL).

Other Benefits Announced

1. Additional Rs. 50,000 crore to be disbursed

Governor Shaktikanta Das also mentioned than an additional Rs. 50,000 crore will be given through targeted long-term repo operation (TLTRO) to address the liquidity needs of NBFCs and microfinance.

Talk to our investment specialist

2. Re-financing window for financial institutions

Mr Das also announced re-financing window of Rs. 50,000 crore for other financial institutions like the NABARD, National Housing Bank and Sidbi.

3. Non-performing assets norms relaxed

Mr Das also said that 90-day non-performing assets norm would not apply on moratorium granted on existing loans given by banks.

4. Eased Liquidity Ratio (LCR)

The central bank has also eased the liquidity coverage ratio requirement of scheduled commercial banks from 100% to 80% immediately. This will free up more Capital for the banks. They can further deploy this in the Market.

5. No dividend payouts

The central bank has also asked banks to not make any dividend payout due to financial difficulties caused by the outbreak of the pandemic.

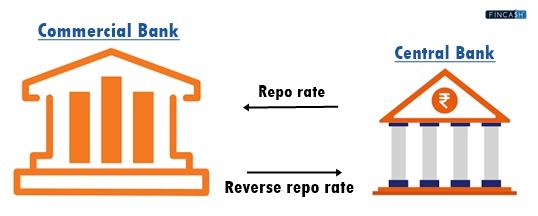

What is Reverse Repo Rate?

Reverse Repo Rate is that rate at which the Central bank (RBI) borrows money from other commercial banks in the country. This can be used to control the supply of money in the country. The increased reverse repo rate will decrease the money supply in the economy while other things remain constant.

Conclusion

RBI’s decision to reduce reverse repo rate will prove to be beneficial for the India economy and should help to elevate the economy from the impact of Coronavirus. Financial experts believe that the economy can jump back faster with the current alterations made.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.