Table of Contents

बीएसई सेन्सेक्सची वर्षानुवर्षे वाढ

इक्विटी दीर्घकालीन का चांगल्या आहेत?

जेव्हाही आपण इक्विटी गुंतवणुकीबद्दल ऐकतो तेव्हा सर्वप्रथम आपण ऐकतो की दीर्घकालीन गुंतवणुकीसाठी इक्विटी चांगल्या असतात. तथापि, विविध लोक इक्विटी गुंतवणुकीच्या संदर्भात नकारात्मक विचार करतात. तर, इक्विटी ही दीर्घ मुदतीसाठी चांगली गुंतवणूक का आणि कशी आहे, इक्विटी गुंतवणुकीमागील मिथक आणि हे करताना तपासले जाणारे मापदंड समजून घेऊ.गुंतवणूक इक्विटी आणि संकल्पना मध्येइक्विटी फंड.

सेन्सेक्सची मागील कामगिरी समजून घेणे

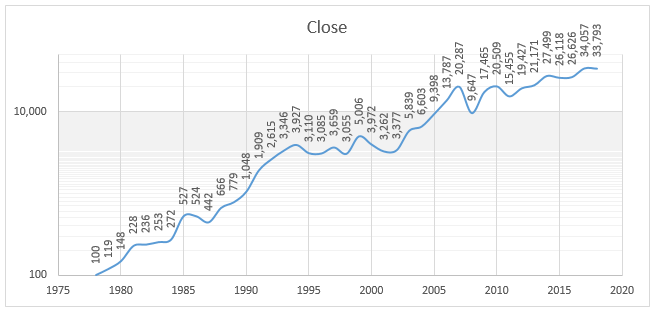

आता खाली दिलेल्या आलेखाच्या मदतीने सेन्सेक्सच्या स्थापनेपासूनच्या कामगिरीवर लक्ष केंद्रित करूया.

(3 जानेवारी 2018 रोजी स्रोत- BSE लिमिटेड)

सेन्सेक्सचा दिलेला आलेख असे दर्शवतो की १९७९ मध्ये त्याची स्थापना झाल्यापासून एकूण वाढ झाली आहे. डेटा घेतलेली तारीख ०३ जानेवारी २०१८ आहे. १९७९ पासून आजपर्यंत,चक्रवाढ वार्षिक वाढ दर (CAGR) अंदाजे १६.३९% आहे. तथापि, याचा अर्थ असा नाही की सेन्सेक्सने केवळ वरच्या दिशेने वाटचाल पाहिली आहे.तथापि, सेन्सेक्सची सर्वात मोठी वाढ १९७९-१९९४ या कालावधीतील आहे जेव्हा बाजार १०० ते ३,९२७ अंकांपर्यंत वाढला होता.. ज्या लोकांनी या काळात गुंतवणूक केली असेल त्यांना बऱ्यापैकी नफा मिळाला असता. शिवाय, या गुंतवणूकदारांनाही इतरांप्रमाणे फारसा नकारात्मक परताव्याचा सामना करावा लागला नाही. परिणामी, या लोकांनी निश्चितपणे कमावले असते.2003-2007 दरम्यान गुंतवणूकदारांना परतावा मिळालेला दुसरा सर्वोत्तम टप्पा होता, परंतु या कालावधीतील वाढ पहिल्या टप्प्याइतकी प्रभावी नव्हती.

तर, तुम्हाला असे वाटते की दबाजार नेहमी एक चांगला वेग साक्षीदार आहे?त्यातही मंदीचे सावट आहे. सप्टेंबर 1994 - 1999, 2000 - 2003, आणि 2008 - 2010 या काळात सेन्सेक्समध्ये घसरण झाल्याचे काही सर्वात वाईट स्पेल होते.. या कालावधीत कोणीही गुंतवणूक केली असती तर ती नक्कीच नकारात्मक झाली असती. तथापि, पुन्हा, जर या गुंतवणूकदारांनी त्यांची गुंतवणूक लांब ठेवली असती तर त्यांना नक्कीच नफा मिळाला असता. आपण नकाशात बघू शकतो, मंदीचा काळ फारसा दिसत नाही.

तर, इक्विटीबद्दलचे गैरसमज समजून घेतल्यानंतर, आता स्टॉक कसे निवडायचे ते पाहू.

इक्विटी गुंतवणुकीमागील सामान्य समज

आधी सांगितल्याप्रमाणे, इक्विटी गुंतवणुकीशी संबंधित अनेक मिथकं आहेत. तर, इक्विटी गुंतवणुकीमागील काही प्रचलित मिथकं पाहू.

1. जर एखाद्या समभागाने भूतकाळात चांगले काम केले असेल तर तो भविष्यातही चांगले काम करेल

शेअर्समध्ये गुंतवणूक करताना लोक विश्वास ठेवतात ती पहिली समज; जर एखाद्या कंपनीने भूतकाळात चांगली कामगिरी केली असेल तर ती भविष्यातही चांगली कामगिरी करेल. हा विचार अजून काही आरामदायी पातळी देऊ शकतो; ते पूर्णपणे खरे नाही. कारण; कंपनीचे यश नेहमीच ती कोणत्या वातावरणात कार्य करते आणि बदलत्या व्यवसाय परिस्थितीशी जुळवून घेण्यास सक्षम आहे की नाही यावर अवलंबून असते. तसे करणे शक्य नसेल तर; कंपनी भविष्यात कामगिरी करण्याच्या स्थितीत राहणार नाही.

त्यामुळे कोणत्याही कंपनीच्या शेअर्समध्ये गुंतवणूक करण्यापूर्वी लोकांनी स्वत:चे विश्लेषण केले पाहिजे. त्यांनी कंपनीची भूतकाळातील कामगिरी, तिची भविष्यातील क्षमता, ती ज्या उद्योगात काम करते त्या उद्योगाची परिस्थिती आणि इतर संबंधित बाबी तपासल्या पाहिजेत.

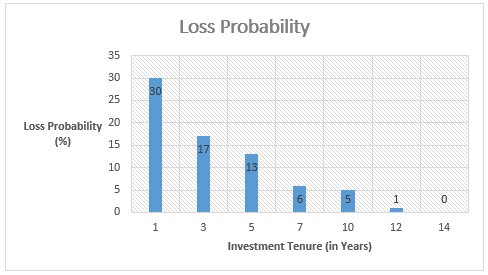

2. मी इक्विटीजद्वारे जलद परतावा मिळवण्यास सक्षम नाही कारण ते पूर्ण नशीब आहे

लोकांना असे वाटते की ते इक्विटी गुंतवणुकीद्वारे कमाई करू शकत नाहीत कारण ते पूर्ण नशिबावर आधारित आहे. तथापि, आधीच्या परिच्छेदात नमूद केल्याप्रमाणे, लोकांना हे समजून घेणे आवश्यक आहे की होल्डिंग कार्यकाळात वाढ झाल्याने सरासरी परताव्यातील फरक कमी होतो. कारण, दीर्घकालीन, अल्पकालीन अस्थिरतेचे चढउतार कमी होते आणि तोटा होण्याची शक्यताही कमी असते. परिणामी, मध्ये फरककमाई कार्यकाळात वाढ झाल्यामुळे कमी होण्यास सुरुवात होते. ही संकल्पना खाली दिलेल्या तक्त्याच्या मदतीने स्पष्ट केली आहे.

| गुंतवणुकीचा कार्यकाळ | सरासरी परतावा (%) | परताव्याचे सरासरी विचलन (%) |

|---|---|---|

| 1 वर्ष | १८ | ± ३४ |

| 3 वर्ष | 13 | ± 16% |

| 5 वर्ष | 13 | ± 13% |

| 7 वर्ष | 13 | ± 10% |

| 10 वर्ष | 13 | ± 9% |

| 12 वर्ष | 13 | ± ८% |

| 14 वर्ष | १२ | ± ७% |

3. इक्विटी मार्केट अस्थिर असल्याने शेअर मार्केटमध्ये फक्त काही कमाई करत आहेत

हे व्यक्तींमध्ये प्रचलित मिथकांपैकी एक आहे. बर्याच लोकांना असे वाटते की ते शेअर्समध्ये गुंतवणूक करून कमाई करू शकत नाहीत. बर्याच घटनांमध्ये व्यक्तींना वाटते; शेअर बाजारात तेजी दिसून येत असली तरी; तरीही मी माझे भविष्य घडवू शकलो नाही. तथापि, हे खरे नाही.

*इक्विटी गुंतवणूक ही शून्य रकमेची खेळ आहे हे समजून घेतले पाहिजे. म्हणून, एका व्यक्तीचा नफा दुसर्या व्यक्तीचे नुकसान आहे. तथापि, तुम्ही नफा कमावला की तोट्यात गेला याचा परिणाम तुम्ही बाजारात प्रवेश केल्यावर आणि बाहेर पडल्यावर ठरवले जाते. *

इक्विटी गुंतवणुकीतील यशाची गुरुकिल्ली ही त्याची दीर्घकालीन होल्डिंग आहे, याचा पुनरुच्चार केला जाईल. जगातील नामवंतांपैकी एकगुंतवणूकदार वॉरन बफेने आपले साम्राज्य केवळ गुंतवणुकीमुळे निर्माण केले नाही. त्याऐवजी, दीर्घकालीन गुंतवणूक ठेवल्यामुळे त्याने संपत्ती कमावली आहे. दीर्घकालीन गुंतवणुकीच्या बाबतीत, गुंतवलेल्या छोट्या रकमेतूनही मोठा परतावा मिळतो. जे लोक खूप काळ गुंतवणुकीत राहतात ते थोड्या गुंतवणुकीतही नशीब कमवू शकतात. खालील आलेख गुंतवणुकीच्या कालावधीत वाढ झाल्यामुळे तोट्याची संभाव्यता कशी कमी होते हे दाखवते.

Talk to our investment specialist

इक्विटीमध्ये गुंतवणूक कशी करावी

तो सर्वात महत्वाचा टप्पा आहे. इक्विटीमध्ये गुंतवणूक करताना लोकांना काही मूलभूत नियमांचे पालन करणे आवश्यक आहे. यापैकी काही नियम खाली सूचीबद्ध आहेत.

संपूर्ण विश्लेषणानंतर स्टॉक्समध्ये गुंतवणूक करा आणि झुंडीच्या वर्तनाचे अनुसरण करू नका

गुंतवणुकीचा प्राथमिक नियम आहे; तुम्हाला समजत असलेल्या आर्थिक साधनांमध्ये गुंतवणूक करा आणि तुम्हाला समजत नसलेल्यांमध्ये नाही. त्यामुळे, लोकांना ज्या शेअर्समध्ये गुंतवणूक करायची आहे त्याचे संपूर्ण विश्लेषण करावे. त्यांनी त्याचे वार्षिक अहवाल पाहिले पाहिजेत, भविष्यातील संभावना तपासल्या पाहिजेत. याव्यतिरिक्त, एखाद्याने त्यांच्या स्टॉक निवड प्रक्रियेत पक्षपातीपणा दाखवू नये. तसेच, गुंतवणूक करताना बरेच लोक झुंडीच्या वर्तनाचे पालन करतात, जे तसे नसावे. ती चांगली कल्पना नाही. कळपाचा भाग बनलेले लोक, बाजार शिखरावर असताना प्रवेश करतात आणि जेव्हा तळ बनवतात तेव्हा विक्री करतात. म्हणून, सर्व खरेदी करत असताना तुम्ही शेअर्स खरेदी करणार नाही याची काळजी घ्याकॉल करा आणि जेव्हा प्रत्येकजण विक्रीच्या नादात जातो तेव्हा विक्री करू नका.

विविधीकरण ही यशाची गुरुकिल्ली आहे

गुंतवणुकीच्या बाबतीत महत्त्वाची भूमिका वैविध्यपूर्ण आहे, जी यशाची गुरुकिल्ली आहे कारण ती जोखमीची पातळी कमी करण्यास मदत करते. बरोबर उद्धृत केल्याप्रमाणे"तुमची सर्व अंडी एकाच टोपलीत उबवू नका;" त्याचप्रमाणे तुमची गुंतवणूक पूर्वनिर्धारित प्रमाणात असंख्य समभागांमध्ये वितरित केली जावी. या संदर्भात विविधीकरणाचा अर्थ असा आहे की लोक भांडवलीकरण, क्षेत्रे आणि इतर मापदंडांच्या संदर्भात विविध कंपन्यांच्या वेगवेगळ्या शेअर्समध्ये कॉर्पसची गुंतवणूक करतात. कारण अशी परिस्थिती असते जिथेमिड-कॅप शेअर्स लार्ज-कॅप शेअर्सपेक्षा जास्त कामगिरी करतात. म्हणून, एखाद्या शेअरची कामगिरी कशी आहे यावर सतत लक्ष ठेवणे आवश्यक आहे.

तुमचा पोर्टफोलिओ वेळेवर संतुलित करा

बरोबर म्हटले आहे की, चूक करणे हे मानवाचे काम आहे. त्याचप्रमाणे शेअर मार्केटमध्ये गुंतवणूक करताना अनेक लोक चुका करतात. या संदर्भात चूक म्हणजे अशा शेअर्समध्ये गुंतवणूक करणे जिथे तुमचे खराब सौदे आहेत. तथापि, सर्वात महत्त्वाचा भाग म्हणजे तुमच्या पोर्टफोलिओचे पुनर्संतुलन करून चुकीची गुंतवणूक सुधारणे. तुमच्या इक्विटी गुंतवणुकीचे वेळेवर निरीक्षण करणे महत्त्वाचे आहे. यामुळे कोणते स्टॉक विकायचे आणि कोणते टिकवून ठेवायचे हे ओळखण्यास मदत होईल. पोर्टफोलिओचे पुनर्संतुलन केल्याने नेहमी खराब स्टॉक्सपासून मुक्त होण्यास मदत होते आणि त्याद्वारे लोक अधिक कमाई करू शकतातउत्पन्न.

अशा प्रकारे, वरील पॉइंटर्सवरून असे म्हणता येईल की जेव्हाही तुम्ही इक्विटीमध्ये गुंतवणूक करण्याचा निर्णय घेता तेव्हा तुम्हाला बाजाराच्या वेळेपेक्षा शेअर मार्केटमध्ये बराच वेळ घालवावा लागतो. तसेच, लोकांनी कंपनीच्या शेअर्समध्ये गुंतवणूक करण्यापूर्वी नेहमी समजून घेतले पाहिजे जेणेकरून त्यांचे गुंतवणूकीचे पैसे सुरक्षित राहतील आणि संपत्ती निर्मितीचा मार्ग मोकळा होईल.

दीर्घकालीन गुंतवणुकीसाठी शीर्ष 10 इक्विटी म्युच्युअल फंड

*मालमत्तेचे व्यवस्थापन करणाऱ्या शीर्ष निधीची यादी5 वर्षे वरीलपैकी आणि सर्वोत्तम वार्षिक रिटर्न्स (CAGR) परत केले आहेत.

The primary objective of the Scheme is to achieve long-term capital appreciation by investing in equity & equity related instruments of mid cap & small cap companies. Principal Emerging Bluechip Fund is a Equity - Large & Mid Cap fund was launched on 12 Nov 08. It is a fund with Moderately High risk and has given a Below is the key information for Principal Emerging Bluechip Fund Returns up to 1 year are on (Erstwhile Sundaram Select Midcap Fund) To achieve capital appreciation by investing

in diversified stocks that are generally termed

as mid-caps. Sundaram Mid Cap Fund is a Equity - Mid Cap fund was launched on 30 Jul 02. It is a fund with Moderately High risk and has given a Below is the key information for Sundaram Mid Cap Fund Returns up to 1 year are on (Erstwhile Motilal Oswal MOSt Focused Midcap 30 Fund) The investment objective of the Scheme is to achieve long term capital appreciation by investing in a maximum of 30 quality mid-cap companies having long-term competitive advantages and potential for growth. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Motilal Oswal Midcap 30 Fund is a Equity - Mid Cap fund was launched on 24 Feb 14. It is a fund with Moderately High risk and has given a Below is the key information for Motilal Oswal Midcap 30 Fund Returns up to 1 year are on To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments HDFC Long Term Advantage Fund is a Equity - ELSS fund was launched on 2 Jan 01. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on An Open-ended growth scheme with the objective of long term growth of capital, through a portfolio with a target allocation of 90% equity and 10% debt and money market securities. Aditya Birla Sun Life Equity Fund is a Equity - Multi Cap fund was launched on 27 Aug 98. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Equity Fund Returns up to 1 year are on The primary objective for Franklin IndiaTaxshield is to provide medium to long term growth of capital along with income tax rebate Franklin India Taxshield is a Equity - ELSS fund was launched on 10 Apr 99. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Taxshield Returns up to 1 year are on An Open ended Growth Scheme with the objective to achieve long term growth of capital at controlled level of risk by investing primarily in ‘Mid-Cap’ Stocks. The level of risk is somewhat higher than a fund focused on large and liquid stocks. Concomitantly, the aim is to generate higher returns than a fund focused on large and liquid stocks. Aditya Birla Sun Life Midcap Fund is a Equity - Mid Cap fund was launched on 3 Oct 02. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Midcap Fund Returns up to 1 year are on The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies and the secondary objective is to generate consistent returns by investing in debt and money market securities. Nippon India Small Cap Fund is a Equity - Small Cap fund was launched on 16 Sep 10. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Small Cap Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek to generate continuous returns by actively investing in equity and equity related securities of

companies in the Banking Sector and companies engaged in allied activities related to Banking Sector. The AMC will have the discretion to completely or

partially invest in any of the type of securities stated above with a view to maximize the returns or on defensive considerations. However, there can be no

assurance that the investment objective of the Scheme will be realized, as actual market movements may be at variance with anticipated trends. Nippon India Banking Fund is a Equity - Sectoral fund was launched on 26 May 03. It is a fund with High risk and has given a Below is the key information for Nippon India Banking Fund Returns up to 1 year are on The primary investment objective of the scheme is to seek to generate consistent returns by investing in equity and equity related or fixed income securities of Pharma and other associated companies. Nippon India Pharma Fund is a Equity - Sectoral fund was launched on 5 Jun 04. It is a fund with High risk and has given a Below is the key information for Nippon India Pharma Fund Returns up to 1 year are on 1. Principal Emerging Bluechip Fund

CAGR/Annualized return of 24.8% since its launch. Ranked 1 in Large & Mid Cap category. . Principal Emerging Bluechip Fund

Growth Launch Date 12 Nov 08 NAV (31 Dec 21) ₹183.316 ↑ 2.03 (1.12 %) Net Assets (Cr) ₹3,124 on 30 Nov 21 Category Equity - Large & Mid Cap AMC Principal Pnb Asset Mgmt. Co. Priv. Ltd. Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 2.08 Sharpe Ratio 2.74 Information Ratio 0.22 Alpha Ratio 2.18 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,552 Returns for Principal Emerging Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 2.9% 3 Month 2.9% 6 Month 13.6% 1 Year 38.9% 3 Year 21.9% 5 Year 19.2% 10 Year 15 Year Since launch 24.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Principal Emerging Bluechip Fund

Name Since Tenure Data below for Principal Emerging Bluechip Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. Sundaram Mid Cap Fund

CAGR/Annualized return of 23.8% since its launch. Ranked 13 in Mid Cap category. Return for 2024 was 32% , 2023 was 40.4% and 2022 was 4.8% . Sundaram Mid Cap Fund

Growth Launch Date 30 Jul 02 NAV (22 Apr 25) ₹1,277.61 ↑ 7.61 (0.60 %) Net Assets (Cr) ₹11,333 on 31 Mar 25 Category Equity - Mid Cap AMC Sundaram Asset Management Company Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.8 Sharpe Ratio 0.34 Information Ratio 0.15 Alpha Ratio 3.95 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,480 31 Mar 22 ₹21,162 31 Mar 23 ₹21,693 31 Mar 24 ₹33,395 31 Mar 25 ₹37,537 Returns for Sundaram Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 3.8% 3 Month 1.8% 6 Month -5.6% 1 Year 14.6% 3 Year 22.2% 5 Year 29.6% 10 Year 15 Year Since launch 23.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 32% 2022 40.4% 2021 4.8% 2020 37.5% 2019 11.8% 2018 -0.3% 2017 -15.4% 2016 40.8% 2015 11.3% 2014 11.2% Fund Manager information for Sundaram Mid Cap Fund

Name Since Tenure S. Bharath 24 Feb 21 4.1 Yr. Ratish Varier 24 Feb 21 4.1 Yr. Data below for Sundaram Mid Cap Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Consumer Cyclical 19.48% Financial Services 19.47% Industrials 13.59% Health Care 10.64% Basic Materials 10.07% Technology 6.6% Consumer Defensive 3.88% Communication Services 3.62% Real Estate 3.42% Utility 1.95% Energy 1.65% Asset Allocation

Asset Class Value Cash 5.63% Equity 94.37% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity Cummins India Ltd (Industrials)

Equity, Since 31 Dec 17 | 5004803% ₹345 Cr 1,270,127

↑ 8,529 The Federal Bank Ltd (Financial Services)

Equity, Since 31 Dec 18 | FEDERALBNK3% ₹342 Cr 19,247,362 Coromandel International Ltd (Basic Materials)

Equity, Since 30 Nov 10 | 5063953% ₹291 Cr 1,747,182 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 31 Mar 21 | KALYANKJIL3% ₹278 Cr 6,016,821 Lupin Ltd (Healthcare)

Equity, Since 31 Jan 23 | 5002572% ₹257 Cr 1,350,321 Persistent Systems Ltd (Technology)

Equity, Since 30 Apr 22 | PERSISTENT2% ₹257 Cr 484,892 Indian Bank (Financial Services)

Equity, Since 31 Jul 23 | 5328142% ₹242 Cr 4,738,175

↓ -158,971 Fortis Healthcare Ltd (Healthcare)

Equity, Since 31 Dec 21 | 5328432% ₹238 Cr 3,879,249 Mahindra & Mahindra Financial Services Ltd (Financial Services)

Equity, Since 31 Jan 24 | M&MFIN2% ₹229 Cr 8,478,867 AU Small Finance Bank Ltd (Financial Services)

Equity, Since 31 Oct 20 | 5406112% ₹216 Cr 3,817,491 3. Motilal Oswal Midcap 30 Fund

CAGR/Annualized return of 22.1% since its launch. Ranked 27 in Mid Cap category. Return for 2024 was 57.1% , 2023 was 41.7% and 2022 was 10.7% . Motilal Oswal Midcap 30 Fund

Growth Launch Date 24 Feb 14 NAV (22 Apr 25) ₹93.0829 ↑ 0.70 (0.76 %) Net Assets (Cr) ₹26,028 on 31 Mar 25 Category Equity - Mid Cap AMC Motilal Oswal Asset Management Co. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.66 Sharpe Ratio 0.47 Information Ratio 0.63 Alpha Ratio 8.9 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,888 31 Mar 22 ₹23,342 31 Mar 23 ₹25,677 31 Mar 24 ₹41,172 31 Mar 25 ₹48,151 Returns for Motilal Oswal Midcap 30 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.3% 3 Month -2.5% 6 Month -9.9% 1 Year 15.2% 3 Year 26.4% 5 Year 36.6% 10 Year 15 Year Since launch 22.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 57.1% 2022 41.7% 2021 10.7% 2020 55.8% 2019 9.3% 2018 9.7% 2017 -12.7% 2016 30.8% 2015 5.2% 2014 16.5% Fund Manager information for Motilal Oswal Midcap 30 Fund

Name Since Tenure Ajay Khandelwal 1 Oct 24 0.41 Yr. Niket Shah 1 Jul 20 4.67 Yr. Rakesh Shetty 22 Nov 22 2.27 Yr. Sunil Sawant 1 Jul 24 0.67 Yr. Data below for Motilal Oswal Midcap 30 Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Technology 34.02% Consumer Cyclical 16.09% Industrials 11.09% Health Care 5% Communication Services 3.44% Real Estate 2.8% Basic Materials 2.32% Utility 2.06% Financial Services 0.09% Asset Allocation

Asset Class Value Cash 28.33% Equity 71.67% Top Securities Holdings / Portfolio

Name Holding Value Quantity Coforge Ltd (Technology)

Equity, Since 31 Mar 23 | COFORGE10% ₹2,349 Cr 3,190,000

↑ 340,000 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 23 | PERSISTENT10% ₹2,254 Cr 4,249,800

↑ 249,800 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 29 Feb 24 | KALYANKJIL7% ₹1,619 Cr 35,027,075

↑ 26,975 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Mar 23 | DIXON7% ₹1,581 Cr 1,134,324

↑ 134,324 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 24 | MAXHEALTH4% ₹975 Cr 9,969,361

↑ 1,913,231 One97 Communications Ltd (Technology)

Equity, Since 30 Sep 24 | 5433964% ₹934 Cr 13,066,359

↑ 3,065,359 Trent Ltd (Consumer Cyclical)

Equity, Since 30 Nov 24 | 5002514% ₹873 Cr 1,800,000

↓ -820,200 Polycab India Ltd (Industrials)

Equity, Since 30 Sep 23 | POLYCAB3% ₹825 Cr 1,750,000

↓ -100,000 Bharti Hexacom Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIHEXA3% ₹815 Cr 6,250,000

↑ 174,429 KEI Industries Ltd (Industrials)

Equity, Since 30 Nov 24 | KEI3% ₹768 Cr 2,500,000

↑ 1,250,000 4. HDFC Long Term Advantage Fund

CAGR/Annualized return of 21.4% since its launch. Ranked 23 in ELSS category. . HDFC Long Term Advantage Fund

Growth Launch Date 2 Jan 01 NAV (14 Jan 22) ₹595.168 ↑ 0.28 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.15 Alpha Ratio 1.75 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,787

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.5% 3 Year 20.6% 5 Year 17.4% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. Aditya Birla Sun Life Equity Fund

CAGR/Annualized return of 21.2% since its launch. Ranked 16 in Multi Cap category. Return for 2024 was 18.5% , 2023 was 26% and 2022 was -1.1% . Aditya Birla Sun Life Equity Fund

Growth Launch Date 27 Aug 98 NAV (22 Apr 25) ₹1,699.36 ↑ 2.94 (0.17 %) Net Assets (Cr) ₹21,668 on 31 Mar 25 Category Equity - Multi Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.69 Sharpe Ratio 0.28 Information Ratio -0.21 Alpha Ratio 3.82 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,397 31 Mar 22 ₹21,099 31 Mar 23 ₹20,222 31 Mar 24 ₹27,766 31 Mar 25 ₹30,687 Returns for Aditya Birla Sun Life Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 3.6% 3 Month 3.7% 6 Month -2.8% 1 Year 11.1% 3 Year 15.1% 5 Year 24% 10 Year 15 Year Since launch 21.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 18.5% 2022 26% 2021 -1.1% 2020 30.3% 2019 16.1% 2018 8.5% 2017 -4.1% 2016 33.5% 2015 15.2% 2014 2.9% Fund Manager information for Aditya Birla Sun Life Equity Fund

Name Since Tenure Harish Krishnan 3 Nov 23 1.41 Yr. Dhaval Joshi 21 Nov 22 2.36 Yr. Data below for Aditya Birla Sun Life Equity Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 33.46% Consumer Cyclical 11.39% Industrials 10.38% Technology 9.94% Basic Materials 9.45% Health Care 7.48% Consumer Defensive 7.44% Energy 5.39% Communication Services 3.13% Real Estate 0.58% Asset Allocation

Asset Class Value Cash 1.25% Equity 98.75% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 16 | ICICIBANK8% ₹1,626 Cr 13,500,000 Infosys Ltd (Technology)

Equity, Since 30 Apr 05 | INFY5% ₹1,074 Cr 6,365,588

↓ -134,412 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK5% ₹936 Cr 5,404,179

↑ 372,810 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 28 Feb 19 | KOTAKBANK4% ₹868 Cr 4,563,682

↑ 63,682 Reliance Industries Ltd (Energy)

Equity, Since 31 May 19 | RELIANCE4% ₹815 Cr 6,789,998 HCL Technologies Ltd (Technology)

Equity, Since 30 Nov 11 | HCLTECH3% ₹567 Cr 3,600,000 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Dec 18 | SUNPHARMA3% ₹536 Cr 3,365,000

↓ -867,179 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Nov 17 | BHARTIARTL3% ₹531 Cr 3,382,814

↓ -153,374 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Jan 15 | CHOLAFIN2% ₹469 Cr 3,350,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 23 | LT2% ₹445 Cr 1,407,458

↓ -292,542 6. Franklin India Taxshield

CAGR/Annualized return of 21% since its launch. Ranked 28 in ELSS category. Return for 2024 was 22.4% , 2023 was 31.2% and 2022 was 5.4% . Franklin India Taxshield

Growth Launch Date 10 Apr 99 NAV (22 Apr 25) ₹1,423.27 ↑ 3.29 (0.23 %) Net Assets (Cr) ₹6,359 on 31 Mar 25 Category Equity - ELSS AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆ Risk Moderately High Expense Ratio 1.83 Sharpe Ratio 0.19 Information Ratio 1.32 Alpha Ratio 2.32 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,793 31 Mar 22 ₹21,613 31 Mar 23 ₹22,171 31 Mar 24 ₹32,145 31 Mar 25 ₹35,012 Returns for Franklin India Taxshield

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 3.7% 3 Month 3.1% 6 Month -3.2% 1 Year 11.1% 3 Year 18.8% 5 Year 27.6% 10 Year 15 Year Since launch 21% Historical performance (Yearly) on absolute basis

Year Returns 2023 22.4% 2022 31.2% 2021 5.4% 2020 36.7% 2019 9.8% 2018 5.1% 2017 -3% 2016 29.1% 2015 4.7% 2014 4% Fund Manager information for Franklin India Taxshield

Name Since Tenure R. Janakiraman 2 May 16 8.84 Yr. Rajasa Kakulavarapu 1 Dec 23 1.25 Yr. Data below for Franklin India Taxshield as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 30.86% Consumer Cyclical 13.13% Technology 10.95% Industrials 9.83% Health Care 6.41% Communication Services 5.59% Consumer Defensive 5.31% Basic Materials 4.65% Utility 4.03% Energy 3.03% Real Estate 1.63% Asset Allocation

Asset Class Value Cash 3.86% Equity 96.14% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 07 | HDFCBANK9% ₹565 Cr 3,260,417 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK9% ₹547 Cr 4,546,914 Infosys Ltd (Technology)

Equity, Since 29 Feb 12 | INFY5% ₹325 Cr 1,922,741 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 07 | BHARTIARTL5% ₹308 Cr 1,963,637

↓ -250,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 19 | LT5% ₹280 Cr 883,853 HCL Technologies Ltd (Technology)

Equity, Since 31 Oct 21 | HCLTECH4% ₹230 Cr 1,462,587 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 14 | 5322154% ₹229 Cr 2,252,948 Zomato Ltd (Consumer Cyclical)

Equity, Since 30 Nov 21 | 5433203% ₹167 Cr 7,500,000 United Spirits Ltd (Consumer Defensive)

Equity, Since 31 Oct 18 | UNITDSPR3% ₹164 Cr 1,276,457

↓ -298,543 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Nov 17 | KOTAKBANK3% ₹161 Cr 843,530 7. Aditya Birla Sun Life Midcap Fund

CAGR/Annualized return of 21% since its launch. Ranked 16 in Mid Cap category. Return for 2024 was 22% , 2023 was 39.9% and 2022 was -5.3% . Aditya Birla Sun Life Midcap Fund

Growth Launch Date 3 Oct 02 NAV (22 Apr 25) ₹731.26 ↑ 3.49 (0.48 %) Net Assets (Cr) ₹5,502 on 31 Mar 25 Category Equity - Mid Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.94 Sharpe Ratio 0.31 Information Ratio -1.01 Alpha Ratio 3.38 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,116 31 Mar 22 ₹23,680 31 Mar 23 ₹22,337 31 Mar 24 ₹32,732 31 Mar 25 ₹36,576 Returns for Aditya Birla Sun Life Midcap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 3.2% 3 Month 1.9% 6 Month -7.8% 1 Year 9.4% 3 Year 16.2% 5 Year 28.9% 10 Year 15 Year Since launch 21% Historical performance (Yearly) on absolute basis

Year Returns 2023 22% 2022 39.9% 2021 -5.3% 2020 50.4% 2019 15.5% 2018 -3.7% 2017 -16% 2016 44.8% 2015 5.7% 2014 10.4% Fund Manager information for Aditya Birla Sun Life Midcap Fund

Name Since Tenure Vishal Gajwani 31 Oct 24 0.41 Yr. Dhaval Joshi 21 Nov 22 2.36 Yr. Data below for Aditya Birla Sun Life Midcap Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 20.13% Basic Materials 17.17% Consumer Cyclical 15.68% Health Care 12.4% Industrials 11.14% Technology 7.36% Real Estate 3.6% Consumer Defensive 3.23% Utility 2.75% Communication Services 1.39% Energy 0.38% Asset Allocation

Asset Class Value Cash 3.75% Equity 96.25% Top Securities Holdings / Portfolio

Name Holding Value Quantity Fortis Healthcare Ltd (Healthcare)

Equity, Since 31 May 17 | 5328434% ₹180 Cr 2,938,828

↓ -161,172 Cholamandalam Financial Holdings Ltd (Financial Services)

Equity, Since 31 Dec 14 | CHOLAHLDNG3% ₹158 Cr 964,000 Torrent Power Ltd (Utilities)

Equity, Since 31 Oct 19 | 5327793% ₹139 Cr 1,100,000 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 23 | SHRIRAMFIN3% ₹139 Cr 2,244,070 Gujarat Fluorochemicals Ltd Ordinary Shares (Basic Materials)

Equity, Since 30 Sep 19 | FLUOROCHEM3% ₹138 Cr 384,431 AU Small Finance Bank Ltd (Financial Services)

Equity, Since 30 Nov 19 | 5406113% ₹136 Cr 2,407,000 Glenmark Pharmaceuticals Ltd (Healthcare)

Equity, Since 28 Feb 21 | 5322963% ₹128 Cr 1,000,000 United Breweries Ltd (Consumer Defensive)

Equity, Since 31 Jul 21 | 5324783% ₹127 Cr 652,792 Max Financial Services Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5002712% ₹122 Cr 1,225,565 K.P.R. Mill Ltd (Consumer Cyclical)

Equity, Since 31 Aug 20 | KPRMILL2% ₹120 Cr 1,500,000 8. Nippon India Small Cap Fund

CAGR/Annualized return of 20.8% since its launch. Ranked 6 in Small Cap category. Return for 2024 was 26.1% , 2023 was 48.9% and 2022 was 6.5% . Nippon India Small Cap Fund

Growth Launch Date 16 Sep 10 NAV (22 Apr 25) ₹157.898 ↑ 1.60 (1.03 %) Net Assets (Cr) ₹55,491 on 31 Mar 25 Category Equity - Small Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.55 Sharpe Ratio 0.07 Information Ratio 0.53 Alpha Ratio -0.23 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹21,742 31 Mar 22 ₹31,334 31 Mar 23 ₹33,418 31 Mar 24 ₹51,907 31 Mar 25 ₹55,076 Returns for Nippon India Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 4.1% 3 Month -2% 6 Month -9% 1 Year 6.2% 3 Year 21.6% 5 Year 39.3% 10 Year 15 Year Since launch 20.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.1% 2022 48.9% 2021 6.5% 2020 74.3% 2019 29.2% 2018 -2.5% 2017 -16.7% 2016 63% 2015 5.6% 2014 15.1% Fund Manager information for Nippon India Small Cap Fund

Name Since Tenure Samir Rachh 2 Jan 17 8.16 Yr. Kinjal Desai 25 May 18 6.77 Yr. Data below for Nippon India Small Cap Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 22.17% Consumer Cyclical 13.91% Financial Services 13.54% Basic Materials 12.14% Consumer Defensive 8.89% Technology 8.65% Health Care 8.16% Energy 2.03% Utility 1.98% Communication Services 1.54% Real Estate 0.54% Asset Allocation

Asset Class Value Cash 6.04% Equity 93.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 22 | HDFCBANK2% ₹1,152 Cr 6,650,000 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 28 Feb 21 | MCX2% ₹924 Cr 1,851,010 Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Oct 12 | KIRLOSBROS1% ₹714 Cr 4,472,130 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Nov 18 | DIXON1% ₹655 Cr 470,144 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5900031% ₹639 Cr 31,784,062 State Bank of India (Financial Services)

Equity, Since 31 Oct 19 | SBIN1% ₹627 Cr 9,100,000 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 30 Apr 18 | TIINDIA1% ₹615 Cr 2,499,222 NLC India Ltd (Utilities)

Equity, Since 31 Oct 22 | NLCINDIA1% ₹563 Cr 27,190,940 Adani Wilmar Ltd (Consumer Defensive)

Equity, Since 31 Jan 25 | 5434581% ₹553 Cr 22,483,343

↑ 183,343 Apar Industries Ltd (Industrials)

Equity, Since 31 Mar 17 | APARINDS1% ₹521 Cr 899,271 9. Nippon India Banking Fund

CAGR/Annualized return of 20.7% since its launch. Ranked 15 in Sectoral category. Return for 2024 was 10.3% , 2023 was 24.2% and 2022 was 20.7% . Nippon India Banking Fund

Growth Launch Date 26 May 03 NAV (22 Apr 25) ₹619.258 ↑ 3.06 (0.50 %) Net Assets (Cr) ₹6,566 on 31 Mar 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.94 Sharpe Ratio 0.46 Information Ratio 0.54 Alpha Ratio -6.4 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,796 31 Mar 22 ₹21,684 31 Mar 23 ₹23,468 31 Mar 24 ₹31,409 31 Mar 25 ₹35,338 Returns for Nippon India Banking Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 9.2% 3 Month 14% 6 Month 7.7% 1 Year 19.2% 3 Year 20.2% 5 Year 29.8% 10 Year 15 Year Since launch 20.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 10.3% 2022 24.2% 2021 20.7% 2020 29.7% 2019 -10.6% 2018 10.7% 2017 -1.2% 2016 44.1% 2015 11.5% 2014 -6% Fund Manager information for Nippon India Banking Fund

Name Since Tenure Vinay Sharma 9 Apr 18 6.98 Yr. Kinjal Desai 25 May 18 6.85 Yr. Bhavik Dave 18 Jun 21 3.79 Yr. Data below for Nippon India Banking Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 95.28% Technology 2.81% Asset Allocation

Asset Class Value Cash 1.91% Equity 98.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK21% ₹1,311 Cr 7,564,660

↓ -150,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK16% ₹953 Cr 7,915,358 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 17 | 53221510% ₹589 Cr 5,800,228 State Bank of India (Financial Services)

Equity, Since 31 Mar 14 | SBIN5% ₹307 Cr 4,459,330 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 May 19 | INDUSINDBK4% ₹260 Cr 2,627,608 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Jul 20 | SBICARD4% ₹228 Cr 2,720,827 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Oct 23 | 5329784% ₹215 Cr 1,146,038 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jul 23 | KOTAKBANK3% ₹201 Cr 1,055,000

↓ -455,000 Cholamandalam Financial Holdings Ltd (Financial Services)

Equity, Since 30 Apr 19 | CHOLAHLDNG3% ₹191 Cr 1,160,355 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Nov 20 | SBILIFE3% ₹186 Cr 1,300,170 10. Nippon India Pharma Fund

CAGR/Annualized return of 20.6% since its launch. Ranked 35 in Sectoral category. Return for 2024 was 34% , 2023 was 39.2% and 2022 was -9.9% . Nippon India Pharma Fund

Growth Launch Date 5 Jun 04 NAV (22 Apr 25) ₹495.491 ↑ 2.94 (0.60 %) Net Assets (Cr) ₹8,081 on 31 Mar 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk High Expense Ratio 1.88 Sharpe Ratio 0.35 Information Ratio -0.49 Alpha Ratio -4.46 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,447 31 Mar 22 ₹20,234 31 Mar 23 ₹18,871 31 Mar 24 ₹29,909 31 Mar 25 ₹33,564 Returns for Nippon India Pharma Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.3% 3 Month 0.3% 6 Month -3.1% 1 Year 17.2% 3 Year 19.5% 5 Year 22.4% 10 Year 15 Year Since launch 20.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 34% 2022 39.2% 2021 -9.9% 2020 23.9% 2019 66.4% 2018 1.7% 2017 3.6% 2016 7.6% 2015 -10.6% 2014 19.4% Fund Manager information for Nippon India Pharma Fund

Name Since Tenure Sailesh Raj Bhan 1 Apr 05 20.01 Yr. Kinjal Desai 25 May 18 6.86 Yr. Data below for Nippon India Pharma Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Health Care 98.89% Asset Allocation

Asset Class Value Cash 1.11% Equity 98.89% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Oct 09 | SUNPHARMA14% ₹1,045 Cr 6,556,349 Divi's Laboratories Ltd (Healthcare)

Equity, Since 31 Mar 12 | DIVISLAB9% ₹712 Cr 1,298,808

↓ -52,000 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 08 | 5002578% ₹590 Cr 3,098,126

↓ -102,567 Cipla Ltd (Healthcare)

Equity, Since 31 May 08 | 5000876% ₹450 Cr 3,200,000

↑ 100,000 Dr Reddy's Laboratories Ltd (Healthcare)

Equity, Since 30 Jun 11 | DRREDDY5% ₹409 Cr 3,662,170 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Sep 20 | APOLLOHOSP5% ₹393 Cr 648,795 Abbott India Ltd (Healthcare)

Equity, Since 31 May 11 | ABBOTINDIA4% ₹292 Cr 95,985

↑ 9,595 Vijaya Diagnostic Centre Ltd (Healthcare)

Equity, Since 30 Sep 21 | 5433503% ₹260 Cr 2,843,231 Medplus Health Services Ltd (Healthcare)

Equity, Since 30 Nov 22 | 5434273% ₹259 Cr 3,627,277

↑ 62,597 GlaxoSmithKline Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Aug 22 | GLAXO3% ₹250 Cr 1,011,921

↑ 179,134

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.