+91-22-48913909

+91-22-48913909

Table of Contents

Mutual Fund Investing: Contribution to Economy

Mutual fund Investing has a significant contribution when it comes to the development of the Indian Economy. The Indian financial Market has seen a great upheaval in the early eighties and nineties. Mutual Funds investment has acted as a bridge connecting the gap between the supply and demand for funds in the financial markets. Since 2003, the Financial Sector has been on a constant rise. The mutual fund Industry has acted on the forefront to contribute to the Indian economy.

Talk to our investment specialist

Mutual Fund Investing: A History

Mutual fund industry was set up in the year 1963 by the UTI act of the Parliament. It has seen a massive evolution over four distinct phases to reach its present condition. Entry of the public sector in 1987 followed by the entry of the private sector in 1993 marked the two major phases of the mutual fund industry. Since February 2003, the industry has entered the phase of consolidation and growth.

Mutual Fund Investing: Contribution to Economy

Development of Financial Sector

Development of financial sector enhances the four pillars of the Financial System: Efficiency, stability, transparency, and inclusion. Mutual fund investing plays an important role in this development. They pool the resources from the small investors together, thus increasing participation in the financial markets. Next, mutual funds provide services to small investors to make informed decisions. Such detailed services and analysis help lighten the risk Factor for these small investors. Thus, it helps investors to reinvest in mutual funds. Our mutual fund industry has been growing at a healthy speed of nearly 20% per annum over the last decade.

Mutual Funds as a Source of Investment

Mutual funds have gained an unprecedented thrust since 2003. Indians generally save up to 30% of our salaried Income which is very high. Mutual funds have been a good option for investing money of the salaried class. Diversification of mutual fund schemes has allowed more investors to come in and pool their assets. The total amount of savings in the financial saving showed a whopping 18% increase in 2014. Investors are now more inclined towards putting money in mutual funds than compared to physical assets. This has significantly increased the assets under management (AUM) in the last 4-5 years. The AUM has increased a staggering 29% from August 2014 to August 2015 for fresh mutual fund mobilisation. Mutual funds have had a positive impact on the finance sector in terms of consistent investment. The pooled money is providing a helping hand in the development of the industry.

Household Savings Breakdown

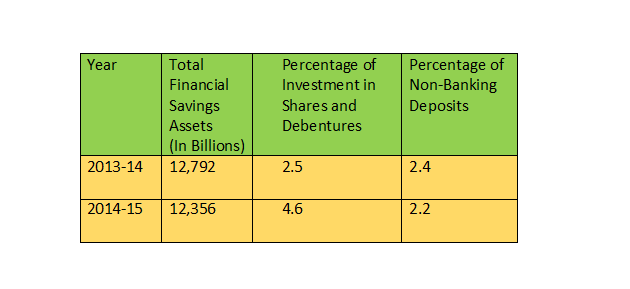

Mutual funds have been the front-runners in the investment sector since last year. The household savings funnelled a good amount of money into mutual funds. Of the total household savings, more than INR 50,000 crores were put in shares and Debentures. The household financial savings rose above 7.5% of national income in 2014-15. Over 15 lakh new individual investment folios were created last year. The net inflows into Equity Mutual Funds are touching the degree previously observed in 2008. Investors are gradually moving away from the physical asset market. With Real Estate prices falling as well as the Inflation protection Asset Class like gold also descending, people are shifting to mutual funds. This will lead to an increased investment in financial savings. Such rise in domestic inflows in mutual funds will support the equity prices.

Breakup of financial savings in shares and debentures (as % of total financial savings shares and debentures) Source: Ministry of Statistics and Programme Implementation- MOSPI

Breakup of financial savings in shares and debentures (as % of total financial savings shares and debentures) Source: Ministry of Statistics and Programme Implementation- MOSPI

Personal savings in India since 2006 (Source: Ministry of Statistics and Programme Implementation- MOSPI)

Personal savings in India since 2006 (Source: Ministry of Statistics and Programme Implementation- MOSPI)

Break-up Financial Assets of households (2013-2015)

Break-up Financial Assets of households (2013-2015)

Market Development due to Mutual Funds

The money markets in India have been significantly impacted by the arrival of mutual funds. It has even strengthened the Government Securities market to some extent. The introduction of money market Mutual Funds (MMMF) in 1991 provided investors with an additional channel for short-term investments. As a result, the money market tools are now within the reach of individuals or retail investors. The MMMFs are a trend today because of the revised SEBI regulations and permission to invest in rated corporate Bonds and debentures.

The money markets have been hugely benefitted by increased mutual funds investment. It has now seen an addition of around 22 lakh new investors during 2014-15. The total number of investors was calculated to be around 4.17 crore in MMMF marking a 6% growth over previous year. This large growth is a sign of healthy domestic investor sentiment. Indian consumers are willing to take risks with brands that have a strong goodwill and positive past record.

Conclusion

Mutual fund investing has certainly played a great role in shaping the economy. But there is still a lot of work to be done. Fund houses have to strive for more innovative schemes and a better approach to attract investors. Mutual Fund investing has the ability to satisfy a diverse Range of investors with the help of various risk-return preferences. Industry AUM of over Rs. 20,00,000 crores is expected by 2018 with an investor support of around 10 crore accounts. The account base(No. of unique folios) currently is still below 1% of the total domestic population. Thus, if a focused and a targeted approach is adopted by government and market regulators, the Mutual Fund industry has the potential to be an integral part of our developing economy.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Please provide the Name of the authors as well