Table of Contents

- Mutual Fund Investment Guide: Introduction To Mutual Funds

- How to Start Investing in Mutual Funds in Five Simple Steps?

- The Mutual Fund Guide to the Investment Cost

- Categories Of Mutual Fund

- Mutual Fund Investment Guide: Selecting Best Mutual Funds

- How to Invest in Mutual Funds for Beginners in India?

- Mutual Fund Calculator

- Advantages Of Mutual Fund Investment

- Investing In Mutual Funds

- How to Invest in Mutual Funds Online?

- Conclusion

- Frequently Asked Questions

Mutual Fund Investment Guide

Are you new to mutual fund investments? Then refer to mutual fund investment guide for having an overall understanding about mutual funds. Asset Management Companies (AMCs) prepare a mutual fund investment guide to create awareness about the concept of mutual funds among people.

A Mutual Fund invests the money collected from individuals in financial instruments like shares and Bonds. There are many categories of mutual funds like ELSS funds, Index Funds, and tax saving funds.

Also, in the current scenario, mutual funds are becoming more popular and acknowledged among individual investors, courtesy to the benefits one can acquire. Amidst an array of advantages, what drives a majority of investors is:

- Ability to begin with any amount, even as low as Rs. 500

- Diversification across varying stocks and additional instruments, such as gold, debt, and more

- Automated Systematic Investment Plans (SIP)

- Investment without the need for a Demat account

Mutual fund investment guide also helps individuals to determine the money required to fulfill their objectives. So, with the help of mutual fund investment guide let us understand the different aspects of mutual funds like what is a mutual fund, How to Invest in Mutual Funds, different Types of Mutual Funds like index funds, ELSS funds, tax saving funds, selecting the best mutual funds, mutual fund calculators and other aspects of mutual funds.

Mutual Fund Investment Guide: Introduction To Mutual Funds

Most of the mutual fund investment guide start by giving a brief introduction about mutual funds. As mentioned earlier, a Mutual fund is an investment avenue that collects money from different individuals sharing a common objective of trading in shares, bonds, and other financial securities. Mutual funds in India are run by AMCs or fund houses. Individuals owning mutual fund units are entitled to a proportional share of profits and losses depending on the fund’s performance. The regulatory authority of mutual funds in India is Securities and Exchange Board of India (SEBI). Association of Mutual Funds in India (AMFI) is another body which is responsible for developing the mutual fund industry in India.

How to Start Investing in Mutual Funds in Five Simple Steps?

When you even try collecting answers for how to start investing in mutual funds, experts suggest that you stay wary of certain essential factors before beginning. Here are the simple five things that you must know:

- Risk Profiling: The process of identifying your risk tolerance, capacity and capability is referred to as risk profiling.

- Asset Allocation: Once you have comprehended the risk profile, you must look into dividing the money between several asset classes. Generally, the Asset Allocation must have a mixture of both debt and equity instruments to balance the risks.

- Identification: The next step should be identifying such funds that are worthy of investment in each class of asset. If you want, you can compare different mutual funds based on their past performances and your investment goals.

- Mutual Fund Schemes: Next, make sure that you decide upon the mutual fund scheme you will invest in and apply for the same either offline or online.

- Follow-Ups: Lastly, don’t stop with the diversification of your assets. Keep following up to make sure that your portfolio is making the best.

The Mutual Fund Guide to the Investment Cost

When going through a mutual fund guide, cost of investment is a factor that you should not overlook. The fund value gets calculated according to the Net Asset Value (NAV), which is the value of the portfolio’s net expenses. The AMC calculated it after every business day. Also, AMCs will be charging you an administration fee that covers their advertising, brokerage, salaries and other expenditure. Usually, this is evaluated with expense ratio. The lower the expense ratio, the lesser will be the investment cost in that mutual fund. Moreover, AMCs, might also charge loads that are typically the sales charges that a company incurs in the form of a distribution cost. If you are starting new and are not acquainted with associated costs, you may find yourself in a position where profits from investment keep decreasing substantially because of overhead expenses. Thus, it is recommended that you read the fine print to figure out fees and expenses before choosing the fund.

Categories Of Mutual Fund

Categories or types of mutual funds is also one of the topics covered in a mutual fund investment guide. Since mutual fund schemes are designed to suit the customer’s requirements, there are various types of mutual funds. For instance, a risk seeking individual would invest in a fund whose stakes in equity markets are higher. In contrast, an individual who is risk averse would invest in a scheme having more exposure in debt and fixed income instruments. Basically, mutual funds can be of two different types, such as open-ended and close-ended schemes. However, when they are classified on the basis of nature, mutual funds turn out to be of three types, such as equity, debt and balanced. Based on these requirements, mutual funds are classified into various categories like Equity Funds, Debt fund, index funds, and so on. Mutual Fund also offers one of the best tax saving Mutual Fund scheme- ELSS, which is a type of equity funds.

Open-Ended Schemes

Under this scheme, units are purchased and sold at the Net Asset Value (NAV) consistently. Thus, it enables investors to enter or exit the market according to their convenience.

Close-Ended Schemes

Under this type, the capital of unit is fixed and only a certain number can be sold. Investors, in this scheme, cannot purchase units after the New Fund Offer (NFO) has been passed. This means that they are not allowed to exit the scheme before the term ends.

Exchange-Traded Funds (ETFs)

This type trades in a stock exchange and owns different types of assets, such as gold bars, bonds, foreign currency, oil futures, and more. They provide a flexibility of buying and selling units on the stock exchange throughout a day.

Tax Saving Funds

Also known as equity-linked saving schemes, these funds are adequate for those who are looking forward to growing capital while saving tax. This type of mutual fund offers tax rebates under Section 80C of the income tax Act.

Equity Funds

Equity funds refer to the mutual fund schemes that invest a predominant portion of their corpus amount in equity shares of different companies. This mutual fund schemes do not offer fixed returns as their performance is dependent on the performance of underlying equity shares. These funds can be considered as a good option for long-term investment purposes. The various categories of equity funds include Large cap funds, Small cap funds, ELSS, sectoral funds, etc.

Best Equity Mutual Funds to Invest in 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Principal Emerging Bluechip Fund Growth ₹183.316

↑ 2.03 ₹3,124 2.9 13.6 38.9 21.9 19.2 Invesco India Growth Opportunities Fund Growth ₹88.71

↑ 0.71 ₹5,930 -2.3 -9.2 16.4 19.9 25.6 37.5 ICICI Prudential Banking and Financial Services Fund Growth ₹125.58

↑ 1.49 ₹8,843 6.4 1.1 16 14.3 24.4 11.6 Motilal Oswal Multicap 35 Fund Growth ₹55.7131

↑ 0.40 ₹11,172 -5.6 -12 14.3 19.1 22.3 45.7 Sundaram Rural and Consumption Fund Growth ₹92.2592

↑ 0.40 ₹1,398 -1.5 -10.7 12.9 17.2 22.1 20.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 31 Dec 21

Debt Funds

Also referred to as fixed income funds, the corpus of these funds is mostly invested in fixed income instruments. Some of the assets forming part of the debt funds include treasury bills, commercial papers, certificate of deposits, government bonds, corporate bonds, and so on. The debt funds are classified on the basis of maturity profile of the underlying assets, for instance, Liquid Funds whose portfolio consists of assets having a maturity period of less than or equal to 90 days. These funds are considered by risk-averse investors whose risk appetite is low.

Best Debt Mutual Funds to Invest in 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Long Term Plan Growth ₹36.5985

↑ 0.03 ₹14,049 3.3 4.9 10.1 8 7.5 8.2 UTI Dynamic Bond Fund Growth ₹30.7564

↑ 0.03 ₹626 3.5 4.4 10.1 9.7 9.3 8.6 Aditya Birla Sun Life Corporate Bond Fund Growth ₹111.729

↑ 0.10 ₹25,293 3.1 4.7 9.8 7.6 7.4 8.5 HDFC Corporate Bond Fund Growth ₹32.186

↑ 0.03 ₹32,191 3.1 4.5 9.6 7.5 7.2 8.6 HDFC Banking and PSU Debt Fund Growth ₹22.7368

↑ 0.02 ₹5,837 3.1 4.5 9.1 7 6.8 7.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Apr 25

Index Funds

Index funds also known as index tracker funds refer to the mutual funds whose performance is based on the performance of an index. The underlying assets of an index fund are similar to that as held by a particular index in the same proportion.

Best Index Funds to Invest in 2025

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Nifty Next 50 Index Fund Growth ₹55.9576

↑ 0.37 ₹6,083 -1.2 -15.9 2.5 13.5 22.2 27.2 IDBI Nifty Junior Index Fund Growth ₹47.2413

↑ 0.31 ₹81 -1.2 -15.7 2.5 13.4 21.9 26.9 Aditya Birla Sun Life Frontline Equity Fund Growth ₹490.76

↑ 2.54 ₹26,286 0 -7.5 9 13.1 22.7 15.6 SBI Bluechip Fund Growth ₹86.2501

↑ 0.47 ₹46,140 -0.1 -7.1 8.2 12.4 22.2 12.5 Nippon India Large Cap Fund Growth ₹83.4589

↑ 0.51 ₹34,212 -0.9 -7.1 6.5 17.6 26.5 18.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Apr 25

Talk to our investment specialist

Mutual Fund Investment Guide: Selecting Best Mutual Funds

Selecting the best mutual fund is one of the challenges that individuals face while investing in mutual funds. To overcome this challenge, mutual fund investment guide explains How to select the best mutual fund as per the individual's requirement. The primary concern of individuals is whether my mutual fund investment will give me best returns. Most individuals generally invest in a mutual fund by just considering its ranking which is a misnomer.

Before selecting a mutual fund, individuals should specify their objectives first. Without determining their objective or the goal to be achieved, individuals would not be able to select a mutual fund based that is in-line with their objectives. Post determining their objective, individuals then search for the mutual fund as per their requirements. While investing in mutual funds, individuals should consider various parameters like past performance of the fund, its due diligence process, credentials of the fund manager in-charge of the fund, entry and exit load attached to the fund, expense ratio of the fund, and many other related factors. In addition, they also should assess the performance of the fund house.

How to Invest in Mutual Funds for Beginners in India?

If you have already made up your mind find a perfect answer for how to invest in mutual funds for beginners in India, there are a few factors to be kept in mind, such as:

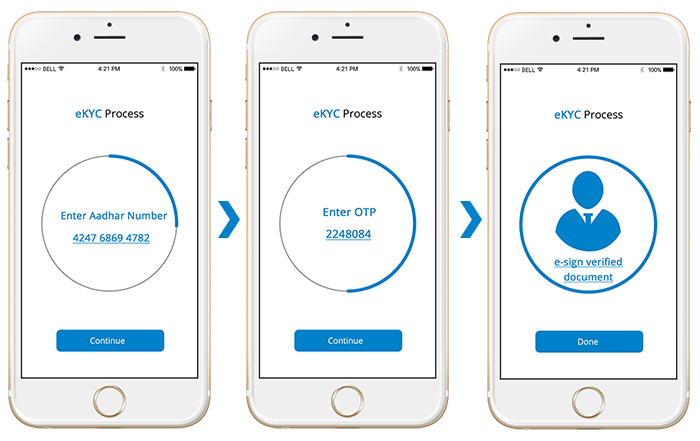

Complete your Know Your Customer (KYC) To invest in mutual funds, you would have to comply with the guidelines of KYC. For this, you would have to submit the photocopies of age proof, residence proof, Permanent Account Number (PAN) and more as asked by the fund house.

Know about the Available Schemes Undoubtedly, the market of mutual fund is flooded with different options. There is a scheme for everybody. Thus, before investing, ensure that you have completed your homework and explored the market to comprehend different scheme types. Once done, align them with your objectives, affordability and risk appetite. Being a newcomer, you can also get financial advice from the experts to maximize your return.

Assess the Risk Factors Keep in mind that investing in mutual funds has a lot of risks. There are schemes that offer massive returns but generally come with higher risks. If you think you have an adequate risk appetite, you can choose equity schemes. Or else, it’s better to go with debt schemes that provide moderate returns.

Once all of this is completed, a bank account will be required to make the investment. Also, most of the fund houses also ask for an online or a physical copy of the cancelled cheque leaf with Magnetic Ink Character Recognition (MICR) and Indian Financial System Code (IFSC) of the bank.

Mutual Fund Calculator

mutual fund calculator is one of the areas that is explained in this mutual fund investment guide. Also known as the sip calculator, mutual fund calculator helps individuals to understand how much amount they need to invest now in order to fulfill their objectives. There are various calculators available with respect to planning for retirement, purchasing a house, purchasing a vehicle, planning for higher education, and other goals that individuals wish to achieve.

Advantages Of Mutual Fund Investment

Any mutual fund investment guide always shows the benefits of investing in a mutual fund scheme. Some of the advantages of the mutual funds include:

- Diversification wherein the money collected is invested in a group of assets instead of a single asset.

- Professional Management which means that the mutual funds are managed by professional managers also known as the fund manager. These professionals invest the money only after a thorough research of the company.

- Liquidity which means the mutual funds can be easily converted into cash. In other words, individuals can easily get in and get out of mutual funds.

Investing In Mutual Funds

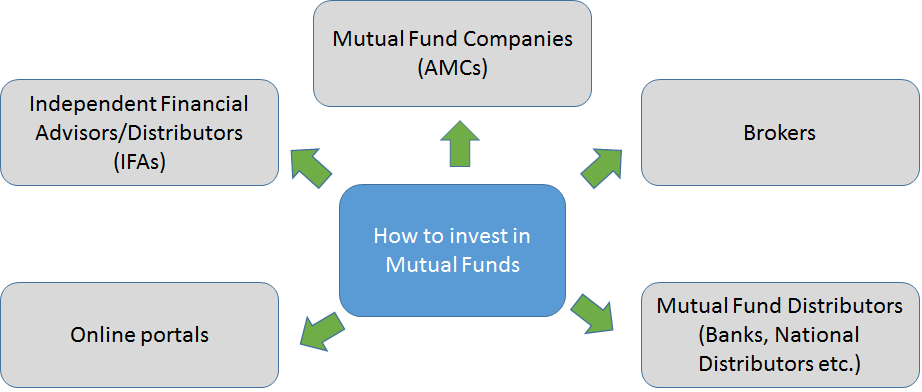

A Mutual Fund investment guide also talks about how to invest in mutual funds too. Investment in mutual funds can be done through various channels. Some of the prominent channels of mutual fund investment include directly through the mutual fund company, independent financial advisors, mutual fund brokers, online portals, and other channels.

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

In addition, mutual fund investment guide also covers certain additional information such as the best mutual fund schemes to invest, the future of mutual fund industry in India, performance of mutual fund industry, and other aspects. Mutual fund investment guide serves as a companion those who want to invest in mutual funds, however, are not much familiar with the investment process. Thus, individuals should go through the mutual fund investment guide so that their process of investment becomes easier and can reap maximum benefits from mutual fund investment.

Frequently Asked Questions

1. How to choose a mutual fund?

A. If you are a beginner in mutual funds, you must choose an adequate mutual fund scheme according to your risk tolerance and investment objective.

2. How to start investing in mutual funds online?

A. If you want to invest in Mutual Fund Online, you can do so by directly visiting the website of the fund house. Then, you can complete the eKYC and then invest in the scheme of your preference.

3. What is the meaning of KYC?

A. KYC stands for Know Your Customer, which is a necessary requirement by SEBI. It is used for declaring the address proof and the identity of investors.

4. Can I invest in mutual funds without a DEMAT account?

A. Yes, you can. To do so, you would have to visit the mutual fund house’s branch of the AMC. There, you can fill up the form and submit the self-attested address and identity proof for KYC. And then, you would have to submit a cheque for the initial amount and you will receive a folio number and a PIN.

5. What is the minimum amount that can be invested each month in mutual funds?

A. If you don’t want to bet for a higher amount, you can invest in mutual fund schemes through a Systematic Investment Plan (SIP). With this plan, you can begin from as low as a Rs. 500 per month investment.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.