Why Open an NSDL Demat Account?

Since the inception of the “Digital-Age”, electronic stock trading mode has gained considerable popularity and has slowly replaced the idea of trading in an “open outcry’ system. Today, almost all trades take place on an electronic trading portal using the internet. In this Electronic Era, having a Demat account is a must in the stock trading Industry.

A Demat account is an electronic account, used to store securities like equity shares and Bonds in a digital format. Whereas, a Demat Trading Account is used to buy or sell investments.

With technological advancements, the electronic format equity shares have replaced the old-school physical share certificates. Transferring and storing physical share certificates were somewhat risky and often resulted in a loss. Therefore, the idea of depositories came forward to help store shares in digital format. Depositories like NSDL and CDSL allow one to store financial instruments like shares, Debentures, bonds, exchange-traded funds(ETFs), Mutual Funds, government securities(GSecs), treasury bills(T-Bills) etc in dematerialized form.

NSDL and CDSL are both SEBI registered entities and every stock broker is registered with either of them or both. Established in 1996, NSDL stands for National Securities Depository Limited, based out of Mumbai and is the country’s first and prime institution Offering depository and Demat account services. On the other hand, Central Depository Services Limited (CDSL) provides services like trade settlement, re-materialization, demat account maintenance, sharing periodic status reports, account statements etc.

NSDL Demat account

When a digital/electronic account is opened with National Securities Depository Limited(NSDL), it is called an nsdl demat account. However, to open one, a depository cannot be approached directly. Instead, a depository participant (DP), who is registered with NSDL, needs to be contacted. One can merely visit the website of the depository to remain informed about all the depository participants registered with the NSDL. Also, NSDL sends SMS alerts to its account holders to help them stay updated about all their investments. Besides, it provides a consolidated account statement or CAS that grants investment information to the account holder.

NSDL Demat Account Opening Process

- Get in touch with an NSDL registered DP.

- Post that, fulfil the KYC requirements by submitting the filled-up application form with a copy of the PAN Card, address proof(passport, Aadhaar) and Bank details to the DP.

- Then the submitted documents will be verified by the DP.

- The DP will open a Demat account with NSDL on your behalf, only if the verification was successful.

- Once open, the details like your NSDL Demat account number(starts with “IN” and followed by a 14-digit numeric code), DP ID, client ID, a copy of your client master report, tariff sheet, a copy of the rights and obligations of the beneficial owner and depository participant will be shared with you.

- Your DP will also hand you over the NSDL Demat account login credentials, using which you can easily log into your NSDL Demat account.

Talk to our investment specialist

NSDL Chargers

NSDL do not directly charge their investors as it provides its services to the investors via stock brokers or depository participants (DP). The NSDL DP charges the investors as per their own fee structure.

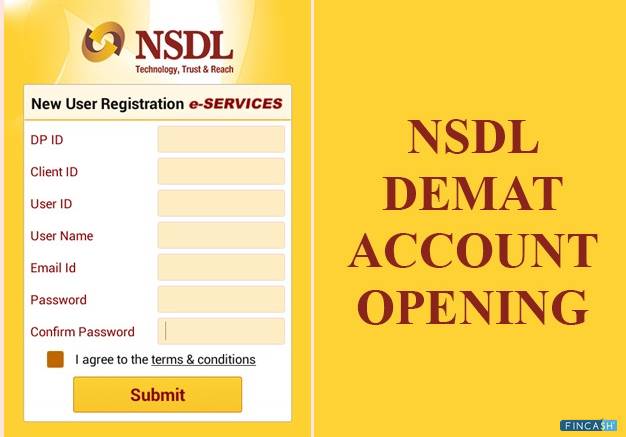

NSDL Account Login Process

- Visit https://eservices.nsdl.com/

- Press the New User Registration Tab.

- Fill the registration page with the following details:

- DP ID

- Client ID (provided by your DP)

- Choose your User ID (between 3 to 8 characters)

- User Name

- Email ID

- Password and Confirm Password (between 8 to 16 characters), both alphanumeric.

- Agree to the terms and conditions and press the “submit” button.

- You will get a One-Time Password (OTP) on the Demat account-registered mobile number.

- Enter the OTP. Get Started!

Pros of NSDL Demat account

Earlier, a buyer was unable to analyze the asset quality before purchasing which involved quite a risk of bad deliveries. But, with NSDL, there are the least chances of bad deliveries as securities are held in Dematerialised format here.

Physical certificates always had a risk of getting stolen/lost, damaged or mutilated. As the certificates are retained in an electronic format with NSDL, the above-mentioned risks can be easily averted.

Unlike the physical system, where the security had to be sent to the company registrar for change of ownership, the electronic system with NSDL saves a lot of time by making the securities get directly credited to the account holder’s account in a hassle-free way. Also, there is no chance of losing the certificates in transit.

An NSDL Demat account allows faster liquidity with the settlement done on a T+2 Basis, which is calculated from the day of trade to the second working day.

An NSDL Demat account has reduced a broker’s back-office task to a considerable extent while cutting down the Brokerage Fee. Besides, it waives the necessity of maintaining a long trail of paperwork as everything is done digitally.

Details can be easily changed in an NSDL Demat account. You just need to inform your DP and share relevant documents to update any data.

Cons of Demat account

- As everything happens digitally, there is always a risk of getting hacked.

- Coordination-related problems might arise at times.

- Technical hitches also lead to disputes sometimes.

Conclusion

With an NSDL Demat account, opened through DP, one can easily purchase or sell securities in the stock Market electronically via a trading platform. Also, an NSDL Demat account helps one to enjoy features like access to a dedicated NSDL mobile application, electronic voting Facility, electronic delivery instruction slip(DIS) and many more. To protect the Demat from unauthorized access, the ID and password need to be kept safe as the login credentials are extremely confidential.

FAQs

1. What is the NSDL full form?

A: The full-form of NSDL is National Securities Depository Limited.

2. How can I create an NSDL account login?

A: To create an NSDL account login, you have to visit https://eservices.nsdl.com/ and fill the registration form available on the website. Also, NSDL offers nomination facilities to individuals holding Demat account singly or jointly, instructions to your DP over internet through SPEED-e facility and provision of freezing the Demat accounts to make sure that the debits from the account are not permitted.

It provides Basic Services Demat Account(BSDA), which is similar to a regular Demat account, but with no or considerably low annual maintenance charges.

3. Where can an NRI/PIO open a demat account?

A: NRI/PIO can open a demat account with any DP of NSDL. You have to mention the type [NRI as compared to Resident] and the sub-type [Repatriable or Non-Repatriable] in the account opening form collected from the DP.

4. Is it necessary to have nominee in the demat account?

A: Nomination is not mandatory for demat account. However, in the unfortunate case of death of sole account holder, having a nominee makes the process of transmission very easy and fast.

5. Where is the NSDL head office?

A: National Securities Depository Limited, 4th floor, 'A' Wing, Trade World, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai - 400 013.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like