Table of Contents

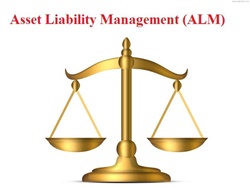

What is Asset/Liability Management?

Asset/Liability management is referred to as the process of regulating the use of cash flows and assets to decrease the company’s risk of loss from not paying a specific liability within the timeline. Adequately managed liabilities and assets upsurge business profits.

Typically, the process of asset/liability management can be applied to Bank loans and pension plans. In a way, it also comprises the Economic Value of equity.

Explaining Asset and Liability Management

The idea of asset/liability management concentrates on the cash flow timing as company managers have to plan for the liabilities’ payments. This process must focus on the available assets to pay debts and such Earnings or assets that can be easily converted into cash. This process can be applied to varying categories of assets available on the Balance Sheet.

Asset/Liability Management in Banking

Asset and liability management process can also be used in the banking sector. A bank has to pay interest on deposits and charge the same on loans. To manage these two different variables, bankers regulate the net interest margin or the difference between the interest earned through loans and interest paid on deposits.

Let’s take an example here. Suppose a bank, on an average, earned 16% on three-year-long loans and paid 14% on three-year-long deposit certificates. This way, the interest margin will be -

16% - 14% = 2%

Considering that the banks are subjected to interest rate risk, clients usually demand higher interest rates on deposits to keep their assets at the bank.

Talk to our investment specialist

Asset Coverage Ratio

One of the important ratios used in the asset and liability management is the asset coverage ratio that evaluates the assets’ value available to pay the debts of a company. This ratio can be calculated with the below-mentioned formula:

Asset coverage ratio = ((BVTA-IA)-(CL-STDO)) / (Total Debt Outstanding)

Here,

- BVTA = Book Value of total assets

- IA = intangible assets

- CL = Current Liabilities

- STDO = short term debt obligations

Tangible assets, like machinery and equipment, are quantified at the book value, which is the cost of the asset less total Depreciation. On the other hand, intangible assets, like patents, get subtracted from the formula as these are more difficult to sell and value. Debts that can be paid within 12 months are known as the short-term debt and are subtracted from the formula.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.