Table of Contents

Net Interest Margin Banks

A financial institution's Net Interest Margin (NIM) compares the net interest revenue from credit products like loans and mortgages to the interest it expends on holders of savings accounts and Certificates of Deposit (CDs). The NIM, a profitability metric expressed as a percentage, provides an approximation of the likelihood that a Bank or investment firm would prosper over the long term. By Offering insight into the profitability of their interest revenue vs their interest expenses, this indicator aids potential investors in deciding whether or not to participate in a specific financial services organisation.

A positive net interest margin denotes a profitable operation, whereas a negative value denotes inefficient investment. In the latter case, a company might take corrective action by using funds to pay off the debt still owed or by moving those assets to more lucrative investments.

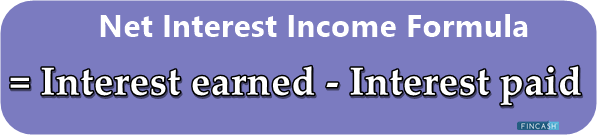

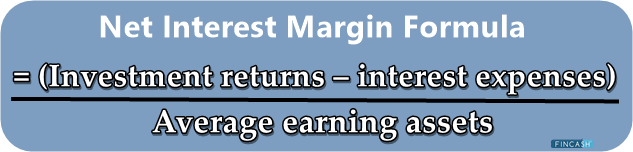

Net Interest Margin Formula

Net interest margin = (Investment returns – interest expenses) / Average earning assets

Net Interest Margin Example

Consider that Company ABC has average earning assets of Rs. 10,000,000, a Return on Investment of Rs. 1,000,000, a cost of interest of Rs. 2,000,000, and other impressive numbers.

In this case, ABC has a net interest margin = (1,000,000 – 2,000,000) / 10,000,000

Net interest margin = -10%

This means it lost more money on interest costs than on investment Income. This company would probably do better if it used its investment funds to settle the debt instead of making this investment.

Talk to our investment specialist

Net Interest Margin Interpretation

As the central bank directives are crucial in dictating the demand for savings and loans, they also significantly impact a bank's net interest margins. Consumers are likely to borrow money and less likely to save it when interest rates are low. This results in higher net interest margins in the longer run. On the other hand, as interest rates rise, loans become more expensive, making savings more appealing and lowering net interest margins.

Retail Banking and Net Interest Margin

Most retail banks pay interest on customer deposits, which typically Range around 1% yearly. The net interest spread is the 4% difference between these two sums if a bank of this type pooled the deposits of five clients and utilised the money to lend to a small business at a 5% yearly interest rate. Calculating that ratio over the entire bank's asset base, the net interest margin goes one step further.

Assume a bank has Rs. 1.2 million in earning assets, Rs. 1 million in deposits that pay depositors 1% interest annually, and Rs. 900,000 in loans that bear a 5% interest rate. This indicates that its interest costs are Rs. 10,000, and its investment returns are Rs. 45,000. According to the methodology, as mentioned above, the bank's net interest margin is 2.92%. Investors might want to seriously consider Investing in this company, given that its NIM is firmly in the black.

Conclusion

The nominal average of borrowing and lending rates is the net interest spread. However, it disregards the possibility that the instrument volume and instrument composition of earning assets and borrowed money may change. The net interest margin is a measure of profitability that compares a bank's interest income with its client payments.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.