Table of Contents

PAN Card Application Fees-related Queries

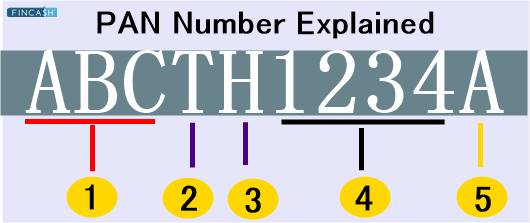

One of the most valuable resources and identity proofs, a PAN Card is what every trader requires for conducting businesses in any sector. A penalty is levied by the government, on the taxpayers who do financial transactions without a PAN. Therefore, having a PAN is mandatory for every taxpayer in the country.

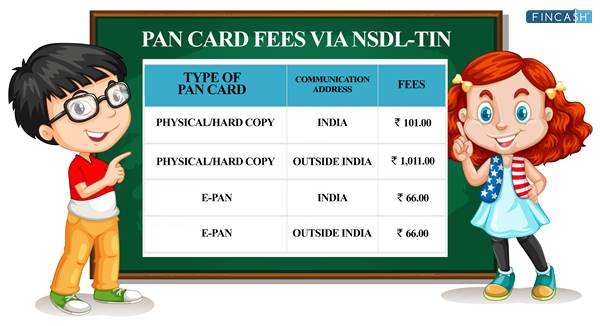

Charges for PAN Card applications are minimal. The cost depends on the address/location of the applicant. PAN Card fees are mostly high for those residing abroad, as the PAN Card needs to be sent outside the country.

New PAN Card Fees 2025

Those who are based in India need to pay an application fee of INR 101 for a new PAN Card. The amount comprises a processing fee of INR 86 and 18% GST. Recently the government has imposed a uniform fee for all applicants residing in India to do away with the disparity in terms of the PAN processing fee in the past. However, a difference in the price can be witnessed only on the Basis of the mode of payment an applicant chooses.

Reprint/Changes Charges of a PAN Card (India)

If a PAN Card is lost/damaged or just requires some changes/correction, its holder can get the needful done by paying a fee of INR 110, which includes a processing fee of INR 93 and 18% GST. The fee structure is applicable only for those who have communication addresses in India. For applicants with communication addresses outside the country, the rates vary.

The flourishing Economy of Indian has attracted numerous foreign traders to take interest in the Indian Market for carrying out businesses. A PAN is mandatory for them as well. Both organisations and individuals need to go through the process, the same as an Indian resident.

Talk to our investment specialist

Fees for e-PAN Card

Today, people get a choice of opting for an e-PAN Card without applying for a hard copy. In that case, costs vary.

| Address Type | Charges |

|---|---|

| Indian Communication Address | INR 66 |

| Foreign Communication Address | INR 66 |

PAN Fees for New/Reprint for Individuals Residing Abroad

For applicants with communication addresses outside India, the fee is

INR 1011(application fee and dispatch charges of NR 857 plus 18% GST).For a new PAN application and

INR 1020(application fee of INR 93 and dispatch charges of INR 771 plus 18% GST) for reprint/change of PAN Card.

Modes of Payment for PAN Application

Applicants with Indian communication addresses can pay through both Debit and credit cards, Demand Drafts or by using Net Banking. If the transaction is done via Credit/debit cards, the Bank generally charges an extra 2% on the application fee. Also, the bank often imposes applicable Taxes above the PAN Card fee. Demand Drafts in favour of “NSDL PAN”, payable at Mumbai, are only accepted. A surcharge of INR 4 and service tax are added when paid through Net Banking.

Companies/organizations and individuals with foreign communication addresses are eligible to pay the PAN Card fees through Credit/Debit cards or Demand Drafts(DD). However, the DD needs to be in favour of “NSDL-PAN”, payable in Mumbai to get accepted. If paid through a debit/credit card, the applicant has to pay additional bank charges of 2% along with service tax. Also, bank-imposed conversion or exchange charges might be incurred.

Permission to Pay the PAN Card Fees on Behalf of Others

If it is an individual application, then either the applicant can make the payment himself/herself or the Immediate Family of the applicant can pay the application fee on the applicant’s behalf.

If the PAN Card application is given by someone belonging to Hindu Undivided Families, then only the Katra of the HUF can pay on behalf of the applicant.

In the case of associations, trusts and local authorities, only an authorized signatory can pay on behalf of the applicant, as per the rules of the income tax Act.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Sir g my sister is pencard is lost but very problem is not confirm is pen in serial number apply is duplicate pencard in give old pencard account number sir my problem solving- thanks