Table of Contents

Form 60 - File if you don't have PAN Card

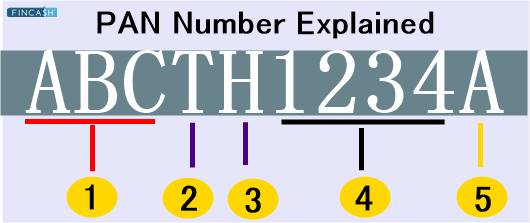

The Government of India has introduced the Permanent Account Number (PAN) for the convenience of citizens in the country. It is a unique number that serves as identity proof and also contains all information regarding a taxpayer like the Taxes paid, outstanding taxes, Income, refunds, etc. This was introduced so that taxpayers can enjoy security and prevent tax frauds.

However, some still do not possess the PAN number, which can be a problem when it comes to banking transactions and other financial issues. In order to aid this situation, Form 60 is made available. Let’s take a look at this.

What is Form 60?

Form 60 is a declaration form that an individual can file if one does not have a PAN Card. This can be filed for transactions specified under rule 114B. Many who have applied for a PAN card might be still awaiting. In the meanwhile, Form 60 can be filed for any such crucial financial transactions.

Form 60 Uses

You can use this for tax-related filing and also other transactions as mentioned below:

Sale or purchase of Motor Vehicle (Does not include two-wheelers)

Opening of a Bank Account

Applying for Debit or Credit Card

Payment at a Hotel or Restaurant (Only for cash payment above Rs. 50,000)

Traveling costs included while travelling to a foreign country (Only for cash payment above Rs. 50,000)

Purchasing of Foreign Currency (Only for cash payment above Rs. 50,000)

Bonds and Debentures (Amount more than Rs. 50,000)

Mutual Funds (Amount more than Rs. 50,000)

Buying Bonds issued by Reserve Bank of India (RBI) (Amount more than Rs. 50,000)

Depositing Money in Bank/Post-Office (Cash amount more than Rs. 50,000 for a day)

Buying Bank Draft/Pay Order/Banker’s Cheque (Cash amount more than Rs. 50,000 for a day)

Life Insurance premium (Amount more than Rs. 50,000 in one day)

FD with Bank/Post-Office/NBFC/Nidi Company (Amount more than Rs. 50,000 at one time or Rs. 5 lakhs for a financial year)

Securities Trading (Amount more than Rs. 1 lakh per transaction)

Shares Trading of Unlisted Company (Amount more than Rs. 1 lakh per transaction)

Sale or Purchase of immovable property (Amount or registered value more than Rs. 10 lakhs)

Purchase and sale of Goods and Services (Rs. 2 lakhs per transaction)

Talk to our investment specialist

Form 60 for NRI

Non-resident Indians can also make use of Form 60. The set of transactions are mentioned below:

Sale or purchase of Motor Vehicle

Opening of a Bank Account

Opening Demat account

Bonds and Debentures (Amount more than Rs. 50,000)

Mutual Funds (Amount more than Rs. 50,000)

Depositing Money in Bank/Post-Office (Cash amount more than Rs. 50,000 for a day)

Life insurance Premium (Amount more than Rs. 50,000 in one day)

FD with Bank/Post-Office/NBFC/Nidi Company (Amount more than Rs. 50,000 at one time or Rs. 5 lakhs for a financial year)

Securities Trading (Amount more than Rs. 1 lakh per transaction)

Shares Trading of Unlisted Company (Amount more than Rs. 1 lakh per transaction)

Sale or Purchase of immovable property (Amount or registered value more than Rs. 10 lakhs)

Note: For financial transactions with hotels and restaurants, availing debit or credit card, travelling expenses, NRIs will not be required to show PAN or Form 60.

Form 60 Submission

You can submit Form 60 both online and offline. For offline filing, you can submit it to the concerned authority. For example, if you are submitting Form 60 as per the income tax Act, kindly submit it to the tax authority.

If you want to submit it for banking related issues, duly fill and submit the form to the concerned bank.

The online way of filing Form 60 is mentioned below:

- Verify through Aadhaar authentication

- You will receive a One-time Password (OTP) on your mobile number or mail ID

- Biometric modalities i.e through iris scanning or fingerprint

- Two-way authentication through OTP and biometric mode

Documents Required

Along with a duly filled Form 60, you need to submit other documents as well. They are mentioned below:

- aadhaar card

- Driving License

- Voter’s ID

- Passport

- Bank Passbook

- Address Proof

- Ration Card

- Electricity and Telephone bill copies

- Domicile Certificate

Note: If you have filed Form 49A for a PAN card already, then just give the application Receipt and bank account summary of 3 months. Other documents will not be required.

Information to File on Form 60

Mentioned below are the necessary information to file:

- Name

- Birth Date

- Address

- Transaction Amount

- Transaction Date

- Transaction Mode

- Aadhaar Number

- PAN Application Acknowledgement Number

- Income Details

- Signature

Can Form 60 Substitute for PAN Card Everywhere?

No, it cannot be a substitute for a PAN card in every case. For the sake of your convenience, the government has provided relaxation via Form 60 for a particular set of transactions.

Your communication through transactions with the Income Tax Department is traced through your PAN. The following cases are not exempt from PAN card.

You need a PAN Card in case you:

- Exceed the compulsory filing threshold of Income Tax Return

- Turnover in business or salary is more than Rs. 5 lakhs

- Are Managing Director, Head of a hindu undivided family (HUF), Partner with a Firm, etc

- Are filing return under Section 139(4A)

- Are an employer liable to file Income Tax Return for providing fringe benefits

Note: You also need a PAN card for KYC requirement, PayTM, OLA, etc

Consequences of Incorrect Declaration Under Form 60

If an incorrect declaration is submitted under Form 60, consequences mentioned under Section 277 will be applied. Section 277 states that person entering misleading or untrue information will be held liable under as follows:

- If the tax evasion is more than Rs. 25 lakhs imprisonment of a minimum of 6 months to maximum 7 years with fine will be applied.

- Other cases will Call for imprisonment of a minimum of 3 months and maximum of 2 years with fine.

Other Forms related to PAN

Other forms related to PAN are mentioned below:

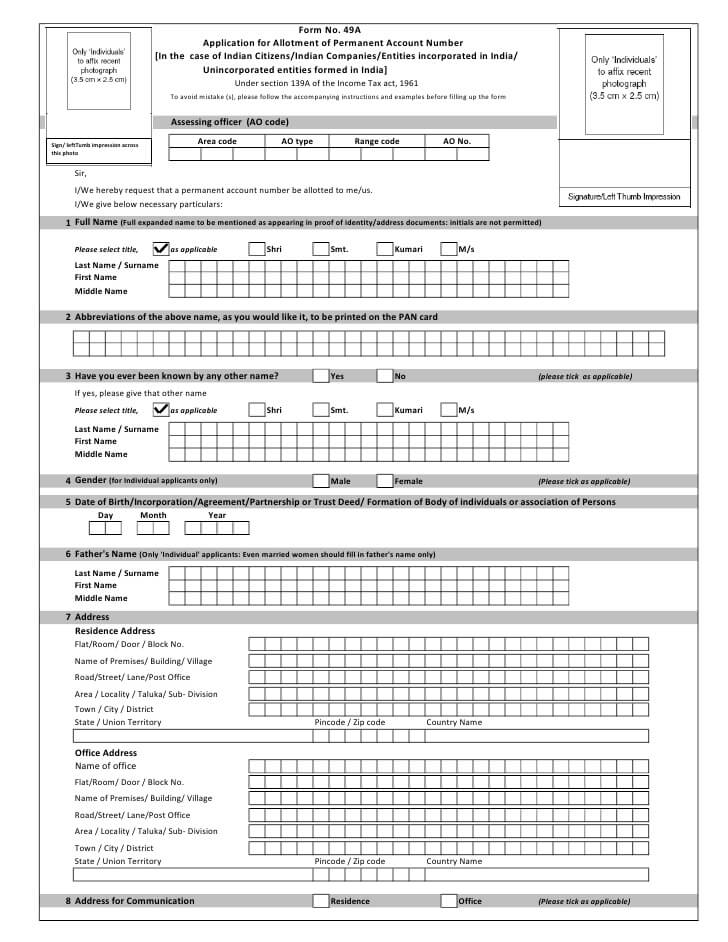

1. Form 49A

This form is for Indian residents for obtaining PAN and correction of PAN.

2. Form 49AA

This form is for Non-resident Indian or companies outside India.

Conclusion

Form 60 is a boon in case you don’t have a PAN Card. However, applying and obtaining a PAN card is important for necessary transactions under the Income Tax Act. In case, you are filling out Form 60, make sure to fill in the right details to avoid consequences.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like