PAN 49a Form - A Detailed Guide!

To apply for a PAN Card, you need to fill the PAN 49a form and submit it along with the other required documents at the NSDL e-governance website or to the NSDL centre. This form is only for Indian citizens and Indian citizenship who are currently residing outside India.

For issuing PAN, you need to download the PAN card form in PDF, fill in the required details, and submit it to the NSDL centre. Following this, you can make the payment online and receive the acknowledgement certificate.

Further, know how to fill in the 49a Form and its further process of sending to NSDL.

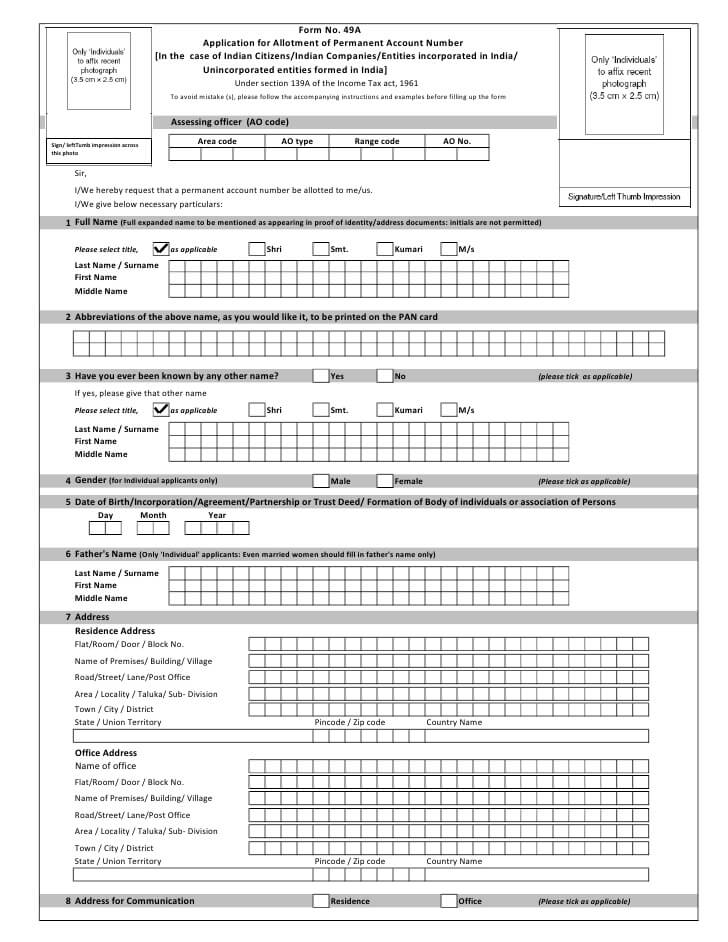

49a PAN Card Form Structure

In order to make it fairly easy for citizens to fill-in the required details, the form is divided into multiple sections. There is enough blank space on two sides of the form where you get to affix your photographs. This form consists of a total of 16 sections and each section has sub-sections that must be filled correctly in the form to be considered valid.

Sections of PAN Card Form

It’s important to understand the different components of the PAN card form and fill the sub-sections neatly. Here are the 16 sections present in the 49a form.

1. AO Code: Mentioned right on the top of the form, the AO code suggests your tax jurisdiction. These codes are used to identify the tax laws you are supposed to follow, as tax laws differ for individuals, companies, and other entities. The Assessing Officer Code consists of the four sub-sections - AO type, Range code, Area code, and Assessing Officer number.

2. Full Name: Right below the AO code, you will find the section where you need to mention your full name - first and the last name along with the marital status.

3. Abbreviation: If you have seen PAN cards, you must have noticed that the names of the cardholders are mentioned in the abbreviated form. So, here’s where you have to type the abbreviation of the name you’d like to be displayed on the PAN card.

Talk to our investment specialist

4. Other Name: Mention the names other than your first and last name, i.e. if there’s any nickname or other name you are known by. The other names are to be mentioned with the first name and last name. If you have never been known by other names, check the “no” option.

5. Gender: This section is for the individual PAN card applicants only. The options are displayed in the boxes and you have to tick the box containing your orientation status.

6. Date of Birth: Individuals need to mention their date of birth. Companies or trusts, on the other hand, need to mention the date the company was launched or the partnership was formed. The DOB has to be written the D/M/Y format.

7. Father’s Name: This section is for individual applicants only. Every applicant, including married women, have to mention their father’s first and last name in this section. In some 49a form, there’s the “family details” section where you have to submit your mother’s and father’s names.

8. Address: The address section must be filled carefully, as there are many blocks and sub-sections. You need to give your residential and office address, along with the city name and PIN code.

9. Address of Communication: The next section requests the candidate to choose between the office and residence address for communication purposes.

10. Email and Phone Number: Enter the country code, state code, and your mobile number under this section, along with the email ID.

11. Status: There is a total of 11 options in this section. Select the status as applicable. The status options include individual, hindu undivided family, Local Authority, Trust, Company, Government, Association of Persons, Partnership Firm, and more.

12. Registration Number: This is for the company, limited liability partnerships, firms, trusts, etc.

13. Aadhaar Number: If you are not allotted the Aadhaar number, mention the enrollment ID for the same. Right below the Aadhar number, enter your name as mentioned in the aadhaar card.

14. Income Source: Here, your source/s of Income is to be mentioned. Choose from salary, income from a profession, house property, Capital gains, and other sources of income.

15. Representative Assessee: Mention the name and address of the representative assessee.

16. Documents Submitted: Here, you have to list the documents you have submitted for the proof of age, date of birth, and address. So, these were the 16 components of the 49a PAN form. At last, you have to mention the date you are filling and submitting this form. At the bottom right of the page, there is a column for signature.

Documents to Apply 49a Form

- Voter ID Card

- Aadhar Card

- Ration Card

- Driving License

- Passport

- Recent passport size photograph

- Utility Bills

- Pensioner Card

PAN Card 49a Form PDF

Alternatively,

An 49a form is easy available in platforms like TIN of NSDL and UTIITSL.

Key Tips for Filling NSDL 49a Form

- The form must be filled with black ink and only one character is allowed in each box.

- For the language, English is the only language available for the applicants applying for the PAN card.

- Two photographs of the applicant must be attached at the top right and left corner of the form. There is a blank space for the photographs

- Double-check the form after filling and make sure that you have filled in all the details correctly. Incorrect details could lead to a delay in processing the application.

Once you have filled the form, submit it with the required documents to the NSDL center either online or offline.

Note: Do not confuse the 49a form with the 49AA form. The latter is for the non-residents of India or organizations based outside India, but are eligible for a PAN card.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like