Best Bank of Baroda Debit Cards 2025 - 2026

With a network of 9,583 branches in India and 10,442 ATMs abroad, Bank of Baroda (BOB) is the second-largest public sector bank in India. The bank was founded in the year 1908 and since then the company is growing leaps and bounds. Today the bank has a worldwide presence with branches, subsidiaries and ATMs located in major countries across the world.

BOB offers various financial products and services to cater to the needs of customers like banking, insurance, investment banking, loans, Wealth Management, credit cards, private equity, etc. The banks offer all major payment networks - MasterCard, Rupay, Visa, etc., on credit and debit cards. If you are looking to buy a Debit Card, BOB debit cards are a must to consider as they offer many benefits and reward points. Let's take a look at it.

Types of Bank of Baroda Debit Cards

- NCMC Debit cum Prepaid card

- Visa Contactless Card

- Visa Classic Card

- RuPay Platinum Card

- Baroda Master Platinum Card

- RuPay Classic Card

- Master Classic Card

- VISA Platinum Chip Card

1. NCMC Debit cum Prepaid card

- RuPay National Common Mobility Card (NCMC) works as a prepaid card cum debit card

- The card comes with advanced and secure technology for safe payment

- This card supports both contact and contactless transactions

- It can be used for transit payments like metro, bus, cab, toll, parking, and small value offline retail payments having NCMC specification terminal

Transaction Limit

You can also withdraw cash on a daily Basis and make retail payments.

Following are the transaction limit for this debit card:

| Type | Limit |

|---|---|

| Daily ATM withdrawal limit | Rs. 50,000 |

| POS purchase limit | Rs. 1,00,000 per day |

| No. of transactions allowed per day | 4 |

| Maximum offline purchase limit | Rs. 2,000 |

2. Visa Contactless Card

- This debit card is based on near field communication technology so that you can have contactless transactions at POS terminals accepting contactless cards

- You can use this card for ease of shopping at millions of outlets worldwide

- Easy cash withdrawals in India and abroad

Transaction Limit

The Visa contactless card is accepted at member banks of NFS (National Financial Switch) having more than 1, 18,000+ ATMs across the country

Following are the transaction limit for this debit card:

| Type | Limit |

|---|---|

| Cash withdrawal per day from ATM | Rs. 50,000 |

| Purchase limit per day (POS) | Rs. 2,00,000 |

| Contactless transactions at POS | Rs. 2,000 |

3. Visa Classic Card

- This card is ideal for making hotel reservations, buying books online, or making everyday purchases

- This card is ideal for convenient shopping, dining, travelling, where Visa cards are accepted with PIN-based authorisations

- Visa card offers attractive benefits like 15% off at Titan, Flat 20% off on Ferns and Petals, etc., (valid up to 31st March 2020)

Transaction Limit

Visa Classic card can be used at all BOB Interconnected ATMs and member Bank’s ATM of NFS in India

Following are the transaction limit:

| Type | Limit |

|---|---|

| Cash withdrawal per day | Rs. 25,000 |

| Shopping limit | Rs. 50,000 |

Get Best Debit Cards Online

4. RuPay Platinum Card

- This card is launched to provide attractive offers and scheme in coordination with NPCI

- Earn 5% cash back on utility bill payment you can use this card at all BOB Interconnected ATMs and NFS ATMs across the country

- Rupay offers attractive discounts on diamond and gemstone jewellery shopping

- For International usage, RuPay Platinum Card can be used at ATM/POS terminals displaying Diners Club International, Discover or Pulse logos

Transaction Limit

The RuPay Platinum card comes with secured PIN & CVD2 for online transactions.

Following are the transaction limit:

| Type | Limit |

|---|---|

| POS/e-commerce (per day) | Up to Rs. 1,00,000 |

| Cash withdrawal per day from ATM | Rs. 50,000 |

| Accidental insurance | Up to 2 lacs |

| POS/e-commerce | Up to Rs. 1,00,000 |

5. Baroda Master Platinum Card

- This card is meant for premium customers to meet their requirement of higher cash withdrawal

- With Baroda Master Platinum Card you can have a safe and convenient shopping experience

- You can enjoy free domestic airport lounge access, one per quarter

- This card is convenient for shopping, travelling, dining out at outlets accepting Master cards in India and abroad

Transaction Limit

The card is issued in affiliation with MasterCard and therefore, you can use it in ATM/ Merchant outlet having a MasterCard logo and NFS member bank ATMs.

Following are the transaction limit for this card:

| Type | Limit |

|---|---|

| Shopping limits per day | Rs. 1,00,000 |

| Cash withdrawal per day | Rs. 50,000 |

6. RuPay Classic Card

- This card is India’s first domestic card RuPay Debit Card in coordination with NPCI

- It has additional security of PIN-based authorization so you can make transactions without any worry

- 20% off on spending of Rs.2000 & above at selected stores

- On purchase of gold Jewellery, get silver jewelry of same weight free from D. Khushaldas Jewellery (valid till 31st March 2020)

Transaction Limit

RuPay Classic Card can be used in more than 6,900 BOB Interconnected ATMs and 1,18,000+ NFS ATMs across the country.

Following are the transaction limit:

| Type | Limit |

|---|---|

| Withdrawal at ATMs per day | Rs. 25,000 |

| Spend limit at POS | Rs. 50,000 |

| Accidental insurance | Upto 1 lakh |

7. Master Classic Card

- BOB has launched a Master Classic card for domestic use. The purpose of this card is to broaden the product Range so that customers can have alternatives to pick the best as per their requirements

- It is a secured card with PIN and CVV2 for online transactions

Transaction Limit

The Master Classic Card can be used at NFS member bank ATMs in India and also for POS/online purchases.

Following are the transaction limit for this card:

| Type | Limit |

|---|---|

| Withdrawal at ATMs per day | Rs. 25,000 |

| Purchase per day at POS/e-commerce merchants | Up to Rs. 50,000 |

8. VISA Platinum Chip Card

- It is an International Debit Card, wherein you can make hassle-free transactions in India and abroad

- VISA Platinum Chip Card offers higher limits every day for premium category

- As Visa is accepted at millions of outlets worldwide, you can have shopping, dining, entertainment and other experiences across the world without any hassle

- Enjoy attractive offers on Ferns & Petals, Titan, Borosil, etc.

Transaction Limit

VISA Platinum Chip Card can be used in more than 6,900 BOB Interconnected ATMs spread across the country.

Following are the transaction limit:

| Type | Limit |

|---|---|

| Cash limit per day (ATM) | Rs. 50,000 |

| Purchase limit per day (POS)Rs. 2,00,000 |

BOB Debit Card Registration For Online Transaction

You can make online transactions via BOB internet banking. Follow the following steps for activating internet banking:

Go to the BOB official website. Download the internet banking form from the Home Page. You can also get form from the BOB bank branch.

All individual account holders should use the Retail form and all non-individuals, i.e. HUFs, companies, partnership firms, Sole proprietors should use Corporate form.

The form should be duly filled in. Ensure it is signed by all signatories, i.e. all joint account holders in case of a joint account and all partners in case of a partnership firm.

The form should be submitted at your BOB bank branch.

Customer will get the User Id by post at your residential address as well as to registered email id.

Passwords should be collected from your BOB bank branch. Retail customers can generate their password online using the “Set/Reset Password” option at official BOB banking website.

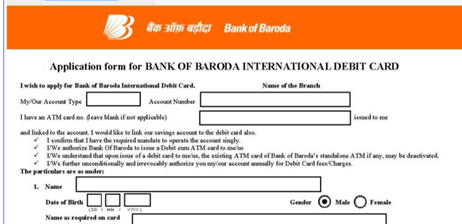

Bank of Baroda ATM Card Application Form Online

Bank of Baroda provides an online application form to apply for an ATM card. Ensure you fill the form correctly and make electronic signature using the signature wizard and submit the form in your nearest Bank of Baroda branch.

Bank of Baroda Online Debit Card

You can easily apply for a debit card online by submitting certain documents like-

- Ration card

- aadhaar card

- PAN Card

- Driving License

- Four passport size photographs

BOB Customer Care Number

- For 24/7 assistance, the customers can Call on

1800 258 44 55,1800 102 44 55 - For 24/7assistance for customers staying abroad, the numbers are

+91 79-49 044 100,+91 79-23 604 000 - For NRIs in India the toll-free number is -

1800 258 44 55,1800 102 4455

Conclusion

Bank of Baroda debit cards are very easy to Handle and use and they are issued to customers generally at the time of opening of the account. Depending upon the need & requirement, you can choose the debit cards from Bank of Baroda.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.