Table of Contents

Equifax Credit Score- An Overview

Whenever you’ve applied for a loan or a credit card, banks must have asked you about your Credit Score. Or rather CIBIL Score? This is because your score defines your financial habits. It shows how responsible you are as a borrower. Most people refer to the CIBIL score because it is the oldest Credit Bureaus in India. Ideally, there are four credit information companies in India- CIBIL, CRIF High Mark, Experian and Equifax that are authorized by the Reserve Bank of India.

What is an Equifax credit score?

Equifax collects and records all credit-related activities of customers and provides credit score and credit information report. These reports help lenders like banks and creditors to check your creditworthiness before lending you money. It also helps them decide the interest rates, loan amount, Credit Limit, etc.

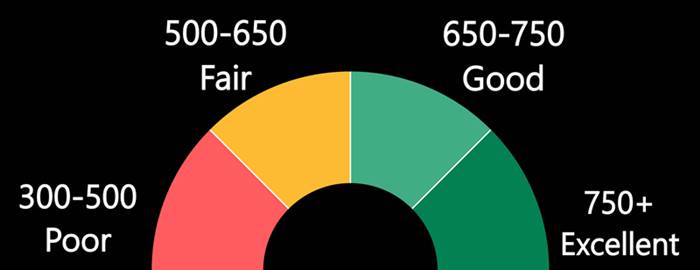

Equifax credit score is a three-digit number ranging from 300-850. The higher the number, the more credit benefits you’ll have in your kitty. Lenders would ideally prefer customers with a strong credit score, which gives them confidence in lending money to a responsible borrower.

Here’s how Credit Score Ranges stand for-

| Credit Range | Meaning |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very good |

| 800-850 | Excellent |

With a poor score, you may not be able to get a loan or a credit card, even if some lenders lend you, it may be with a very high-interest rate. But with a good score, you get easy loan approvals with low rate. Additionally, you’ll also be eligible for best credit cards.

How is the Equifax credit score calculated?

Every credit bureau has its own scoring model. While calculating a credit score, there are many factors taken into consideration like payment history, credit limit, number of credit accounts, types of credit accounts, current debt, age, Income, and other such data. All this information is considered by Equifax to provide accurate Credit Report and credit score.

Check credit score

How to apply for Equifax free credit report?

Visit the Equifax website and download the Dispute Resolution Form. You need to fill the form with the requisite details and authentication documents. Once you fill all the details, send the form and the documentation to the Equifax office address mentioned on the website.

You are entitled for one free credit check every year by RBI-registered credit bureau. So, enrol for your report and start building your score for future financial requirements.

Why should you check your credit reports regularly?

Checking your reports regularly will help you understand your current credit position. It helps you to be more aware of the future financial requirements. It also ensures that all the information in your report is accurate and up to date.

At times, your information in the credit report may not be accurate, which tends to hamper your score. To avoid such unnecessary reasons, it is always better to take your free annual credit report from Equifax and monitor it.

Due to the advent of technology, fraudulent activity on your credit card can happen anytime. Monitoring your credit report can help you keep a track of all the activities. In case you find any information in the report that doesn’t belong to you, notify the credit bureau immediately.

How to maintain strong Equifax credit score?

Always pay your credit amount in full and avoid paying just the minimum balance due. By paying just the minimum balance shows that your credit hungry.

Always pay on time. Paying your loan EMIs and credit card dues on time is a big sign of being responsible. This also helps in building your score strong.

Don’t close your old account, because when you close your old accounts, it cuts your credit history. This hampers your score.

Enquire about your credit only when it is required. Whenever you apply for credit, lenders do a hard check on your report, which temporally affects your score. Making too many credit inquiries can drop your score.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good Equifax

Civil good

Helpful this report