Top 4 Contactless Debit Cards 2025 - 2026

Since digitization, many upgrades have taken place in the world of online payments. One such process is the contactless Debit Card. With contactless debit cards you can make transactions without inserting a PIN at the merchant portal (POS). All you have to do is simply tap the card at the POS. This technique was first introduced in September 2007. Since then, it has gained popularity all over the world.

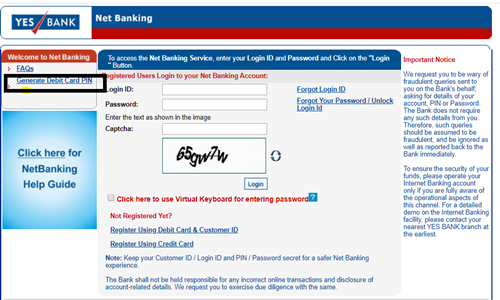

How do Contactless Debit Card Work?

Contactless debit cards work on the principle of near field communications. Radio transmission technology is used to establish contact when the card is waved near a POS terminal. Make sure the card is 4 cm near the POS machine. One point you need to note is- you cannot make Contactless Transaction above Rs. 2,000.

Indian Banks that offer Contactless Debit Cards

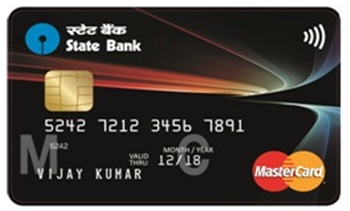

1. SBIIntouch Tap and Go Debit Card

- This card can be used over 30 million merchants worldwide, and over 10 lakh in India

- You can book movie tickets, pay utility bills, book train or flight tickets and earn reward points

- Get 1 reward point for every Rs. 200 transactions

- There are also bonus points given on the first 3 transactions. The freedom reward points can be accumulated and later redeem for exciting gifts

Daily Withdrawal limit

Earn reward points SBIIntouch Tap and Go Debit Card and also make high withdraws every day.

The following table gives an account of the same:

| Withdrawals | Daily Limit |

|---|---|

| ATMs | Rs. 40,000 |

| POS | Rs. 75,000 |

2. ICICI Coral Paywave Contactless Debit Card

- Enjoy faster and contactless payments

- For re-issuance of the card, the charges are Rs. 200 + 18 % GST

- Rs. 599 plus 18% GST will be charged as joining fees for the 1st year

- The annual fee will be charged from the 2nd year, i.e, Rs. 599 plus 18% GST

Withdrawal Limit

The daily cash withdrawal limit for domestic and international is different.

The following table gives an account of the same:

| ATM | POS |

|---|---|

| Domestic Rs. 1,00,000 | Rs. 2,00,000 |

| International Rs. 2,00,000 | Rs. 2,00,000 |

Get Best Debit Cards Online

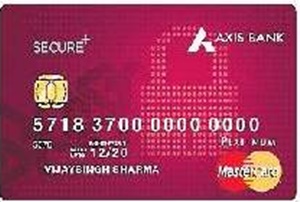

3. Axis Bank Secure + Debit Card

- In case of any financial fraud, get protection up to Rs.75,000 cover

- Avail a 15% discount at partner restaurants

- Get personal accident insurance up to Rs. 5,00,000

- Avail emergency hotel and travel assistance

Insurance, Withdrawals and Fees

To avail the insurance cover, a report should be made to Axis Bank within 90 days of the loss of card.

Below is a table of fees and charges for this debit card.

| Features | Limits/Fees |

|---|---|

| Issuance fee | Rs. 200 |

| Annual fees | Rs. 300 |

| Replacement fees | Rs. 200 |

| Daily ATM withdrawal | Rs. 50,000 |

| Daily purchase limit | Rs.1.25 lakh |

| My design | Rs.150 extra |

| Personal accident insurance cover | Rs. 5 lakh |

4. Kotak Privy League Platinum Debit Card

- You get access to all merchant establishments and ATMs that accept VISA cards in India and abroad

- Enjoy fuel surcharge waiver across any Petrol pump in India

- The card gives offers and discounts at Merchant’s outlet across various categories like travel, shopping etc

- Get access to more than 1000 most luxurious VIP airport lounges in over 130 countries and 500 cities

- This card is issued to Privy League Prima, Maxima and Magna (non-resident customers)

Withdrawal and Insurance Cover

The daily purchasing limit is Rs. 3,50,000 and ATM withdrawal is Rs. 1,50,000.

There is insurance cover for lost baggage, air accident etc.

| Insurance | Cover |

|---|---|

| Lost card liability | Rs. 4,00,000 |

| Purchase protection limit | Rs. 1,00,000 |

| Lost baggage insurance | Rs. 1,00,000 |

| Personal accidental death cover | Up to Rs. 35 lakh |

| Complimentary air accident insurance | Rs. 50,00,000 |

How to Disable Contactless Payment on Debit Cards?

Contactless payment is a permanent feature and you can’t disable it. However, they have an interesting option of swipe or dip for bigger transactions.

Generally, payments up to Rs. 2000 can be done using contactless technology, however, if the amount is bigger, then the card has to be swiped at a POS terminal to make the payment.

Conclusion

With contactless debit cards, you can simply tap-and-wave the card at POS terminals. You don’t have to worry about the security as there are multiple layers of security to protect you against the fraudulent activity.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.