Table of Contents

- What Does Personal Accident Insurance Cover?

- Types of Personal Accident Insurance Policy

- Benefits of Personal Accident Policy

- Best Accident Insurance Policies in India

- FAQs

- 1. Why do you need a personal accident insurance?

- 2. Who can claim the insurance?

- 3. Do different companies offer different accident insurances?

- 4. What should you look for in personal accident insurance?

- 5. How can I pay the premium for accident insurance?

- 6. Is there any tax benefit for accident insurance?

- 7. How can a policyholder claim reimbursement in case of disablement of temporary or permanent nature?

- 8. Does accident insurance cover ambulance expenses?

Personal Accident Insurance - An Initiative Towards Safety

Why is it essential to buy Personal Accident insurance? Accidents and mishaps can happen anytime, anywhere. As per sources, more than 1275 accidents happen on road each day. And out of those approximately 487 incidents lead to severe injuries. Isn’t it better to get yourself protected before any such incident happens? This is where an accident insurance policy helps. In order to safeguard yourself and your dependents during an accidental emergency, it’s important to get a personal accident cover.

The accident Insurance Coverage not only for the insured but their dependents as well. Under a personal accident insurance policy, one gets a lumpsum or the set amount in case of disability or death caused due to the accident. There are various other benefits offered under a personal accident insurance plan. Let’s understand them in detail.

What Does Personal Accident Insurance Cover?

Personal Accident Insurance Policy provides coverage to the insured in case of any bodily injury, demise, Impairment or mutilation caused due to a violent, visible and hazardous accident. In the case of demise of the insured, the policy guards their dependents (family or parents) against economic or adverse repercussions. It is suggested to buy an accident insurance policy that either covers or reimburses all the eventualities, from small-term injuries to death. Moreover, it should protect the family’s future as well. Now, you can easily buy or renew an accident insurance policy online as well.

Types of Personal Accident Insurance Policy

There are two types of personal accident insurance policies offered by the accident Insurance companies in India. these include-

Individual Accident Insurance

This type of personal accident policy guards an individual in case of any intentional or unintentional hazards. The incident may vary from a short-term wound to a life-long injury or finally to death.

Group Accident Insurance

This Personal Accident Insurance Policy is not formulated for individuals. The Group Accident Insurance is bought by the employers for their employees. The premium of this policy is decided depending on the group size. This plan is an added advantage for small companies as the Group Insurance is available at a low price. However, it is a very basic policy and does not include numerous advantages like an individual accident insurance.

Talk to our investment specialist

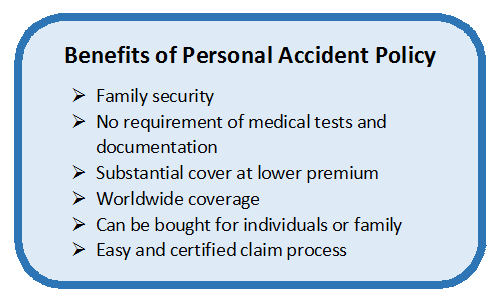

Benefits of Personal Accident Policy

We have listed some of the benefits of a personal accident insurance. Have a look!

Best Accident Insurance Policies in India

Now, if you plan to buy a personal accident insurance policy, you must consider some of the best accident insurance companies in India to buy your accident insurance plan.

- HDFC ERGO General Insurance

- New India Assurance

- Royal Sundaram General Insurance

- SBI General Insurance

- Max Bupa Health Insurance

- ICICI Lombard General Insurance

In conclusion, I would like to say, human life is precious! Make sure you safeguard your life from accidents by buying a personal accident insurance policy. Therefore, before any mishap occurs, get your accident insurance!

FAQs

1. Why do you need a personal accident insurance?

A: Personal accident insurance will cover a policy holder in case of an unfortunate event such as accident. It will cover not only the medical expenses, but also any Income loss caused by accident.

2. Who can claim the insurance?

A: The policy holder can claim the insurance. In case of life-long disability, by the nominee of the policy holder.

3. Do different companies offer different accident insurances?

A: Yes, different companies offer different types of accident insurance coverage. The premiums payable also differ from company to company and the type of accident insurance you are acquiring.

4. What should you look for in personal accident insurance?

A: When you purchase personal accident insurance, the first thing you should look for is the type of coverage offered. The insurance should cover expenses incurred due to hospitalization, loss of income, hospital daily cash, and reimbursement due to broken bones, family transportation allowance, and other similar expenses.

5. How can I pay the premium for accident insurance?

A: Usually, the premiums payable is for the policy holder to remit personal accident insurance in the form of monthly installments. You can make the payment of the premiums online.

6. Is there any tax benefit for accident insurance?

A: According to Section 80C of the income tax Act, personal accident insurances are not eligible for tax benefits.

7. How can a policyholder claim reimbursement in case of disablement of temporary or permanent nature?

A: In case of permanent total disability caused by accident, the sum insured is disbursed to the policy holder's nominee.

- In case of permanent, but partial disablement caused by accident, the policyholder or the nominee will receive a specified amount of money as an Insurance Claim. However, this amount is usually pre-decided; the insurance company takes a final decision considering the extent of the injury and the impairment.

- In case the policyholder suffers a short term disablement, but is confined to the house during the recovery period, the insurance company will primarily consider the loss of income. The company usually provides weekly payment for the confinement period and the impairment.

8. Does accident insurance cover ambulance expenses?

A: Yes, it covers ambulance expenses.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.