Table of Contents

- Types of Debit Cards Offered by Yes Bank

- 1. Yes Premia World Debit Card

- 2. Yes Prosperity Platinum Debit Card

- 3. Yes Prosperity Titanium Plus Debit Card

- 4. Yes Prosperity RuPay Platinum Debit Card

- Withdrawals and Key Charges

- 5. YES BANK RuPay Kisan Card

- Withdrawals and Key Charges

- 6. YES BANK PMJDY RuPay Chip Debit Card

- Withdrawals and Key Charges

- 7. Yes Bank VISA Platinum Debit Card

- Withdrawals and Key Charges

- Yes Bank Debit Card PIN Generation

- Yes Bank Debit Card Customer Care

- Conclusion

Top Yes Bank Debit Cards to Explore!

Founded in 2004, Yes Bank is the fourth largest private sector bank in India. It is known for its high-quality services, a vast Range of product offerings and customer-driven bank. It has more than 1,150 ATMs and 630 branches across India. With such huge connectivity, Yes bank debit cards should be a must considered option. To add more, the bank offers exclusive offers and benefits on their debit cards. This article, we guide you to different types of Yes bank debit cards that will suit your various requirements.

Types of Debit Cards Offered by Yes Bank

1. Yes Premia World Debit Card

- Enjoy complimentary airport lounge access

- Get up to Rs. 200 off on BookMyShow

- Avail access to premium golf courses in India

- Get Comprehensive Insurance coverage on fraudulent transactions and personal accident

- Save up to 2.5% on fuel purchase at any Petrol pump

Withdrawals and Key Charges

With Yes Premia World Debit Card get daily domestic and international cash withdrawal limit of Rs. 1,00,000. The daily domestic purchase limit is of Rs. 3,00,000 and for international it is Rs. 1,00,000.

Following are the key charges for this card:

| Type | Fee |

|---|---|

| Annual Fee | Rs. 1249 |

| International cash withdrawal | Rs. 120 per transaction + Taxes |

| International balance enquiry | Free |

| Physical PIN regeneration | Rs. 50+ taxes, no fees through net banking |

| Replacement of lost/stolen card | Rs. 149 per instance |

| ATM decline due to Insufficient Funds | Rs. 25 per instance |

| Cross currency markup | 3% |

2. Yes Prosperity Platinum Debit Card

- This card comes with the NFC contactless payments feature

- Yes bank offers lost card liability and personal accident insurance cover

- Enjoy complimentary lounge access domestic, once per quarter

- Avail special offers on shopping, dining, travel, entertainment, etc.

- The bank give worldwide access to over 15,00,000 ATMs and over 3,00,00,000 merchants

Withdrawals and Key Charges

Get daily cash withdrawal limit of Rs. 1,00,000 and daily purchase limit at POS (Point of Sale) of Rs. 2,00,000

Following are the key charges:

| Type | Fee |

|---|---|

| Annual fee | Rs. 599 |

| International cash withdrawal | Rs. 120 per transaction |

| International balance enquiry | Rs. 20 per transaction |

| Physical PIN regeneration | Rs. 50 per instance |

| ATM decline due to insufficient funds | Rs. 25 per transaction |

| Replacement of lost/stolen card | Rs. 149 per instance |

| Cross currency markup | 3% |

Get Best Debit Cards Online

3. Yes Prosperity Titanium Plus Debit Card

- This Yes bank debit card comes with a host of benefits and privileges across categories like travel, shopping, dining, etc.

- Save up to 2.5% on fuel purchase at any petrol pump

- Enjoy discount up to Rs. 200 on BookMyShow

- Get worldwide access to over 15,00,000 million ATMs and over 3,00,00,000 merchants

Withdrawals and Key Charges

Yes Prosperity Titanium Plus Debit Card gives you daily cash withdrawal limit of Rs. 50,000 and purchase limit at POS of Rs. 1,50,000.

Following are the key charges to note:

| Type | Fee |

|---|---|

| Annual fee | Rs. 399 |

| International cash withdrawal | Rs. 120 per transaction |

| International balance enquiry | Rs. 20 per transaction |

| Physical PIN regeneration | Rs. 50 per instance |

| ATM decline due to insufficient funds | Rs. 25 per transaction |

| Replacement of lost/stolen card | Rs. 149 per instance |

| Cross currency markup | 3% |

GST as applicable

4. Yes Prosperity RuPay Platinum Debit Card

- Enjoy special offers on shopping, travel, dining, entertainment, etc.

- Rupay gives access to domestic airport lounges across the country, twice per quarter

- Earn up to 5% cashback on utility bills

- Save up to 2.5% on fuel purchase at any petrol pump in India

- Get unlimited access to over 2,00,000 ATMs & 20,00,000 POS terminals in India

Withdrawals and Key Charges

Get gaily cash withdrawal limit of Rs. 25,000 and purchase limit at POS of Rs. 25,000.

Following are the key charges to note:

| Type | Fee |

|---|---|

| Annual fee | Rs. 99 |

| Physical PIN regeneration | Rs. 50 per instance |

| ATM decline due to insufficient funds | Rs. 25 per transaction |

| Replacement of lost/stolen card | Rs. 99 per instance |

5. YES BANK RuPay Kisan Card

- This Yes bank debit card ensures a convenient digital payment solution for farming and all other needs

- Make purchases directly in-store for like pesticides, seeds, fertilizers, fuel, shopping, etc.

- Save up to 2.5% on fuel purchase at any petrol pump

- Get 24x7 access to your account across 2,00,000 ATMs and 20 lakh POS terminals in India

- Enabled for online transactions such as travel, utility payments, etc.

Withdrawals and Key Charges

Enjoy daily cash withdrawal limit and POS purchase limit of Rs. 1 lakh.

Following are the key charges for YES BANK RuPay Kisan Card:

| Type | Fee |

|---|---|

| Annual fee | Free |

| Physical PIN regeneration | Rs. 50 per instance |

| ATM Decline due to insufficient funds | Rs. 25 per transaction |

| Replacement of lost/stolen card | INR 99 per instance |

GST as applicable

6. YES BANK PMJDY RuPay Chip Debit Card

- YES Bank offers this debit card under Prandhan Mantri Jandhan Yojana (PMJY) scheme for inclusive banking to Unbanked customers, catering all basic banking needs

- This card is accessible to over 2,00,000 ATMs and over 20 lakh POS terminals in India

- Enabled for online transactions such as travel, utility payments, etc.

- Get assured reward points on every transaction and redeem against wide range of products and services

Withdrawals and Key Charges

Get daily cash withdrawal limit and POS purchase limit of Rs.10,000.

Following are the key charges for YES BANK PMJDY RuPay Chip Debit Card:

| Type | Fee |

|---|---|

| Annual fee | Free |

| Physical PIN regeneration | Rs. 50 per instance |

| ATM decline due to insufficient funds | Rs. 25 per transaction |

| Replacement of lost/stolen card | Rs. 99 per instance |

7. Yes Bank VISA Platinum Debit Card

- Take the privileges of attractive lifestyle and benefits like golf, shopping, dinning, travel, entertainment, etc

- Enjoy 15% off on Green Fee at selected Golf Clubs in India

- Experience seamless, fast and safe payments up to Rs. 2000 with contactless payments

- Get 1x Reward Points on all domestic retail spends & 4x points on all International retail spends

Withdrawals and Key Charges

You can daily withdrawal cash up to Rs. 30,000 and make purchase up to Rs. 1,00,000. Purchase limit and liability coverage would be Rs. 50,000 for virtual card.

| Type | Fee |

|---|---|

| Annual fee | Rs. 149 |

| International cash withdrawal | Rs. 120* per transaction |

| International balance enquiry | Rs. 20* per transaction |

| Physical PIN Regeneration | Rs. 50 per instance |

| ATM decline due to insufficient funds | Rs. 25 per transaction |

| Replacement of lost/stolen card | Rs. 149/* per instance |

| Cross currency markup | 3% |

*GST applicable

Yes Bank Debit Card PIN Generation

Generally, when you open an account with Yes Bank, you get a KIT that has your cheque book, passbook, debit card and Personal Identification Number (PIN).

To change your Yes bank debit card PIN, you can do via net banking, mobile banking or through an ATM centre.

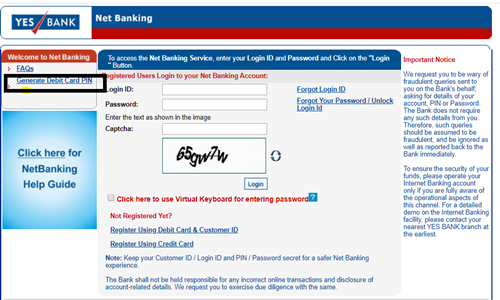

Steps to Change PIN Via Yes Internet Banking

- Go to Yes bank’s internet banking

- Log in by using your login ID and Password

- On the left hand, you can see Generate Debit Card PIN, click on the highlighted box and proceed further

- You will be routed to a new window where you have to enter your customer ID and date of birth

- After submitting, you will receive an OTP on your registered number. Enter the OTP and click on the continue button

- Enter the desired ATM PIN and click submit

Once the ATM PIN is changed, you will get a message on your registered mobile number.

Yes Bank Debit Card Customer Care

You can get in touch with the Yes bank customer care at:

- Email at-

yestouch@yesbank.in. - You can SMS

‘help’ space < CUST ID> to + 91 9552220020 - Toll-free number -

1800 1200 or +91 22 61219000

Customers from outside India can Call @ + 91 22 3099 3600

For international:

| Country | Customer Care Number |

|---|---|

| USA/Canada | 1877 659 8044 |

| UK | 808 178 5133 |

| UAE | 8000 3570 3089 |

Conclusion

A debit card puts you in the habit of budgeting and at the same time gives you a smooth and hassle-free transaction at the merchant portal and ATM centre. Also, you get many benefits, rewards and privileges just like you saw for Yes Bank Debit Cards.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

The article is useful thx!