Table of Contents

How do Credit Ratings Work in India?

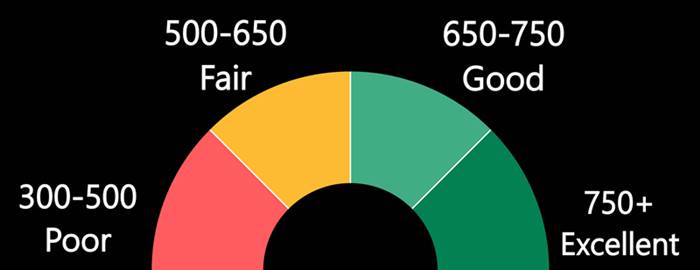

A credit rating is assessing the creditworthiness of an individual or an entity. The rating determines whether the borrower will be able to repay the loan on time. It also influences the lender's decision on approving loan applications and deciding the rate of interest of the loan. Of course, a good rating stands for good payment history.

There are a number of credit rating agencies in India that rate companies after measuring their ability to repay the borrowed amount. These agencies prepare a detailed report after examining their past payment behaviors and other factors.

Credit Rating Agencies in India

Here are the most well-known credit agencies in India that evaluate the creditworthiness of an individual or business who wishes to apply for a loan or a credit card.

CRISIL

Credit Rating Information Services of India Limited (CRISIL) was the first agency set up in India in 1987. It not only calculates the creditworthiness of companies, but also rates organisations and banks, helping investors to make a better decision before Investing in companies’ Bonds.

CRISIL offers 8 types of credit rating, which are:

| Good Rating | AAA, AA, A |

|---|---|

| Average Rating | BBB, BB |

| Low Rating | B, C, D |

CARE

Launched in 1993, Credit Analysis and Research Limited (CARE) is the second-largest agency in India. It offers a Range of credit rating services in areas like Bank loans, corporate governance, short term & long-term debt instruments, etc.

ICRA

Originally named as Investment Information and Credit Rating Agency of India was formed in 1991. It provides a bank loan rating, mutual fund rating, corporate governance rating, SME rating, insurance sector rating, corporate debt rating, etc.

Some of the other credit rating agencies are ONICRA, FITCH India, Brickwork Ratings (BWR) and Small and Medium Enterprises Rating Agency of India (SMERAI).

Check credit score

How Credit Rating Agencies Work in India

Ideally, every agency has its own algorithm to evaluate the ratings. But, all their evaluations are based on common factors such as credit history, credit duration, number of credit, credit utilization, type of debt, the financial statement of the company, etc. As said, these agencies conduct ratings of individuals, companies, state governments, a non-profit organisation, securities, countries, and local governmental bodies.

Every month, agencies collect credit information from banks. Once they get a request for a credit rating, they gather information and prepare a report. Based on this report, they grade companies or individuals with ratings. The better the rating, the more chances of getting a better rate of interest. Poor credit rating indicates a high risk of defaulting.

Objectives of Credit Rating

It helps in making better decisions for both lenders and borrowers:

Borrowers

- Better rate of interest

Every bank may have a different rate of interest to offer. But, one of the important factors that determine your loan's interest rate is your credit history. The higher the credit rating, the lower your interest rate.

- Easy loan process

Your loan application will be easily approved and processed if you have a high credit rating. Whereas, someone with a bad rating may find hurdles in a loan approval.

Lenders

- Safety

A credit rating shows how responsible is the borrower. Hence, it helps lenders decide whom to lend money. A high credit rating means an assurance about getting the money back safely on time.

- Better lending decision

As per the creditworthiness, the lenders are able to decide what interest rates to offer. It also helps creditors to decide the credit card privileges to offer. Again, the higher the rating, the more credit benefits you’ll have.

Conclusion

Your credit rating would mostly depend on how well you’ve managed your loans and credit cards in the past. So, to ensure your ratings are high, start managing your loan EMIs and credit card well. Follow good credit habits and make your lending decision easy.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.