Table of Contents

A Guide to Credit Score Range in India

You may know your Credit Score, but do you know what does it actually mean? Every score has a significant impact in your financial health, thus it is important to understand it first. When you apply for a new credit, lenders use your scores to predict your level of credit risk. Ideally, the higher your score, the better are the chances of getting easy credit (loan, credit card) approval.

Credit Score Basics

All credit scores have a basic goal ─ helping lenders (such as creditors, banks) to understand how risky it is to lend you money. A high score means you’re a responsible borrower, while a low or poor score means that you have poor debt management. Even if you get a credit with a low score, you may end up paying heavy interest rates.

Breaking Down Credit Score Ranges

There are four RBI-registered Credit Bureaus in India- CIBIL, CRIF High Mark, Equifax and Experian, and each of them has their own credit scoring model.

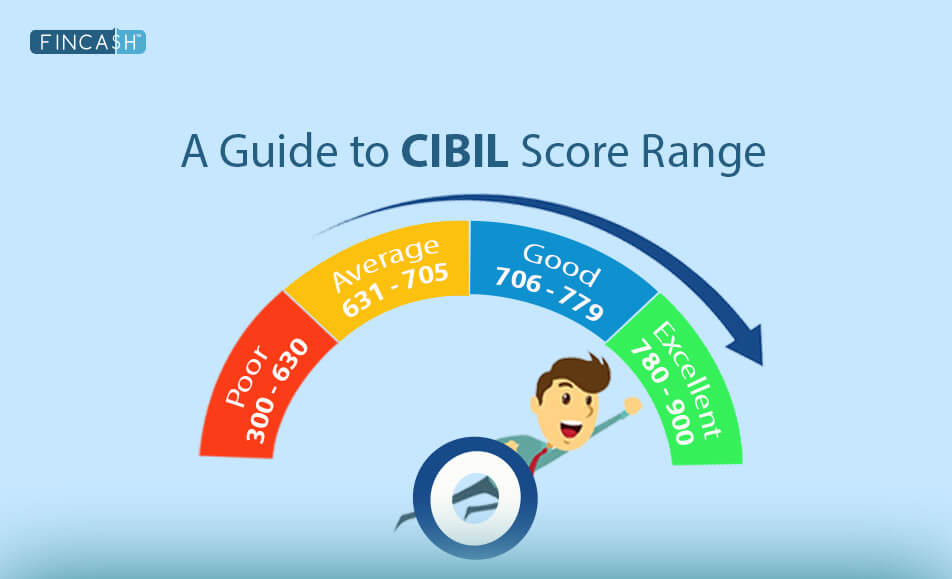

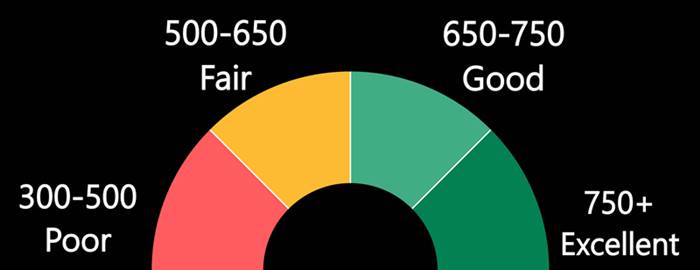

Typically, the score ranges as follows-

| Category | Credit Score |

|---|---|

| Poor | 300-500 |

| Fair | 500-650 |

| Good | 650-750 |

| Excellent | 750+ |

Check credit score

Poor Credit Score: 300-500

Anyone with a score between 300 and 500 may have multiple defaults on credit cards, loan EMIs from several different lenders. Borrowers with such a score may have very little chance of obtaining a new credit card or a loan. They should first focus on repairing their scores.

Fair Credit Score: 500-650

Borrowers falling in this Range of scores may be considered to be at the 'fair or average' category. They may have some faults in their credit history, maybe a delay in past payments, etc. Lenders are likely to approve the credit application of such borrowers, but not at very competitive rates. They might also have limited choices for credit cards.

Good Credit Score: 650-750

Borrowers with such a score have a good payment history, thus lenders easily consider them to lend money. They can easily get a loan or a credit card with lower interest rates. Anyone with such a score will have various credit card options to choose.

Excellent Credit Score: 750+

In this range, borrowers can expect lenders to roll out the red carpet. With such a strong score, lenders offer better loan terms and you may even be able to negotiate for better loan terms. You will be eligible for add-on features on credit cards, such as cash backs, air miles, rewards, etc. So, ensure you build such a score to enjoy all the credit benefits in life.

How does Credit Score affect your Financial Life?

You might wonder 'what is the big deal with a low score'. Well, most of your financial decisions can get affected if you score is poor. Your dream loan may not be approved or you may have to pay heavy interest rates on your loan or credit card.

1. Credit application may not be approved

If your credit score is poor then many lenders may not take the risk to lend you money. So, if you apply for a loan or a credit card with poor credit, your application can be denied.

2. High interest rates on credits

A low credit score means a higher risk of lending you money. So, lenders make you pay for this risk by charging a higher interest rate on loans or credit cards. If you have a good score, you can negotiate for better interest rates.

3. Higher insurance premiums

Globally, Insurance companies check credit. Usually, they charge a higher premium to those who have a bad score. This is beginning to happen in India as well as many insurance companies have started to use credit scores of the applicants.

Conclusion

If you want to have a strong credit life, starting building your score. With an excellent score, you can confidently apply for a new credit line and enjoy all the benefits.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.