Fincash » Mutual Funds India » Earning More Than Before But Still Saving Much Less

Table of Contents

Earning More Than Before But Still Saving Much Less? Know Why!

Despite earning enough, many people are not able to save money. They get 100% hikes and double promotions, but if you look at their savings or Investing pattern, nothing much has changed.

This raises the question of whether the increased Income levels are commensurate with the cost of living or not. In this article, let’s look at various reasons why people are not able to save money despite having larger incomes compared.

Common challenges people face

The following statistics will help you to understand why saving becomes necessary for you:

According to a report by the Reserve Bank of India, the total household debt in India increased from Rs. 10.35 lakh crore in March 2015 to Rs. 15.35 lakh crore in March 2022. This high level of debt can make it challenging for people to save money.

Many people still lack Financial Literacy, which it challenging for them to save and invest their money effectively. According to a survey by Standard & Poor's, only 24% of adults in India are financially literate.

Many people do not have adequate Retirement planning, and they do not save enough for their retirement. According to a survey by HDFC Life, only 19% of Indians are confident that they have saved enough for their retirement.

Growing indebtedness is another cause for reduced saving ability among individuals; as they indulge in debt their incomes go into covering the debt, hence affecting personal finances. One of the other majors has been economic challenges such as rising Taxes which can significantly erode into a person’s disposable income and discourage any attempts at saving money effectively over long-term objectives like retirement planning and college funds for children etc.

Check Here!

Reasons why you are not saving enough despite earning more

There are many reasons why you earn more than before but save less. However, here are some common reasons that you must know:

1. Previous expenditure vs. Current expenditure

As people's income grows, their discretionary spending tends to increase. As per a report, they spend more on discretionary expenses like dining out, entertainment, and travel after their income increases. One of the main reasons people earn but save less is the increase in the cost of living. As salaries increase, you spend more on materials like homes, cars, and luxurious items. This spending is often seen as a reward for hard work and is a way to enjoy the fruits of your labor.

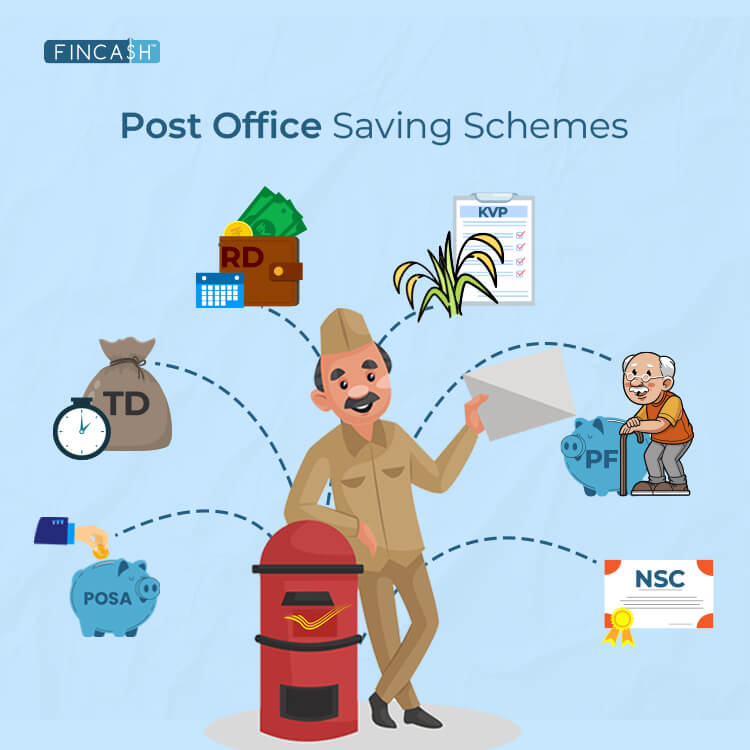

The best way to tackle this situation is by understanding how to manage your finances as your salary increases. First, you must allocate a Fixed Income towards savings and then spend on other items meant for luxury. For example, if you aim to save 25 or 30 percent of your salary, you can make a Recurring deposit or a SIP (Systematic Investment plan) for that particular amount.

2. Attitude towards money

This is also one of the reasons why you tend to save less. In the present scenario, you look at money as a means to enjoy life rather than a tool for building wealth. This mindset has increased spending on experiences like travel, dining out, entertainment, and others. While these activities can be enjoyable, they often come at the expense of saving money for the future. You must follow the rule of 50:30:20 to control these expenses. You must keep 50% of your income to meet all the household expenses, 30% to meet your demands, and 20% to go into your savings.

3. Increased use of credit card

According to a report by the Reserve Bank of India, the number of credit card transactions in India increased from 3.24 crore in March 2020 to 5.16 crore in March 2021. This increase in credit card usage could lead to higher spending and debt if not managed properly. Credit availability is also a primary Factor that doesn’t help you save money. With easy availability and increased credit card usage, you can finance your lifestyle with borrowed money. This directly or indirectly affects your savings as you enjoy your life with borrowed money and high-interest rates. For example, if you are spending 1,000 rupees on a credit card, you end up paying 1,035 rupees when paying the outstanding amount of your credit card. You could have saved this money rather than paying high-interest rates and the borrowed money.

4. Lack of knowledge about personal finance and savings

It is imperative to learn about Personal Finance and start savings and Investing Early in life. Relationships with money set the groundwork for a whole lifetime of financial success. Since most jobs have some kind of retirement plan or option, children should understand all these concepts before they reach adulthood. In today’s world where the concept of digital currency has emerged and credit cards are widely used, it is much easier to lose track when learning how to manage your finances than it once was. Teaching young adults about budgeting and saving could help prepare them for managing their own funds successfully without needing credit cards or loans in dire situations later on down the line.

Such education would provide those who desire entrepreneurship with skills they will need throughout their lives while also helping promote economic development within communities. This lack of knowledge and awareness leads to sticking with low-yield savings accounts, spending beyond their means, or taking on unnecessary loans.

Mastering the basics such as understanding your building an emergency fund, setting up investment goals, various assets to invest, knowledge about modern investments like Mutual Funds, Gold Funds etc. are also essential components of wise Personal Finance Management strategy. All these require discipline as well as time but it will go a long way towards helping you live a more secure financial life in the longer run.

Conclusion

A lack of financial education and planning can lead to decreased savings. These are some important reasons why you cannot save while earning. To summarize, you must create an appropriate budget plan, stick to the targetted expenses, change your mindset towards money, use your current wealth to build wealth and educate yourself on finances and money management.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.