Table of Contents

The Benefits of Investing Early

Investing early is generally not something people just starting out in their careers do. It seems to be a term most people associate with either old age or when they start earning extra money. This happens to be one of the biggest mistakes in Personal Finance since the benefits of investing early (via lump sum or SIP) are huge and well worth putting some cash in advance.

Benefits of Investing Early

Secure Future

Thoughts about investing early for a secure future are often overlooked, especially by the newly employed since ‘Carpe Diem’ seems to be the phrase to live up to. But, given the volatile Market conditions and the shaky global Economy, investing early for a stable future is wise. Your 20s are the years where you have comparatively fewer responsibilities and more disposable Income. The first step is to identify your Financial goals and learn about the different investment options like Mutual Funds, stocks, fixed deposits (FDs), etc. Depending on your short-term and long-term goals, the next step is to choose the options which suit your investment needs. Having time on your side means having a longer duration to find investments that give higher returns. To begin investing early means you can experiment with your investments, customising and re-prioritizing your Portfolio as per your changing lifestyle and financial goals. Also, the earlier you start, the lesser you will need to invest later, as compound interest does wonders while building a huge corpus.

The Power of Compound Interest

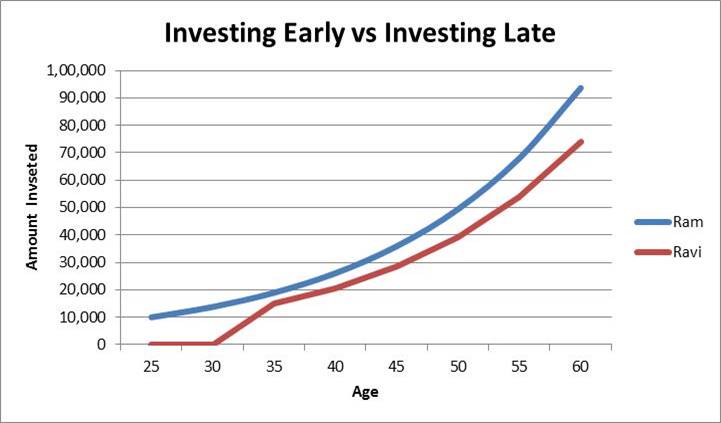

Here, we see that at the age of 25, Ram starts investing INR 10,000 @ 6.6% which is compounded annually for 35 years and at the retirement age of 60, accumulates a sum of more than INR 93,000. Whereas, at the age of 35, Ravi starts investing Rs.15,000 for the same rate of interest of 6.6% compounded annually for 25 years. But, at the age of 60, he only accumulates around INR 74,000. Therefore, compounding can drastically affect an investment. What is really important is the time one stays invested. Compound interest is the interest calculated on the initial principal amount and the accumulated interest of a deposit or loan. It is called as interest on interest.

Quoted as the “8th Wonder of the World” by Albert Einstein, compound interest really helps a few way bucks go a long way. The earlier you start, the better because it works on the basic principle of time value of money. Regular investments in a retirement account or an investment portfolio result in huge compounding benefits.

Talk to our investment specialist

Improves Quality of Life and Spending Habits

By investing early, your investments grow over time. Later on, you can afford things which people who are new to investing can’t. Thus, investing early improves your quality and standard of life. Research says that people who start investing early on are much less likely to have issues with overspending over the long run. Therefore, keeping your spending habits in check.

Tax Benefits

Investments like Public Provident Fund (PPFs), Equity Linked Savings Scheme (ELSS), Unit Linked Insurance Plan (ULIPs), etc. offer tax deductions under Section 80C of the Indian income tax Act. So, instead of paying more Taxes, you can legally save your Tax Liability by investing in these schemes.

Investing early is definitely not easy but it is surely worth it in the long run. Simply start with small amounts and give them time to grow. As Warren Buffett rightfully quoted, " The earlier you start (investing), the better. " So take your baby steps towards the road of investing today and be a millionaire tomorrow.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Nivesh karna chahte hain