HDFC Credit Card Net Banking - Top Features to Use!

Net banking makes managing your finance easier and also helps to carry out secure transactions. It allows you to access your financial and non-financial banking services everywhere with the convenience of transferring funds online through NEFT, RTGS, IMPS anytime. But imagine getting all these benefits via a credit card!

The HDFC Credit Card Net Banking brings you this Facility with ease and convenience to operate.

You can avail information about the credit and cash limit, credit card statements, checking balance, requesting registration for HDFC Auto-Pay facility and also generate new credit card pin among others.

In this article, you will read about the features and steps to use this banking facility.

Features of HDFC Net Banking Credit Card

1. Convenient Banking Option

Linking credit card with internet banking gives easy access to banking facilities. Here are some of the services to know:

- Pay Taxes

- Auto Debit Facility

- PIN Generation

- Credit Card Statements

- Activation of the card

- Reward point information

- Payment Due Date

- Block Credit Card

- Hotlist Credit Card

- Upgrade to new credit card

- Reward Point Redemption

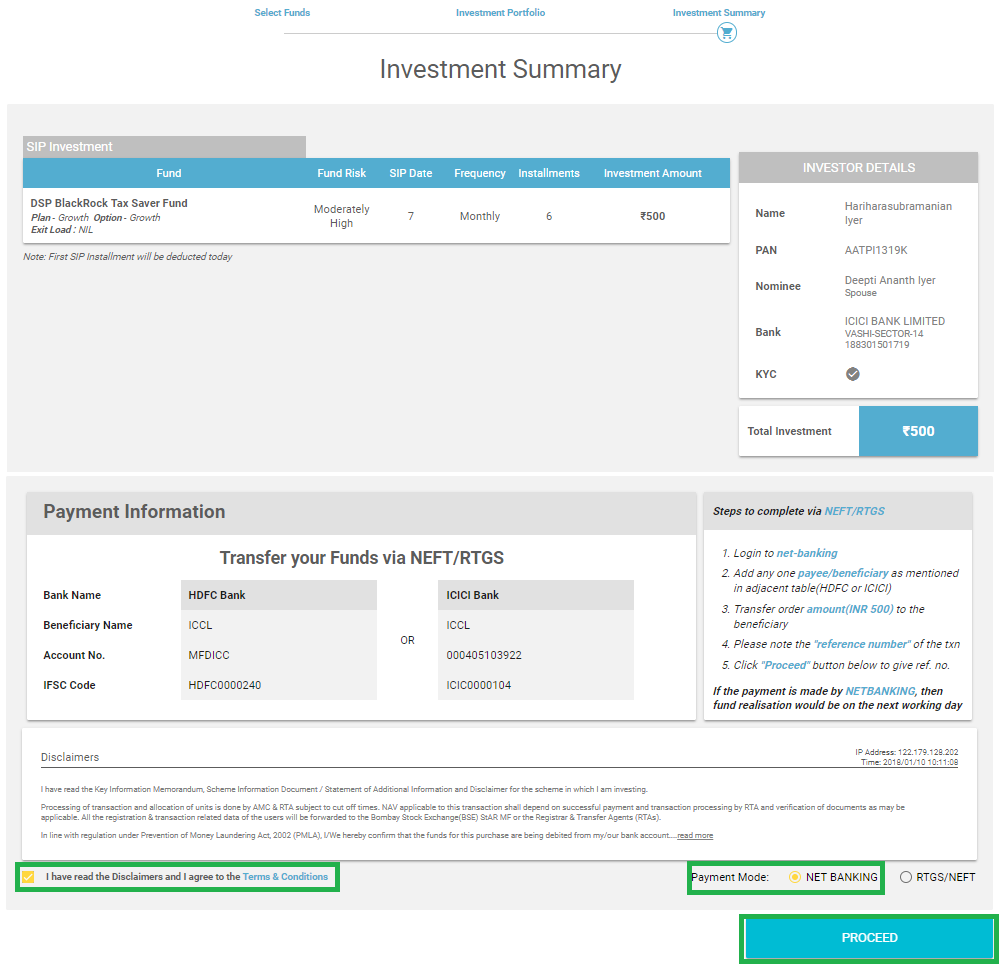

2. Bill Payment

You can pay for over 260 billing merchants online with just one-time registration via NetBanking. Add all the contacts you need to conduct billing transactions so the payment is done without any delay. It also gives you the option to set reminders for payment.

You can make following payments:

- Electricity

- Gas

- Landline phone

- Water

- Subscriptions

- HDFC Credit Card Bill and other banks credit card bill

- Post paid mobile

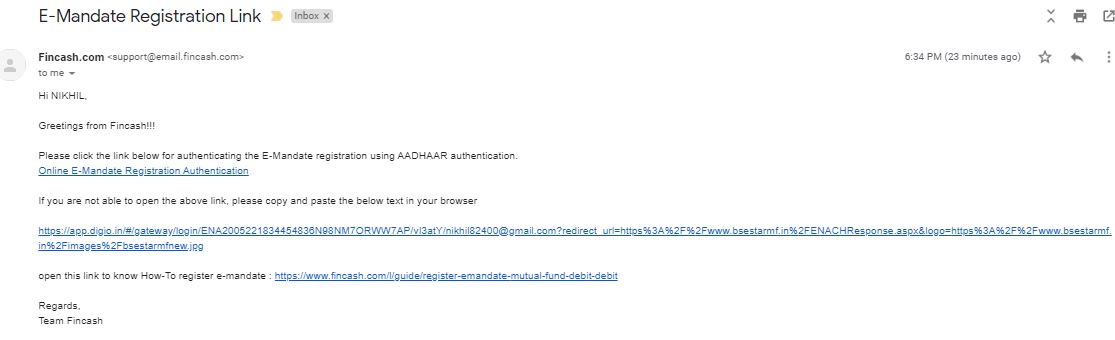

- Mutual Fund installment

- Club membership

- insurance premium

- Rent payment

3. Security

HDFC internet banking brings you complete safety and online security for your transactions.

4. Increase Credit Card Limit

Firstly, remember that your credit card limit depends on your Credit Score. Check with the Bank to know if you are eligible to increase your credit card limit.

Here are a few steps to follow in order to check your eligibility:

- Login to your HDFC net banking account

- Click on ‘Credit Card Upgrade with Enhancement’ on the homepage of your account

- choose your credit card type

- Click on Continue

- If you are eligible, you will receive a notification on your screen showing the eligible Credit Limit

- On eligibility, you can upgrade your credit card

Remember that once the lender approves your credit card, you will receive the physical form of the card within 7-10 working days. Your credit score, rewards and other transactions will be further conducted on your upgraded card.

Get Best Credit Cards Online

5. ATM PIN Change

You can change your ATM Pin with the HDFC net banking facility. Here are the steps to follow:

- Login to your HDFC net banking account

- Click on credit cards tab

- Find Credit Card ATM PIN on your account dashboard

- Select the Credit Card from the Dropdown menu

- Click Continue

- A pop-up notification will appear with confirmation for your request for a new PIN

6. Loan Application

One of the best features is that you can apply for a loan against an HDFC credit card. And what’s more? You don’t have to pay any processing fees. In order to avail this facility, you will have to register for net banking with the bank. You can check your loan eligibility with the following steps:

- Log into HDFC Bank Net Banking

- Click on ‘Credit Cards’ on the dashboard

- Find

Credit Loan/EMI option - Choose credit card, transaction, EMI Tenure

- Click on Submit

HDFC Credit Card Customer Care

Here're the city-wise contact numbers available. You can easily contact for any queries related to your HDFC credit card:

| City | Contact Number |

|---|---|

| Ahmedabad | 079 61606161 |

| Bangalore | 080 61606161 |

| Chandigarh | 0172 6160616 |

| Chennai | 044 61606161 |

| Cochin | 0484 6160616 |

| Delhi and NCR | 011 61606161 |

| Hyderabad | 040 61606161 |

| Indore | 0731 6160616 |

| Jaipur | 0141 6160616 |

| Kolkata | 033 61606161 |

| Lucknow | 0522 6160616 |

| Mumbai | 022 61606161 |

| Pune | 020 61606161 |

For credit card related queries in the following cities - Agra, Ajmer, Allahabad, Bareily, Bhubaneshwar, Bokaro, Cuttack, Dhanbad, Dehradun, Erode, Guwahati, Hissar, Jammu and Srinagar, Jamshedpur, Jhansi, Jodhpur, Karnal, Kanpur, Madurai, Mangalore, Mathura, Meerut, Moradabad, Muzaffarpur, Mysore, Pali, Patiala, Patna, Rajkot, Ranchi, Rourkela, Salem, Shimla, Siliguri, Silvassa, Surat, Trichy, Udaipur, Varanasi - 1800-266-4332

FAQs

1. My HDFC bank credit card net banking account has been blocked. What to do?

A: If you have lost your credit card or it is stolen and you have requested to block it, then the bank will initiate the process. Moreover, if this is not the case and your account has been blocked, it might be because you entered the wrong PIN number multiple times.

In this situation, you can wait for 24 hours. If you still find it blocked, then you can get in touch the the HDFC credit card customer care.

2. How can I reactivate my HDFC bank credit card net banking account?

A: You can reactivate your account with a new Ipin. If your account has been blocked because of serious issues, then the bank will issue a new credit card.

3. Can I use Chip credit cards anywhere?

A: Yes, you can in places where the VISA/MasterCard is accepted. At a chip-enabled terminal, you can use your chip card into a POS terminal. If you are using at a location where the chip-enabled terminal is not there, then your card will be swiped and the transaction will complete with a signature as it happens with regular card transactions.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.