Table of Contents

HDFC Debit Card- Check Exciting Rewards & Benefits!

HDFC, also known as Housing Development and Finance Corporation, is one of the most popular banks in India. It was incorporated in 1994, and since then the Bank has been growing steadily and serving a large number of people in India and abroad. When it comes to the HDFC Debit Card, you will find a variety of options to choose from. The debit cards by HDFC are tailored according to the requirements of people, for instance, for shopping, booking movie tickets, air tickets, dining, etc. Moreover, they are easy and convenient to use while travelling overseas.

Types of HDFC Debit cards

1. Jet Privilege HDFC Bank World Debit Card

- Enjoy first swipe bonus of 500 InterMiles every year

- Get joining discounts on domestic & international flights booked via InterMiles.com

- Get insurance cover of up to Rs. 25 lakh

- Enjoy daily domestic ATM withdrawal and shopping limits (combined) of Rs. 3 lakhs

- Get complimentary access to Clipper Lounge across all Indian airports

2. EasyShop Platinum Debit Card

- Get domestic withdrawal limits up to Rs. 1 lakh

- Enjoy 2 complimentary access to Clipper lounges in India per quarter

- Avail cashback point on every Rs. 200 spent on groceries, apparels, supermarket, restaurant and entertainment

- Earn cashback points on every Rs. 100 spent on telecom and utilities

Fees and Eligibility

Annual/renewal fees for this card is Rs. 750 + applicable Taxes.

Both Resident Indians and NRIs can apply for the EasyShop Platinum Debit Card. Resident Indians should hold one of the following: Savings Account, current account, SuperSaver account, loan against shares account or salary account.

3. HDFC Bank Rewards Debit Card

- Avail an insurance cover of Rs. 5 lakh

- Enjoy reward points on shopping from Snapdeal

- Get monthly reward points from Big Bazaar

- Avail daily domestic ATM withdrawal limits up to Rs. 50,000

Eligibility and Fees

Individual account holders should have a savings account, corporate salary account.

Fees attached with HDFC Bank Rewards Debit Card are:

| Type | Fees |

|---|---|

| Saving account holders | Rs. 500 + taxes per annum |

| Annual or Renewal fee | Rs. 500 + applicable taxes |

Get Best Debit Cards Online

4. Rupay Premium Debit Card

- Enjoy daily domestic ATM withdrawal limits up to Rs. 25,000

- Avail access to 27 domestic airport lounges and over 540 International airport lounges, two times per calendar quarter per card

Eligibility and Fees

Indian residents and NRIs can both apply to this card. Resident Indians should hold either a savings account, salary account or current account with the bank.

The bank charges following fees for Rupay premium Debit Card:

| Type | Fees |

|---|---|

| Annual/Reissuance fees | Rs. 200 |

| ATM pin generation | Rs. 50 + applicable charges |

5. Millenia Debit Card

- Enjoy Rs. 4,800 cashback every year

- Avail 5% cashback on shopping via Payzapp and SmartBuy

- Earn 2.5% cashback on online shopping and 1% cashback on offline spends

- Get 4 complimentary domestic airport lounge access annually

Eligibility and Fees

Residential Indians are eligible if they have one of the following- savings account, current account, supersaver account, loan against shares account, salary account, individual account holders- savings account, corporate salary account or senior account with Axis bank.

The bank charges following fees for Millenia Debit Card:

| Type | Fees |

|---|---|

| Annual fee per card | Rs. 500 + taxes |

| Replacement/re-issuance charges | Rs. 200 + taxes |

6. EasyShop Imperia Platinum Chip Debit Card

- Enjoy daily domestic ATM withdrawal limits of Rs. 1 lakh

- Make payments for airline bookings, education, electronics, medical, travel, insurance and tax payments

- Get complimentary airport lounge access across India

- Enjoy one cashback point on every Rs. 100 spent on telecom and utilities

- Avail one cashback point on every Rs. 200 spent for groceries, supermarket, restaurant, apparels and entertainment payments

Eligibility and Fees

The Resident Indians should have one of the following: savings account, current account, supersaver account, loan against shares account or salary account.

The annual fee for EasyShop Imperia Platinum Chip Debit Card is Rs. 750 p.a.

7. EasyShop Business Debit Card

- Get one cashback point on every Rs. 100 that you spend

- Earn one cashback point on every Rs. 200 spent for telecom, utilities, groceries and supermarket, restaurants, clothing and entertainment payments

- Avail complimentary access to Clipper lounges at airports across India

Eligibility and Fees

As this card is meant for business purpose, only particular entities can apply for this card, such as- sole proprietorship current account, HUF current accounts, partnership concerns, private limited companies and public limited companies.

Following are the fees for EasyShop Business Debit Card:

| Type | Fees |

|---|---|

| Annual fees | Rs 250 + taxes |

| Replacement/reissuance charges | Rs. 200 + taxes |

| ATM Pin generation charges | Rs. 50 +applicable charges |

8. EasyShop Woman’s Advantage Debit Card

- Get one cashback reward point every time you spend Rs. 200 on PayZapp, SmartBuy, telecom, utilities, groceries, etc

- Enjoy daily domestic ATM withdrawal limits of Rs. 25,000

Eligibility and Fees

Both Resident Indians and NRIs can apply for the EasyShop Woman’s Advantage Debit Card. Resident Indians should hold one of the following: savings account, current account, SuperSaver account, loan against shares account or salary account.

Following are the fees for EasyShop Woman’s Advantage Debit Card:

| Type | Fees |

|---|---|

| Annual fees/re-issuance charges | Rs. 200 + taxes |

| ATM Pin charges | Rs. 50 + applicable charges |

How to Apply for HDFC Debit Card

You can apply either via offline mode or online:

Offline Mode

You can visit the nearest branch of HDFC Bank, and meet the representative. All the further procedure of applying a debit card will be guided to you by the concerned representative.

Online Mode

With online mode, you can apply for HDFC debit card from anywhere, anytime! All you need to do is follow these steps to apply-

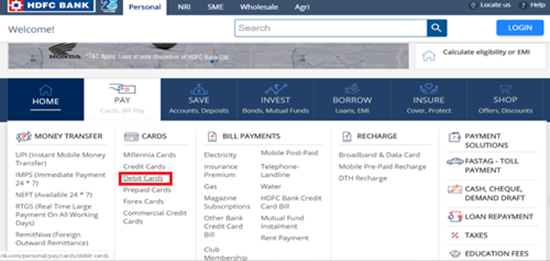

Visit the HDFC Official Website.

On the home page, you will find Pay option, under which you will see a drop down of various card option. Select debit cards.

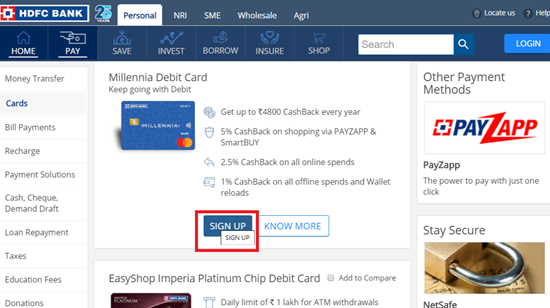

Here, you will find various HDFC debit cards, pick the one that suits your needs.

Click on the Signup, where you will get 2 options, like- 'Existing customer' or 'I'm a new customer'. Select the right option and proceed further.

- After completion of the process, you will get the debit card and the cheque book within 48 hours at your doorstep. You can also track your application status online.

Documents Required for HDFC Debit Card

You need to provide your address details, PAN Card, scanned copy of your identity and address proof.

HDFC Customer Care

For any queries, contact HDFC Bank customers @ 022-6160 6161

You can also Call phone banking officer based on your location. Before calling, make sure you keep card number and associated PIN or Telephone Identification Number (TIN) and Customer Identification Number (Cust ID) ready to access your account.

| Location | Customer care phone banking numbers |

|---|---|

| Ahmedabad | 079 61606161 |

| Bangalore | 080 61606161 |

| Chandigarh | 0172 6160616 |

| Chennai | 044 61606161 |

| Cochin | 0484 6160616 |

| Delhi and NCR | 011 61606161 |

| Hyderabad | 040 61606161 |

| Indore | 0731 6160616 |

| Jaipur | 0141 6160616 |

| Kolkata | 033 61606161 |

| Lucknow | 0522 6160616 |

| Mumbai | 022 61606161 |

| Pune | 020 61606161 |

For Ahmedabad, Bangalore, Chennai, Hyderabad, Delhi & NCR, Kolkata, Pune and Mumbai dial 61606161.

For Chandigarh, Jaipur, Cochin, Indore and Lucknow dial 6160616

Conclusion

Debit cards can be used for a variety of purposes. They also have many benefits and rewards points that you can avail. When it comes to shopping, travel, access to airport lounges, etc., HDFC debit card offers the best benefits. So, what are you waiting for? Apply one immediately!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Nice info and comparision