Fincash » Mutual Funds India » Keep Your Money Safe with Online Banking

Table of Contents

- What is Internet Banking?

- Tips to Keep Your Money Safe with Online Banking

- 1. Avoid Accessing Bank Accounts with Public Wi-Fi Networks

- 2. Save Login Details Cautiously

- 3. Use Strong Passwords

- 4. Use Two-Factor Authentication

- 5. Keep Your Devices Updated

- 6. Cautiously Access the Bank's Website and Download the App

- 7. Regularly Monitor Your Account Activity

- 8. Disconnect the Internet When Not in Use

- 9. Guard Your Login Credentials

- 10. Activate Transaction Alerts

- Conclusion

Top Tips to Keep Your Money Safe with Online Banking

The arrival of online banking has significantly enhanced the convenience of managing our finances. Gone are the days when we had to physically visit the Bank for fund transfers or patiently await paper statements to check our balances. Now, all this information is readily accessible at our fingertips. However, while online banking has undeniably simplified our financial lives, it has also unintentionally updated the operations of cyber criminals.

Today, thieves no longer need to arrange elaborate bank heists to steal someone's account; they've found more secret paths. They patiently wait for individuals to lower their guard, potentially exposing their personal information or deploying malicious software that silently collects sensitive data. To shield yourself from falling prey to these digital troublemakers, it's imperative to safeguard your personal information and consistently adhere to online banking security measures. In this post, let's dive deeper into tips to keep your online banking security updated and secure your money.

What is Internet Banking?

Internet banking, also called online banking or net banking, is a service offered by banks to enhance the convenience of their customers' banking experiences by enabling them to perform various banking tasks over the Internet. This service lets you carry out a wide Range of activities online without needing to visit a physical bank branch. With a mobile device, a computer or an internet connection, you can accomplish tasks such as:

- Checking the bank account balance or reviewing statements

- Initiating and managing fixed and recurring deposits

- Conducting fund transfers and making payments to merchants

- Requesting a chequebook for your bank account

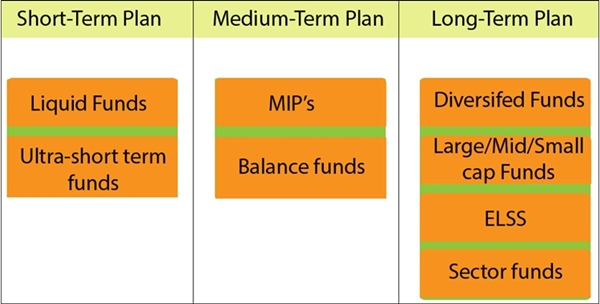

- Purchasing or redeeming Mutual Funds

- Acquiring Life Insurance or general insurance policies

- Settling credit card bills and paying utility bills, including electricity and mobile postpaid bills

- Activating or deactivating debit and credit cards

- Applying for various types of loans

- Recharging DTH services or prepaid mobile phones

Check Here!

Tips to Keep Your Money Safe with Online Banking

Here are some essential tips that you must follow to keep your money safe and practice online banking without any glitches:

1. Avoid Accessing Bank Accounts with Public Wi-Fi Networks

Public Wi-Fi exposes your device to potential hackers who can steal personal information. By doing so, know that others can access your browsing history and passwords. Therefore, activities requiring login credentials, such as online banking or email access, pose risks. Moreover, such networks often lack encryption, making them susceptible to electronic eavesdropping. The risk remains even if you have set up password autofill for email or other password-protected sites. Only access your bank's website through secure Wi-Fi networks, preferably those with passwords, or employ your personal cell phone data connection.

In emergencies, if you must use public Wi-Fi, confirm that the website you're accessing is encrypted by checking whether the URL is starting with "https" or "http." Furthermore, consider disabling file sharing and using a Virtual Private Network (VPN) for added security. This significantly heightens security, making it considerably more challenging for malicious entities to infiltrate your information.

2. Save Login Details Cautiously

While some websites offer the convenience of saving login information, this practice can become a security risk. If someone else uses your device, they may gain unauthorised access to your bank accounts. Many banking sites now implement timeouts after a period of inactivity and do not automatically save your login credentials to mitigate this risk.

3. Use Strong Passwords

For easy recall, many people create passwords based on personal information, such as their names and birthdates. However, such passwords are vulnerable to guesswork by hackers. Therefore, as advised by most banks, it's crucial to establish a strong, unique password. Strong passwords incorporate a blend of uppercase and lowercase letters, numbers, and symbols. Many banks mandate that online accounts use passwords meeting these stringent criteria. Changing your passwords at regular intervals, ideally every 90 days, and employing different ones for various online accounts is advisable. This practice brings an additional layer of security, making it more challenging for hackers to compromise your information. Furthermore, know that longer passwords are more secure. To create a lengthy yet memorable password, start with a well-known verse and incorporate easily remembered numbers and letters. You can further enhance password security by substituting certain letters with special characters.

4. Use Two-Factor Authentication

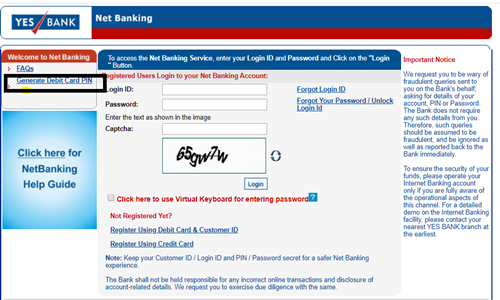

Numerous banks now offer two-Factor authentication for internet banking login. It is recommended to enable this feature. Two-factor authentication represents a more advanced level of security. Different banks may employ varying methods for two-factor authentication, so it's important to verify the specific method used by your bank when logging into your Internet banking.

Common second authentication methods include:

- A four-digit Personal Identification Number (PIN)

- Receiving a One0Time Password (OTP) via your registered mobile number and/or email address

- Image identification

- Automated phone calls to your registered mobile number and more

Typically, you provide your bank with your phone number, and they send a code via phone Call, email, or text when you log in online. To access your account, you must enter this code and your password. 2FA ensures that even if someone obtains your password, they won't gain access without this additional authentication step.

5. Keep Your Devices Updated

Outdated computers and mobile devices may lack the necessary security measures to safeguard your personal and financial data against the latest computer viruses. A hacker could access your bank accounts unnoticed in case there is a virus in your device. Regularly check for software updates by configuring your computer to do so automatically and notify you or manually checking for updates every weekend. However, go against enabling automatic downloads for updates, as manual downloading offers better protection against malware and viruses. Also, remember that when browsing the internet, your devices can become susceptible to viruses, including Trojans, malware, spyware, and more. These malicious entities can monitor your online activity and access sensitive data. To safeguard against such threats, installing antivirus software and keeping it updated is recommended.

6. Cautiously Access the Bank's Website and Download the App

In your inbox, you likely receive numerous informative and marketing emails from your bank, often containing links to the bank's official website. Unfortunately, fraudsters sometimes send similar-looking emails, enticing you to click on URLs for supposed special offers. Clicking on such links can redirect you to a website that mirrors your bank's site, giving a false sense of authenticity. However, this malicious site records your inputted login credentials, which are then exploited by fraudsters to take your funds. Sometimes, clicking on these links can download tracking malware onto your device. Instead, type your bank's web address into your browser's URL bar or use a trusted search engine to locate the correct webpage. You can also bookmark the legitimate page for future reference. Similar caution should be exercised when downloading the bank's mobile banking app.

7. Regularly Monitor Your Account Activity

Many people have a general idea of their monthly transactions and may not even open their monthly bank statements. However, it's advisable to meticulously review your transaction history, especially after conducting high-value online transactions. This is one of the most foolproof ways to ensure the security of your account balances and transactions. This lets you detect any suspicious activity promptly and take immediate action, such as changing your password and notifying your bank. While banks excel at detecting fraud, especially with credit cards, they may not catch every questionable transaction for every customer. Moreover, with this review, not only will you detect unauthorised transactions, but you will also get insights into your spending patterns, aiding in future expenditure control. Hence, a monthly review of your statement is essential.

8. Disconnect the Internet When Not in Use

Maintaining a constant internet connection can leave your computer vulnerable. Most users receive their internet through cable companies, and Wi-Fi is typically always on. It is recommended to keep your Wi-Fi password-protected. Also, whenever possible, disconnect your computer from the network when not in use.

9. Guard Your Login Credentials

Although this may seem like common advice, it cannot be stressed enough – never share your login details, PINs, debit/credit card numbers, CVV numbers, or OTPs with anyone. Fraudsters often impersonate bank representatives when contacting individuals, particularly senior citizens and homemakers. These impersonators request sensitive information under false pretences. It's crucial to remember that banks never require such sensitive data to carry out banking transactions. Exercise caution and think twice before taking action when approaching for such information.

10. Activate Transaction Alerts

Enable SMS and email transaction alerts to maintain continuous vigilance over your bank account. These notifications instantly inform you of any transaction activity within your account. If you notice any transactions you did not initiate, promptly notify your bank. Consider setting up daily or weekly balance alerts if you have limited time for comprehensive statement reviews.

Conclusion

Internet banking and mobile banking offer unparalleled convenience for conducting banking transactions. Banks implement multiple security measures to prevent fraudulent activities, including multi-factor authentication, data encryption, and mandatory password changes every three to six months. Moreover, the RBI has ensured that customers are eligible for full refunds in the case of unauthorised or fraudulent transactions, provided they inform the bank promptly. However, the process can be arduous and time-consuming. Thus, as discussed above, it is equally the responsibility of customers to take necessary precautions to protect their accounts.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.