Table of Contents

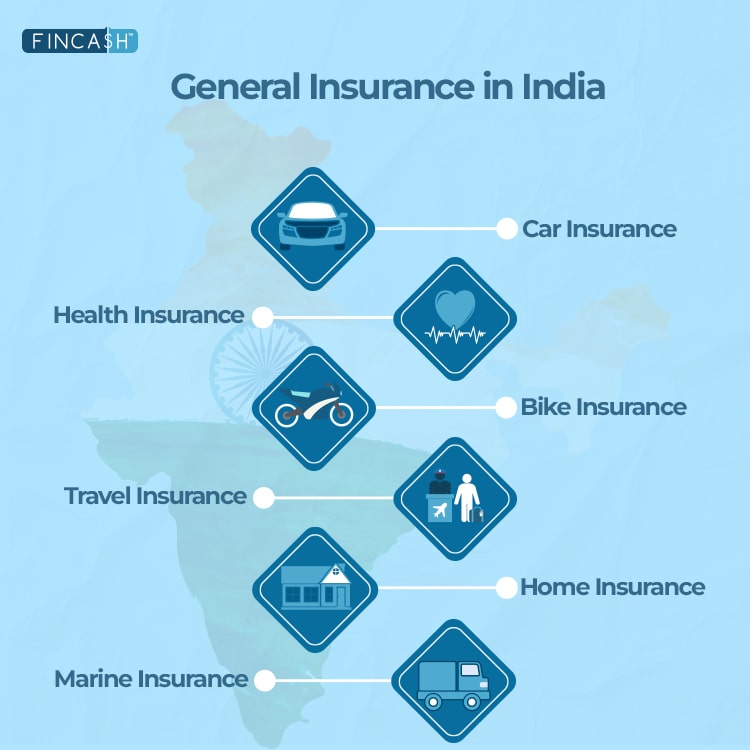

General Insurance in India

General insurance provides coverage to items other than life or essentially covers other than life insurance. It can include personal health insurance, insurance of property against fire/natural calamities etc, covers during trips or travel, personal accident insurance, liability insurance etc. It includes all forms of insurance apart from life insurance.

General insurance also offers corporate covers like coverage against errors and omissions by professionals (indemnity), employee insurance, Credit Insurance, etc. The most common forms of general insurance are car or Motor Insurance, health insurance, Marine Insurance, Travel Insurance, accidental insurance, Fire insurance, and then there other products that fall under non-life insurance. Unlike life insurance, this policy, is not for a lifetime. They usually last for given term. Most of the general insurance products have annual contracts while there are some which have a slightly longer term contract (in most cases 2-3 years).

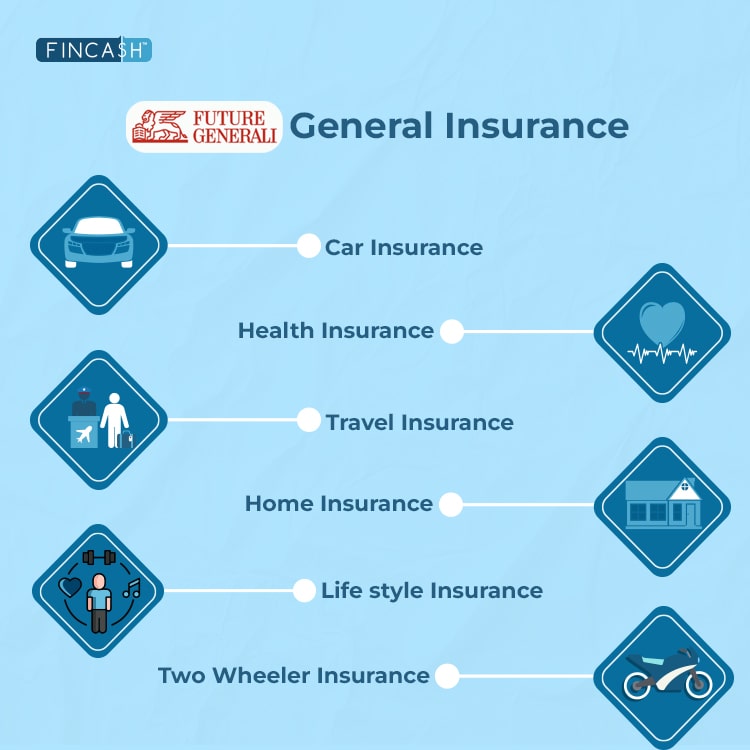

Types of General Insurance

1. Health Insurance

Health insurance is one of the well-known forms of non-life insurance. It provides one with the cover against the medical costs that might occur in hospitals due to an illness, accident, nursing care, tests, hospital accommodation, medical bills, etc. You can enjoy the benefit of health insurance plan by paying a premium to the health insurance providers at regular intervals (usually yearly). The medical insurance providing company accepts the responsibility of covering you against your medical expenses.

2. Car Insurance

car insurance policy covers your car against accidents, theft, etc. It covers the expenses that might arise due to mentioned events. A good car insurance covers your car from all the damages that might be either man-made or natural. Car insurance is mandatory for the owners. The Insured Declared Value or the IDV forms the basis of the premium you need to pay to the car insurance provider. It is also important to compare Car Insurance Online before choosing the best plan.

Talk to our investment specialist

3. Bike Insurance

In our country, two wheelers clearly outnumber four-wheelers. Thus, two-wheeler insurance becomes an important type of insurance. It is also mandatory for the bike owners. It protects your bike, scooter or two-wheeler against both natural and man-made damages. Some bike insurance policies also have rider benefits associated with the main insurance policy to give additional cover against certain events.

4. Travel Insurance

Travel insurance policy is a good cover to have when you travel - both for leisure or business. It involves protection against loss of baggage, trip cancellation, loss of passport or other important documents, and some other unforeseen risks like some medical emergency that might arise during your trip, domestic or abroad. It helps you to have a worry-free trip.

5. Home Insurance

Covering your home with a Home insurance policy takes a huge load off your shoulders. A home insurance policy protects your home( Home structure insurance) and its contents( Home Contents insurance) from any uncalled emergencies. The scope of damages covered depends on what kind of policy you select. It secures your house from natural calamities, man-made disasters and threats. Also, it protects you for the damages that might occur due to theft, burglary, flood, earthquake etc.

6. Marine Insurance or Cargo Insurance

Marine insurance covers the goods that are being transported from place to another. It offers to financially cover the damages that might occur during the course of travel. The damages or losses that may occur during the transit by rail, road, air, and/or sea are insured in this type of insurance.

General Insurance Companies in India 2025

Here is the list of General Insurance companies in India:

| Insurer | Inception Year |

|---|---|

| National Insurance Co. Ltd. | 1906 |

| Go Digit General Insurance Ltd. | 2016 |

| Bajaj Allianz General Insurance Co. Ltd. | 2001 |

| Cholamandalam MS General Insurance Co. Ltd. | 2001 |

| Bharti AXA General Insurance Co. Ltd. | 2008 |

| HDFC ERGO General Insurance Co. Ltd. | 2002 |

| Future Generali India Insurance Co. Ltd. | 2007 |

| The New India Assurance Co. Ltd. | 1919 |

| Iffco Tokio General Insurance Co. Ltd. | 2000 |

| Reliance General Insurance Co. Ltd. | 2000 |

| Royal Sundaram General Insurance Co. Ltd. | 2001 |

| The Oriental Insurance Co. Ltd. | 1947 |

| Tata AIG General Insurance Co. Ltd. | 2001 |

| SBI General Insurance Co. Ltd. | 2009 |

| Acko General Insurance Ltd. | 2016 |

| Navi General Insurance Ltd. | 2016 |

| Edelweiss General Insurance Co. Ltd. | 2016 |

| ICICI Lombard General Insurance Co. Ltd. | 2001 |

| Kotak Mahindra General Insurance Co. Ltd. | 2015 |

| Liberty General Insurance Ltd. | 2013 |

| Magma HDI General Insurance Co. Ltd. | 2009 |

| Raheja QBE General Insurance Co. Ltd. | 2007 |

| Shriram General Insurance Co. Ltd. | 2006 |

| United India Insurance Co. Ltd. | 1938 |

| Universal Sompo General Insurance Co. Ltd. | 2007 |

| Agriculture Insurance Company of India Ltd. | 2002 |

| Aditya Birla Health Insurance Co. Ltd. | 2015 |

| Manipal Cigna health insurance company Limited | 2012 |

| ECGC Ltd. | 1957 |

| Max Bupa Health Insurance Co. Ltd | 2008 |

| Care Health Insurance Ltd. | 2012 |

| Star Health & Allied Insurance Co. Ltd. | 2006 |

Online Insurance

With the advent of technology and internet, buying insurance online has become very easy, especially, buying different types of general insurance covers like health insurance or car insurance. Online insurance purchase is now a big part of the insurance market with all the insurance companies displaying and selling their insurance products on their respective portals.

Also, such a facility also allows to compare insurance quotes from different companies and choose the best insurance plan for yourself. Additionally, you get insurance premium calculators on respective websites. With the help of these premium calculators, you can choose and select the most affordable and appropriate general insurance plan.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like