Table of Contents

- What is the Repo Rate?

- What is the Reverse Repo Rate?

- How does the Reverse Repo Rate Work?

- Importance of Reverse Repo Rate

- Reverse Repo Rate During Demand-Pull Inflation

- Impact of Reverse Repo Rate on Home Loan

- Reverse Repo Rate and Money Flow

- Current Reverse Repo Rate

- Difference Between Repo Rate and Reverse Repo Rate

- Conclusion

- Frequently Asked Questions (FAQs)

- 1. Why is the reverse repo rate used?

- 2. What happens when the reverse repo rate increases?

- 3. Is the reverse repo rate good?

- 4. Does the reverse repo rate cause inflation?

- 5. Who pays interest in reverse repo rate?

- 6. Why RBI increases the reverse repo rate?

- 7. Why is the repo rate higher than the reverse repo rate?

What is Reverse Repo Rate?

“The RBI keeps the reverse repo rate unchanged”, and “the RBI increases the repo rate by 50 bps”. How many times have you read this headline in the newspaper or in a news app’s notification? Too many times, probably. Ever wondered what this really means? Well, if yes, then read on. You will get what you want. And if not, still read on–as you must know what this now-so-widely-used economic term means.

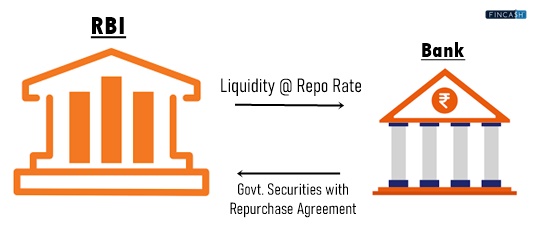

What is the Repo Rate?

It is the rate at which the Reserve Bank of India (RBI) lends to commercial banks for the short term. The higher the repo rate, the fewer banks borrow from RBI. This reduces commercial lending and, thus, the money supply in the Economy. In the opposite situation, when the repo rate is reduced, banks borrow more from RBI because of the reduced rate of borrowing. This induces the money supply in the economy. The current repo rate has been 6.50% since February 2023. The repo rate has been below 6% since August 2019. It went as low as 4% between March 2020 to October 2020 owing to the pandemic-induced economic crisis.

What is the Reverse Repo Rate?

When commercial banks have surplus funds with them, they have two options: either extend credit to the public or deposit the surplus with the RBI. In both cases, banks earn interest. The rate at which they earn interest on depositing money with RBI is called the reverse repo rate.

How does the Reverse Repo Rate Work?

RBI decides the reverse repo rate depending on the existing situation of the economy. This is one of the monetary measures used to control the money supply in the economy. When the reverse repo rate is increased, banks are incentivised to keep more money with the RBI as they get more interest on deposits with RBI. Now, less money will be available with commercial banks, thus decreasing commercial lending. This reduces the money supply in the economy. The reverse repo rate is generally increased at the time of Inflation. Banks resist depositing more money with RBI when the reverse repo rate decreases. Now that they have more money, they lend more to the public, increasing the money supply in the economy. The reverse repo rate is reduced at the time of Recession.

Talk to our investment specialist

Importance of Reverse Repo Rate

The reverse repo rate forms a part of RBI’s monetary policy to keep the economy stable. It is used to curb inflation or tackle the recession. The rate is either increased or decreased as the situation demands. It directly affects the money flow to commercial banks, which determines the money flow in the economy. In a nutshell, the reverse repo rate is important because it helps to:

- Achieve price stability

- Promote economic development

- Maintain liquidity requirements of banks

When there is an excess money supply in the economy, the value of the rupee falls. In such a situation, when the RBI increases the repo rate, the money supply is reduced, thus helping increase the value of the rupee.

Reverse Repo Rate During Demand-Pull Inflation

During Demand-Pull Inflation, the money supply in the economy is high. People have more money; therefore, the demand for goods and services goes beyond production. Such a situation calls for reducing the money supply. The RBI increases the reverse repo rate. Thus, commercial banks keep funds with RBI to earn more interest. This leaves them with less money to give to the public. In turn, the money supply is reduced, and inflation comes down.

Impact of Reverse Repo Rate on Home Loan

Home Loan interest rates increase with a rise in the reverse repo rate. Banks find it more profitable to deposit money with RBI rather than extend credit to the public. They are reluctant to offer credit and thus increase the interest rate. This is true for most types of interest rates.

Reverse Repo Rate and Money Flow

The reverse repo rate directly impacts the money supply by making commercial banks the medium. A rise or fall in the reverse repo rate can withdraw or inject money into the economy.

Current Reverse Repo Rate

RBI’s Monetary Policy Committee (MPC) determines the reverse repo rate every 2 months. The reverse repo rate set by MPC in February 2023 is 3.35%.

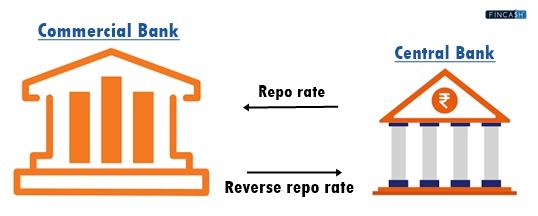

Difference Between Repo Rate and Reverse Repo Rate

Although one might get the idea that repo rate and reverse repo rate are opposites, there are some more major differences between the two. These could be better understood with the help of the following table:

| Repo Rate | Reverse Repo Rate |

|---|---|

| The RBI is the lender, and commercial banks are the borrowers | The RBI is the borrower, and commercial banks are the lenders |

| It is more than the reverse repo rate | It is less than the repo rate |

| An increase in the repo rate makes loans more expensive for commercial banks and the public | An increase in the reverse repo rate reduces the money supply |

| Decreased repo rate makes loans cheap for commercial banks and the public | A decrease in the reverse repo rate increases the money supply in the economy |

Conclusion

A reverse repo rate is an effective tool the RBI uses to maintain liquidity and curb economic inflation. It acts as a major defining Factor for maintaining economic stability and growth. This, along with repo rate, bank rate, CRR and SLR, are the go-to tools for the regulatory authority. In an economic crisis, a calculated increase or decrease leads to a cascading effect that strengthens the economy. These monetary measures have been immensely significant, especially during and after the pandemic.

Frequently Asked Questions (FAQs)

1. Why is the reverse repo rate used?

A: The reverse repo rate maintains stability in the economy by controlling the money supply in case of inflation or recession.

2. What happens when the reverse repo rate increases?

A: As the reverse repo rate increases, banks prefer to keep more of their funds with the RBI as they get more interest. This leads to a fall in lending to the public, thus reducing the money supply in the economy.

3. Is the reverse repo rate good?

A: The reverse repo rate is good for the RBI as it can increase or decrease it accordingly to meet its short-term fund requirements as well as the requirements of the economy. As for commercial banks, a higher reverse repo rate is a good incentive to earn more.

4. Does the reverse repo rate cause inflation?

A: The reverse repo rate does not cause inflation. Rather, a decrease in the reverse repo rate helps curb inflation by reducing the money supply in the economy and, thereby, controlling demand.

5. Who pays interest in reverse repo rate?

A: Commercial banks receive interest from the RBI when they deposit their surplus funds. This interest rate is called the reverse repo rate.

6. Why RBI increases the reverse repo rate?

A: The RBI increases the reverse repo rate to persuade banks to keep more of their funds with RBI so that it reduces the money supply in the economy. This is done to control excess inflation in the economy.

7. Why is the repo rate higher than the reverse repo rate?

A: Repo rate is the rate commercial banks borrow from RBI, and reverse repo rate is the rate at which they lend to RBI. If the reverse repo rate is higher than the repo rate, commercial banks would want to lend more to RBI. This will leave them with less money to lend to the public. This will shake the economic stability.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.