Fincash » Demat Account » Tips to Choose the Best Demat Account

Table of Contents

Tips to Choose the Best Demat Account

When talking about trading and investments, you must take every action cautiously. The Market is full of ups and downs, and at every step, you may find somebody ready to mislead and dupe you. So, being alert is highly necessary. However, as far as opening a Demat account is concerned, you might think it is a simple procedure and may not require attention. But know that doing proper homework can give you a competitive edge and save you some money as well.

This article will give you some of the effective tips to choose the best Demat account.

What is a Demat Account?

The Securities and Exchange Board of India (SEBI) came up with a Demat account, also known as a dematerialization account, in 1996. Since the issuance, as well as the holding of securities and shares, are stored in an electronic format, a Demat account is necessary to trade and invest in Indian securities or the stock market.

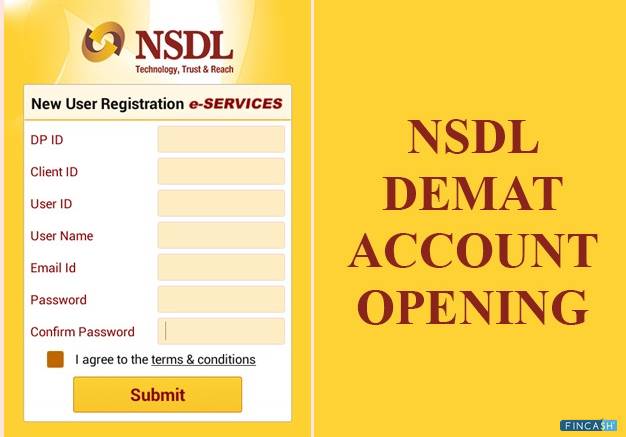

Every Depository Participant (DP) should offer a Basic Services Demat Account (BSDA) to investors. With this, retail investors can avail of basic services at minimal prices. The functioning of a Demat account is almost the same as a regular Bank account. When you purchase stocks, they get credited to this account. And, when you sell them, they get debited from this account. Demat accounts are regulated by two depositories in the country, which are Central Depositories Services Limited (CDSL) and National Securities Depository Limited (NSDL). Every stockbroker should be registered with any of these depositories.

Talk to our investment specialist

Tips to Choose the Best Demat Account

Here are some ways that can lead you towards an efficient and easy Demat account opening.

1. Ease of Opening

To begin with, one of the important considerations when choosing the best Demat account is the ease of opening it. In India, there are three options for such an account:

Regular Demat Account

Indian citizens generally use this account type as it lets them hold stocks and shares electronically rather than dealing with a huge load of paperwork

Repatriable Demat Account

This type of account allows Non-Resident Indians (NRIs) to invest in the Indian stock market from anywhere. But they will require an associated Non-Resident External (NRE) account and should adhere to Foreign Exchange Management Act (FEMA) rules

Non-Repatriable Demat Account

This type of Demat account is for NRIs as well, but it doesn’t let them transfer their funds internationally. Opening a Demat account is a simple process, and you will have to register and e-verify online. You will also have to submit your Aadhaar or PAN, verify bank details, and eSign documents

2. Easy and Straightforward Access to the Demat Account

One of the first things to consider is how a Depository Participant (DP) or the stockbroker is allowing you to access the Demat account. Today, most of them let you access through one single portal, which is extremely effective and easy. However, there are some such service providers who don’t provide this luxury.

If you don’t get to access your account from their platform, you will have to manually log into the account every time you would want to check it. This is a major hassle and inconvenience. So, make sure you choose a platform that is well-equipped technologically and allows single sign-in.

3. Conduct a Research on Depository Participant’s History

Conducting profound research on the DP, you have selected will help you figure out whether they are worth going ahead with. One of the best ways to do so is by reading through online reviews of their services posted by their existing users.

While at it, you must also evaluate the following:

- The typical time taken by the DP for generic processes, like pledging of shares, rematerialization, dematerialization, and more

- Promptness in addressing customer complaints

- If there are any claims pending with the CDSL, NSDL or SEBI

- Help in tracking the stock market

- The Efficiency of carrying transactions

This will help you gain a better idea of the account and its useful features. You must also filter out all those DPs that have negative reviews online and the ones that have been indulging in malpractices, regardless of how negligible.

4. Find Out the Pricing

A Demat account is generally available with a variety of charges, such as:

Opening Fees: This is the cost that you will have to incur to open the Demat account. Today, most brokers, banks, and DPs don’t charge any opening fees

Annual Maintenance Charges (AMC): This is the price billed annually, even if you haven’t used the account for the entire year

Cost of Physical statement: You will have to pay this cost for a physical copy that indicates your transactions and Demat holdings have taken place

DIS Rejection Charge: In case your Debit Instruction Slip (DIS) gets rejected, you will have to pay this penalty charge

Conversion Charges: DPs charge a specific amount for converting physical shares into electronic shares, which is also known as the dematerialization

Thus, it is important that you assess the associated costs so as to make sure you don’t pay anything more than the Industry standards. If you can, try comparing the charges with other service providers to get a fair idea

5. User Interface & Software

To make sure you are choosing the best Demat account, you will have to ensure you are going with tech-smart solutions. One of the features to look for in this regard is the presence of a mobile application and software that allow an intuitive user interface and smooth trading experience. It is recommended to choose a DP that effortlessly links your bank account, Demat account, and Trading Account. Also, ensure that the platform is free of glitches as well.

Wrapping Up

After considering the tips mentioned above, you will be able to choose a Demat account easily. The user-friendly interface, the help of DPs, quick complaint redressal, and transaction security all play crucial roles in comprehending your success. In the end, registering with a dependable name lets you enjoy a seamless experience and enables you to conduct trading and Investing with confidence.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.