Table of Contents

Best Child Plan: How to Choose?

Looking for the best child plan? In India, parents do not buy child plans for their kids during their initial years. Therefore, they miss out the Power of Compounding and tax saving benefits of a Child Insurance Plan. A child plan acts as both an insurance as well as an investment. Getting child insurance is a concrete step towards your child's future and is a must-have for every parent. Different child plans offered by the life Insurance companies in India offer different benefits. It is suggested to look for various child insurance plans and then select the best child plan that suits your needs. However, LIC child plans (especially LIC Money Back Policy) and SBI child plans are the most popular among people. A list of Best Investment Plan for child are mentioned below:

Best Child Plans in India

- LIC Child Career Plan

- LIC Jeevan Ankur

- HDFC Life YoungStar Udaan- Child Plan

- Reliance Child Plan

- Max Life Shiksha Plus Super

- Bajaj Allianz Young Assure

- ICICI Pru Smart Kid Assure Plan

- Birla Sun Life Insurance Vision Star Plan

- Aviva Young Scholar Advantage Plan

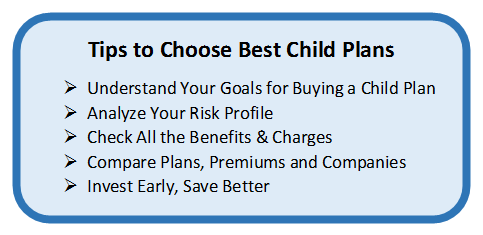

How to Choose the Best Child Plan?

Confused about how to choose the best child plan? We have mentioned a few tips for you. Check them out!

1: Understand your Goals for Buying a Child Plan

When choosing the best child plan it is important to determine whether you require the policy for a specific reason (like your child's health or education) or is it more of a general cover? This will make it easy for you to select a child insurance plan for your kid. Moreover, many Life Insurance companies in India also offer plans that are specifically designed to provide lucrative benefits keeping your child's milestones in mind. Hence, if you are clear with your needs, you can easily choose the best child plan apt for you.

2: Analyse your Risk Profile

For choosing the best child plan that is suitable for you, it is necessary to determine your risk profile. If you are willing to take a little risk, opt for a Children Unit Linked Insurance Plans. They work like a normal Unit Linked Insurance Plan or ULIP and give Market-linked returns. Make sure to opt for a flexible plan, which enables you to shift your Portfolio from equity to debt anytime you wish to reduce the risk Factor. However, if you are looking for a safe investment that offers fixed returns, consider a Traditional Endowment Plan for children.

3: Check all the Benefits & Chargers of the Child Insurance

Another essential thing to do when choosing the best child plan is knowing not only the benefits of child plans but all the extra charges liable on them as well. For instance, if someone is buying a ULIP insurance plan for a child, it is suggested to go through the fine print well before you choose a plan as they are various charges levied under several heads of a ULIP or Unit Linked Insurance Plan. Therefore, you must plan your investment in advance considering all the benefits and flaws of the child insurance plan.

4: Compare Plans, Premiums and Companies Offering Child Plans

The Golden Rule for selecting the best child plan is to research, research and research. We hear about insurance scams and companies unwilling to settle claims. This can be easily avoided if you do your research well. One can easily compare insurance online as well. Opting for cheap insurance may sound good at the start, but it might not be necessarily the best. A low premium might be easy in your pocket but the plan may not be suitable for you, or the policy may not offer you the best benefits suitable for you. Therefore, select the best child plan according to your own personal requirements and priorities.

Talk to our investment specialist

5: Invest Early, Save Better

Similar to various other investments, child insurance plans also offer best returns when started early. Typically, it is suggested by the insurance experts to select the best child plan within 90 days of the child’s birth. Moreover, a minimum tenure of seven years is suitable for most of the child plans. This will ensure a good financial corpus for you at the time of maturity.

Conclusion

To conclude, choosing the best child plan is a stepping stone to secure your child's future. Don't make a hasty decision. Take time to consider all your options and plans to make sure your child's needs are taken care of. So do your homework, follow the above tips and choose the best child plan today!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.