Table of Contents

Different Types of Demat Account in India

Shares are kept in digital format in a Demat (or dematerialized) account. If you are a trader or an investor, you can purchase shares and store them securely in a Demat (dematerialized) account. Apart from shares, various other investments, including shares, ETFs, Bonds, government securities, Mutual Funds, etc., can be kept in a Demat account.

Shares you buy will be credited to your Demat account, and shares you sell will be deducted from them. You can also dematerialize any shares you currently possess in paper form and store them electronically in your Demat account. Such an account comes in different types that serve various investor needs. In this post, let's talk more about the Demat account and its types.

Advantages of Using a Demat Account for Trading

There are many advantages to trading using a Demat account. The following are some of the main benefits:

- Lower Costs: Trading with a Demat account is far less expensive than ever. This makes it possible for deals to be made electronically more often

- Accessibility: In their dematerialized state, one's security is safe and simple to access

- Quicker Transactions: As the securities come in electronic form, trades can happen in a matter of seconds

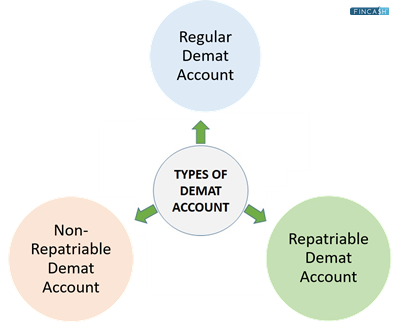

Different Types of Demat Account

There are three different types of Demat accounts to choose from. Both Indian residents and Non-Resident Indians (NRIs) can use Demat accounts. Additionally, investors can choose an appropriate Demat account as well based on their residential status.

1. Regular Demat Account

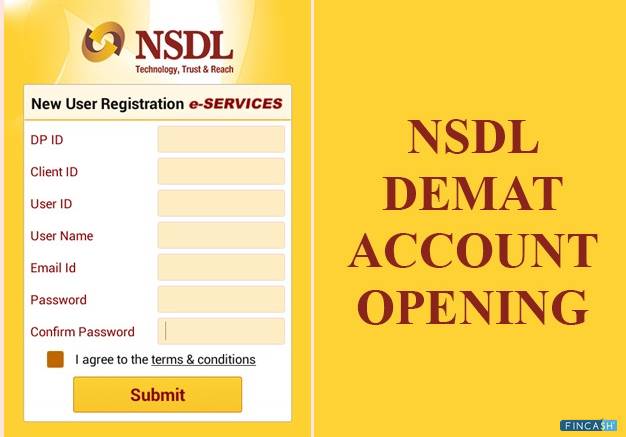

This kind of account is used by Indian citizens and residents. The services of a regular Demat account are offered in India by depositories like Central Depositories Services India Ltd. (CDSL) and National Securities Depository Ltd. (NSDL) through intermediaries, like stock brokers and Depository Participants (DP). The fees vary for such an account type on the Basis of the volume maintained in the account, the type of subscription, and the terms and circumstances established by the depository.

Here is a list of documents required to open a regular Demat account:

- ID proof (Voter ID, driver's license, unique identification numbers, etc.)

- Address proof (voter ID, passport, Aadhar card, ration card, etc.)

- Income proof (ITR acknowledgement copy)

- Bank Account proof (cancelled cheque leaf)

- PAN Card

- 3 passport-sized photographs

The purpose of a regular Demat account is to streamline trading processes.Transferring shares is simpler than ever and can be finished in a matter of hours. Since you can keep shares in electronic form through a conventional Demat account, there is no longer a chance for loss, damage, forgery, or theft compared to physical shares. Another benefit is convenience. It has eliminated time-consuming procedures like purchasing and pasting share Market stamps and limitations on selling shares in odd quantities, which has also helped save money.

This account eliminates paperwork, simplifies operations, and make handling and keeping shares safer and more secure. This lowers the cost of the activity as well. The introduction of regular Demat accounts has simplified and speed up the process of changing addresses and other details too. Regular Demat account holders, or traders who are citizens of India and live in India, can also transfer their assets from an existing Demat account to some other institution without paying additional fees. A Regular Demat account holder must start a new account in their name if they want to transfer to a joint Demat account.

Talk to our investment specialist

2. Repatriable Demat Account

An NRI can invest fast in the Indian stock market from anywhere globally by opening a Repatriable Demat Account. A connected Non-Resident External (NRE) or a Non-Resident Ordinary (NRO) bank account is necessary to channel investments through a Repatriable Demat Account. This Demat account offers the same nomination option as a regular Demat account, which can also have joint holders who must be Indian citizens, regardless of residency status. Moreover, an NRI who wants to register a repatriable Demat account must abide by the Foreign Exchange Management Act's (FEMA) regulations. NRIs must open a Trading Account with a recognised institution that the Reserve Bank of India (RBI) has authorised.

The Portfolio Investment NRI Scheme (PINS) Account enables NRIs to buy and sell stocks through Indian stock markets. Additional categories for this include NRE and NRO PINS accounts. While Portfolio Investment NRI Scheme Demat accounts permit transactions involving funds that can be repatriated to foreign nations, they are not allowed by NRO PINS accounts.

An NRI must present the following documents to open a Repatriable Demat account:

- A copy of their passport

- A copy of their PAN card

- A copy of their visa

- Proof of their overseas address (such as utility bills, rental or Lease agreements, or sale deeds)

- A passport-sized photo

- A Foreign Exchange Management Act (FEMA) declaration

- A cancelled cheque leaf from their NRE or NRO account

The Indian Embassy in the nation where the NRI resides should testify to all these documents.

3. Non-Repatriable Demat Account

The Non-Resident Indians can also open a non-repatriable Demat account. However, in this situation, money cannot be transferred outside the country, and this account needs a corresponding NRO bank account. Maintaining their finances might be challenging when an NRI has income from outside and in India. Additionally, they struggle to monitor their foreign bank accounts and transfer funds to their domestic accounts. They can feel at ease with NRE and NRO Demat accounts.

Here is a list of all the documents required to open a non-repatriable Demat account:

- A copy of their passport

- A copy of their PAN card

- A copy of their visa

- Proof of their overseas address (such as utility bills, rental or lease agreements, or sale deeds)

- A passport-sized photo

- A Foreign Exchange Management Act (FEMA) declaration

- A cancelled cheque leaf from their NRE or NRO account

According to the RBI's regulations, to open this account, an NRI can only own up to 5% of the paid-up Capital in an Indian firm. Using an NRE Demat account and money in the NRE bank account, an NRI can invest in Initial Public Offers (IPOs) on a repatriable basis. To invest on a non-repatriable basis, the NRO account and NRO Demat account will be used. A person can convert an existing Demat account into the NRO category to continue trading after obtaining the status of NRI. In that situation, previously owned shares will be moved to the new NRO holding account.

An NRI may invest in India through the Portfolio Investment Scheme (PINS) and their Demat account. An NRI may trade shares and mutual fund units under the PINS programme. An NRE account and a PINS account function similarly. Even if NRIs have an NRE account, trading in stocks requires a separate PINS account. Initial Public Offerings (IPO), mutual fund investments, and investments made by citizens are all made through NON-PINS Accounts. An NRI must remember that they can only have one PINS account open at any time.

NRE and NRO Non-PINS accounts are two types of non-PINS accounts. Repatriation is not possible for NRO transactions. However, it is possible for NRE transactions. Additionally, trading in futures and options is permitted with NRO Non-PINS accounts.

Basic Service Demat Account (BSDA)

The Basic Service Demat Account (BSDA) is another type of Demat account that SEBI has created. The only significant distinction between BSDA and standard Demat accounts is the upkeep cost.

- If you open a BSDA account with holdings under Rs. 50,000, you won't have to pay maintenance fees

- You will have to pay annual maintenance fees of Rs. 100 if your holdings are between Rs. 50,000 and Rs. 2 lakhs

- The purpose of BSDA is to encourage small investors interested in the investment Industry to make investments

- The BSDA Demat account does have some restrictions

The maximum amount you can retain at any time is Rs. 2 lakhs. So, suppose you purchase stocks today for Rs. 1.50 lakh; they increase in value to Rs. 2.20 lakh tomorrow. Thus, you are no longer qualified for a BSDA-type Demat account, and standard fees will now be levied. Another distinction between BSDA and standard Demat accounts is that the joint account function is not accessible for the former. Only the lone account holder is eligible to open a BSDA account.

Conclusion

For trading on the Indian stock exchanges, Demat accounts are now required. They come in a variety of forms and have varied uses. Opening a standard Demat account is quite straightforward for Indian residents. You can do it through the broker of your choice. NRIs, however, are subject to some regulations and limitations. Thus, they must abide by the rules of the Foreign Exchange Management Act, which require them to open significantly altered versions of Demat accounts.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.