11 Different Types of Loans Available in India

In simple terms, loans are the emergency funds an individual takes to fulfil certain goals like buying a bike, car, home, etc., by giving an assurance of returning the money back, in terms of EMI, within a given period of time. At times, people also take a loan to pay their debts too.

There are various types of loans available in India you can choose based on your requirements. However, most people opt for a personal loan as they lack knowledge about different types of loans in India. Let's take a look at them.

Types of Loan

Mortgage loan, auto loan, payday loan, student loan, Marriage Loan, Home Loan, business loan, etc. are some of the widely taken loans. Each of them is defined for a specific reason and therefore, they may vary from the tenure, interest rate and payment due.

Personal loan

An individual applies for a personal loan to fulfil some personal needs, such as to pay off previous debts, buy luxury things or for an international travel destination. The interest rate of the loans is higher as 10% to 14% compared to other types of loans.

Home loan

Everyone dreams to buy their own house. But, buying a house with a lump sum money is not possible for average people. Therefore, banks offer home loans that will help people to the property they desire. There are different types of home loan, such as:

- Loan for purchasing a house

- Loan to renovate your house

- Loan to purchase a Land

Education loan

Education loans offer a good opportunity for students who are financially weak or who want to study independently. Once they secure a job they need to repay the loan amount from their Earnings.

Auto loan

The auto loan helps you to buy a vehicle of your choice, but if you Fail to pay, then you may face the risk of losing your vehicle. This type of loan may be distributed by a Bank or any automobile dealership, but you should comprehend the loans from the respective dealership.

It is a secured loan if the borrower doesn’t pay the instalments on time, then the lenders can take back the vehicle.

Talk to our investment specialist

Gold loan

Among all the loans in India, gold loan is the fastest and easiest loan available. It was very popular back in the days when the rates of gold were rising. Still, in the current time, you can avail the gold loan easily.

Agricultural loan

Currently, there are many loan schemes offered by the Government of India and banks to help farmers. These loans have low-interest rates, which help farmers to buy seeds, equipment for farming, tractors, insecticides, etc. The repayment of the loans can be done after the yielding and selling of crops.

Overdraft

Overdraft is a process of asking loans from banks. It means an individual can withdraw more money, than the money deposited in their accounts.

Loan against Insurance policies

If you have an insurance policy you can get a loan against it. Insurance ages over 3 years are eligible for such loans. The insurer offers a loan amount on your insurance policy. To avail the loan you need to submit the documents related to the insurance policy to the bank.

Loan against bank FDs

If you have an FD in the bank, you can apply for a loan against the same. If the FD is around Rs. 1,00,000, then you can apply for Rs. 80,000 loan The rate of interest is higher than the interest rate paid by the bank on FD.

Cash credit

Cash credit permits the customer to borrow some amount from the bank. The banks pay in advance to an individual and ask for few securities to the bank in exchange for the credit card. The borrower can renew the process every year.

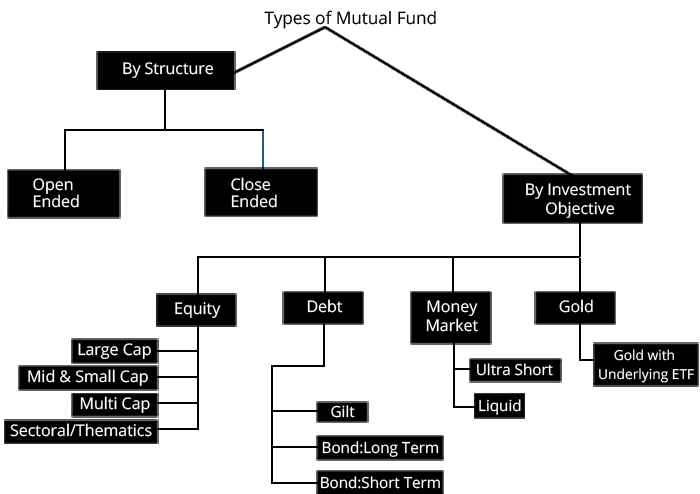

Loan against Mutual Funds or Shares

A lender offers a loan of an amount which is lesser than the total valuation of the shares or Mutual Funds investments. This is because the bank can charge the rate of interest, if the borrower fails to repay the borrowed amount.

How to Apply for a Loan?

While applying for a loan you should be careful to provide all the genuine documents. Here’s the procedure to apply for a loan-

Loan application form

You need to fill the application form for loan you need from the bank and fill all the information correctly.

Credit score

The banks check your Credit Score and maintain all your credit records. If you have a high credit score, then your loan application will be easily approved. But if your score is low, then either your loan will be rejected or you’ll be charged a higher interest rate.

Documents

The borrower needs to provide a series of documents along with the application form. Documents such as identity proof, Income proof and other certificates need to be submitted with the application.

Loan approval

Once you submit all the documents along with the form, the bank verifies all the details. Once the verification is complete and the results are satisfactory, then the bank approves the loan.

An Alternative of Loan- Invest in SIP!

Well, most loan comes with higher interest rates and long tenure. The best way to accomplish your financial goal is by Investing in SIP (Systematic Investment plan). With the help of a sip calculator, you can get a precise figure for your dream business, home, wedding, etc., from which you can invest a fixed amount in SIP.

SIP is only the easiest and hassle-free way to achieve your Financial goals. Try now!

Speed-up your Savings to Fulfill your Financial Goals

If you are planning to fulfil a certain goal, then a SIP calculator will help you to calculate the amount you need to invest.

SIP calculator is a tool for investors to determine the expected return of the SIP investment. With the help of a SIP calculator, one can calculate the amount of investment and time period of investing requires to reach one's financial goal.

Know Your SIP Returns

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.