K-Ratio

What is K-Ratio?

According to the K-ratio definition, it is known to imply a valuation metric that helps in examining the overall consistency of the return of the equity with the passage of time. The data for the given ratio is obtained from VAMI or Value-Added Monthly Index.

The given entity makes use of the technique of linear regression for tracking the overall progress of some initial investment in the security under analysis.

Calculating K-ratio

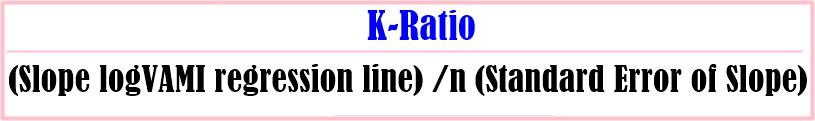

As per the K-ratio definition, it can be calculated with the help of a simple formula.

K-ratio = (Slope logVAMI regression line) / n (Standard Error of Slope)

Here, the value of ‘n’ is known to represent the number of return periods in the return data of the given month.

Importance of K-ratio

The K-ratio came into existence by Lars Krestner –a leading statistician and a derivatives trader. The given valuation parameter was developed with the intent of addressing some perceived gap in the manner how analysis of returns takes place. As the key points of interests of investors happen to be returns & consistency, Kenster went forward with designing the K-ratio for measuring the different between risk & returns. He aimed at achieving the same by analyzing how steady the returns, Portfolio, and security of the managers tend to be over time.

Talk to our investment specialist

The K-ratio is known to take into consideration the returns. At the same time, the given parameter is also known to consider the orders of the respective returns in the measurement of risks. The calculation is known to involve implementing linear regression on the logarithm-based cumulative return of the VAMI or Value-added Monthly Index curve. The results obtained out of regression are utilized in the formula for K-ratio. The slope turns out to be the return –expected to be positive. At the same time, the standard error of the slope is known to represent the overall risk.

In the year 2003, Krestner went forward with introducing the modified version of the original K-ratio. The modified version changed the original formula. It included the number of specific return data points in the section of denominator. In the year 2013, also went forward with introducing additional modification –adding a square root calculation to the numerator section.

Using the K-ratio

The ratio helps in measuring the returns of security with the passage of time. Therefore, it is regarded as a great tool for measuring the overall performance of equities. This is because it aims at taking up the return trend into consideration in comparison to the point-in-time snapshots. The given parameter is known to allow for the comparison of the cumulative returns for multiple equities & equity managers. In addition to analyzing style categories, individual stock returns, and fund managers, the concept of K-ratio can also be utilized for Bonds.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.